- Sweden

- /

- Communications

- /

- OM:NETI B

Net Insight AB (publ)'s (STO:NETI B) 26% Jump Shows Its Popularity With Investors

Net Insight AB (publ) (STO:NETI B) shares have continued their recent momentum with a 26% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

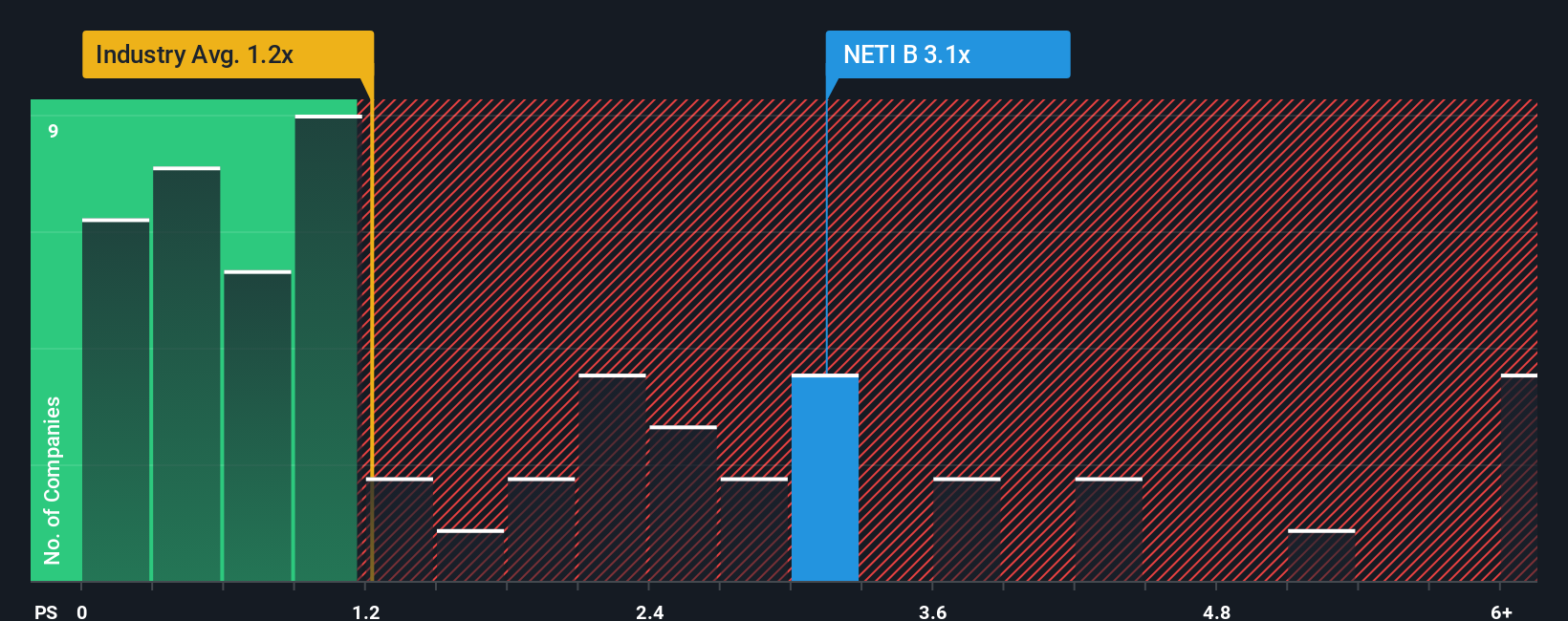

After such a large jump in price, when almost half of the companies in Sweden's Communications industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Net Insight as a stock probably not worth researching with its 3.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Net Insight

How Net Insight Has Been Performing

Net Insight has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Net Insight.Do Revenue Forecasts Match The High P/S Ratio?

Net Insight's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 28% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 13% during the coming year according to the one analyst following the company. With the rest of the industry predicted to shrink by 0.3%, that would be a fantastic result.

In light of this, it's understandable that Net Insight's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

What Does Net Insight's P/S Mean For Investors?

The large bounce in Net Insight's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We can see that Net Insight maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Questions could still raised over whether this level of outperformance can continue in the context of a a tumultuous industry climate. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Net Insight, and understanding should be part of your investment process.

If you're unsure about the strength of Net Insight's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Net Insight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NETI B

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives