- Sweden

- /

- Electronic Equipment and Components

- /

- OM:PRIC B

Auditors Are Concerned About Pricer (STO:PRIC B)

Unfortunately for shareholders, when Pricer AB (publ) (STO:PRIC B) reported results for the period to March 2023, its auditors, Ernst & Young LLP, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

See our latest analysis for Pricer

What Is Pricer's Net Debt?

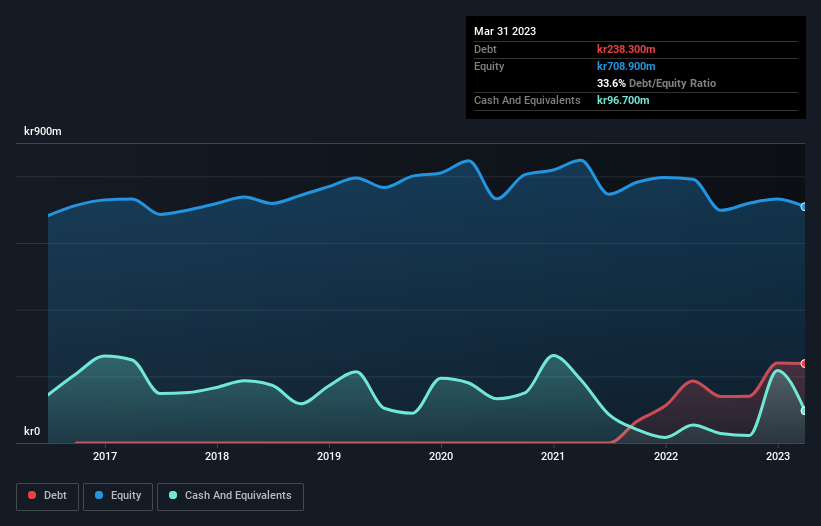

You can click the graphic below for the historical numbers, but it shows that as of March 2023 Pricer had kr238.3m of debt, an increase on kr186.2m, over one year. However, because it has a cash reserve of kr96.7m, its net debt is less, at about kr141.6m.

A Look At Pricer's Liabilities

Zooming in on the latest balance sheet data, we can see that Pricer had liabilities of kr832.2m due within 12 months and liabilities of kr263.2m due beyond that. Offsetting this, it had kr96.7m in cash and kr518.0m in receivables that were due within 12 months. So it has liabilities totalling kr480.7m more than its cash and near-term receivables, combined.

Pricer has a market capitalization of kr991.8m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Pricer has a quite reasonable net debt to EBITDA multiple of 2.1, its interest cover seems weak, at 1.7. The main reason for this is that it has such high depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) In any case, it's safe to say the company has meaningful debt. Importantly, Pricer's EBIT fell a jaw-dropping 78% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Pricer can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Pricer's free cash flow amounted to 26% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

To be frank both Pricer's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least its net debt to EBITDA is not so bad. Overall, it seems to us that Pricer's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Pricer is showing 2 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PRIC B

Pricer

Provides in-store digital solutions in Europe, the Middle East and Africa, the Americas, and Asia and Pacific.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives