It Looks Like The CEO Of NCAB Group AB (publ) (STO:NCAB) May Be Underpaid Compared To Peers

Key Insights

- NCAB Group's Annual General Meeting to take place on 8th of May

- Salary of kr3.52m is part of CEO Peter Kruk's total remuneration

- The overall pay is 45% below the industry average

- Over the past three years, NCAB Group's EPS grew by 42% and over the past three years, the total shareholder return was 75%

The solid performance at NCAB Group AB (publ) (STO:NCAB) has been impressive and shareholders will probably be pleased to know that CEO Peter Kruk has delivered. At the upcoming AGM on 8th of May, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

Check out our latest analysis for NCAB Group

How Does Total Compensation For Peter Kruk Compare With Other Companies In The Industry?

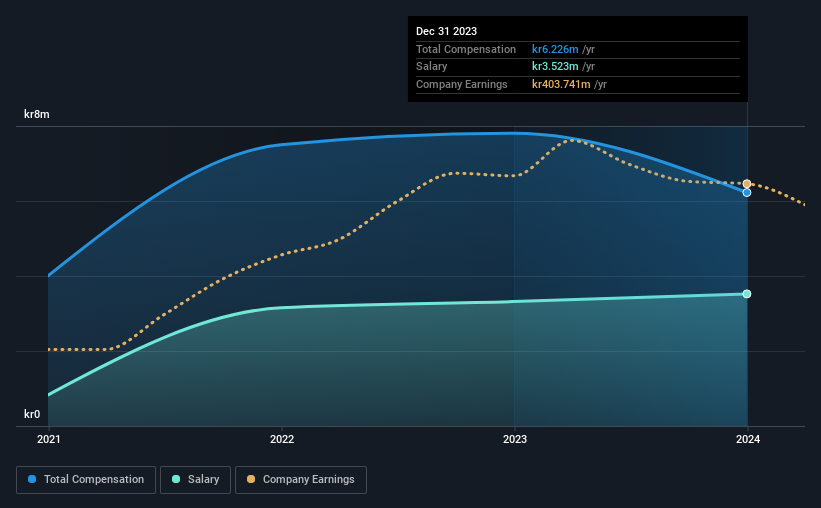

At the time of writing, our data shows that NCAB Group AB (publ) has a market capitalization of kr14b, and reported total annual CEO compensation of kr6.2m for the year to December 2023. Notably, that's a decrease of 20% over the year before. We note that the salary of kr3.52m makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Swedish Electronic industry with market capitalizations ranging from kr11b to kr35b, the reported median CEO total compensation was kr11m. In other words, NCAB Group pays its CEO lower than the industry median. Furthermore, Peter Kruk directly owns kr6.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr3.5m | kr3.3m | 57% |

| Other | kr2.7m | kr4.5m | 43% |

| Total Compensation | kr6.2m | kr7.8m | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Although there is a difference in how total compensation is set, NCAB Group more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at NCAB Group AB (publ)'s Growth Numbers

NCAB Group AB (publ)'s earnings per share (EPS) grew 42% per year over the last three years. Its revenue is down 13% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has NCAB Group AB (publ) Been A Good Investment?

Most shareholders would probably be pleased with NCAB Group AB (publ) for providing a total return of 75% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

Whatever your view on compensation, you might want to check if insiders are buying or selling NCAB Group shares (free trial).

Switching gears from NCAB Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if NCAB Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NCAB

NCAB Group

Engages in the manufacture and sale of printed circuit boards (PCBs) in Sweden, Nordic region, rest of Europe, North America, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.