Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that TagMaster AB (publ) (STO:TAGM B) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for TagMaster

What Is TagMaster's Debt?

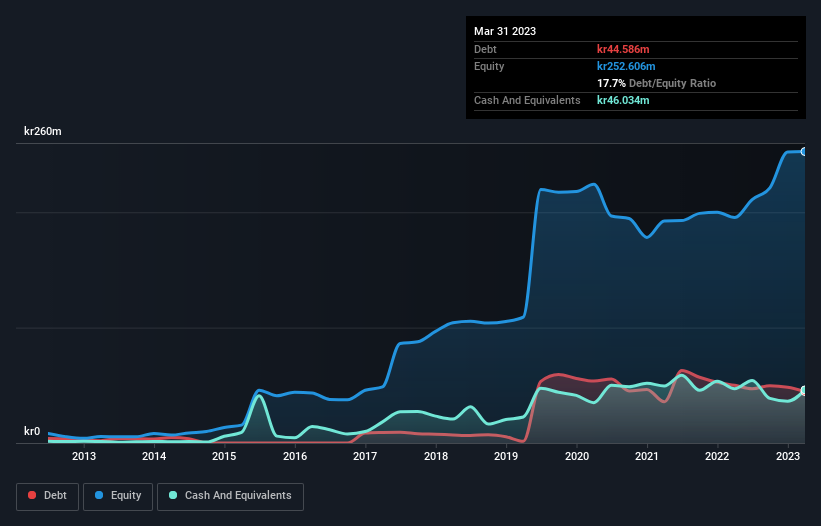

You can click the graphic below for the historical numbers, but it shows that TagMaster had kr44.6m of debt in March 2023, down from kr50.0m, one year before. But it also has kr46.0m in cash to offset that, meaning it has kr1.45m net cash.

A Look At TagMaster's Liabilities

Zooming in on the latest balance sheet data, we can see that TagMaster had liabilities of kr124.3m due within 12 months and liabilities of kr34.1m due beyond that. On the other hand, it had cash of kr46.0m and kr80.5m worth of receivables due within a year. So it has liabilities totalling kr31.9m more than its cash and near-term receivables, combined.

Since publicly traded TagMaster shares are worth a total of kr196.3m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, TagMaster boasts net cash, so it's fair to say it does not have a heavy debt load!

Notably, TagMaster made a loss at the EBIT level, last year, but improved that to positive EBIT of kr3.8m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine TagMaster's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While TagMaster has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, TagMaster actually produced more free cash flow than EBIT over the last year. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While TagMaster does have more liabilities than liquid assets, it also has net cash of kr1.45m. The cherry on top was that in converted 268% of that EBIT to free cash flow, bringing in kr10m. So we are not troubled with TagMaster's debt use. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example TagMaster has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if TagMaster might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TAGM B

TagMaster

An application oriented technical company, develops and sells advanced sensor systems and solutions based on radio, radar, magnetic and camera technologies under the TagMaster, Sensys Networks, and Citilog brand names.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026