The European market has recently experienced mixed returns, with the pan-European STOXX Europe 600 Index remaining relatively flat and individual country indexes like France's CAC 40 showing modest gains, while Germany's DAX saw a slight decline. In this context of varied economic indicators and cautious sentiment from the European Central Bank regarding inflation, investors are keenly observing high-growth tech stocks that demonstrate strong fundamentals and innovative capabilities as potential opportunities in an evolving market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| Bonesupport Holding | 24.39% | 57.52% | ★★★★★★ |

| Napatech | 61.09% | 102.68% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| VusionGroup | 20.40% | 72.60% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

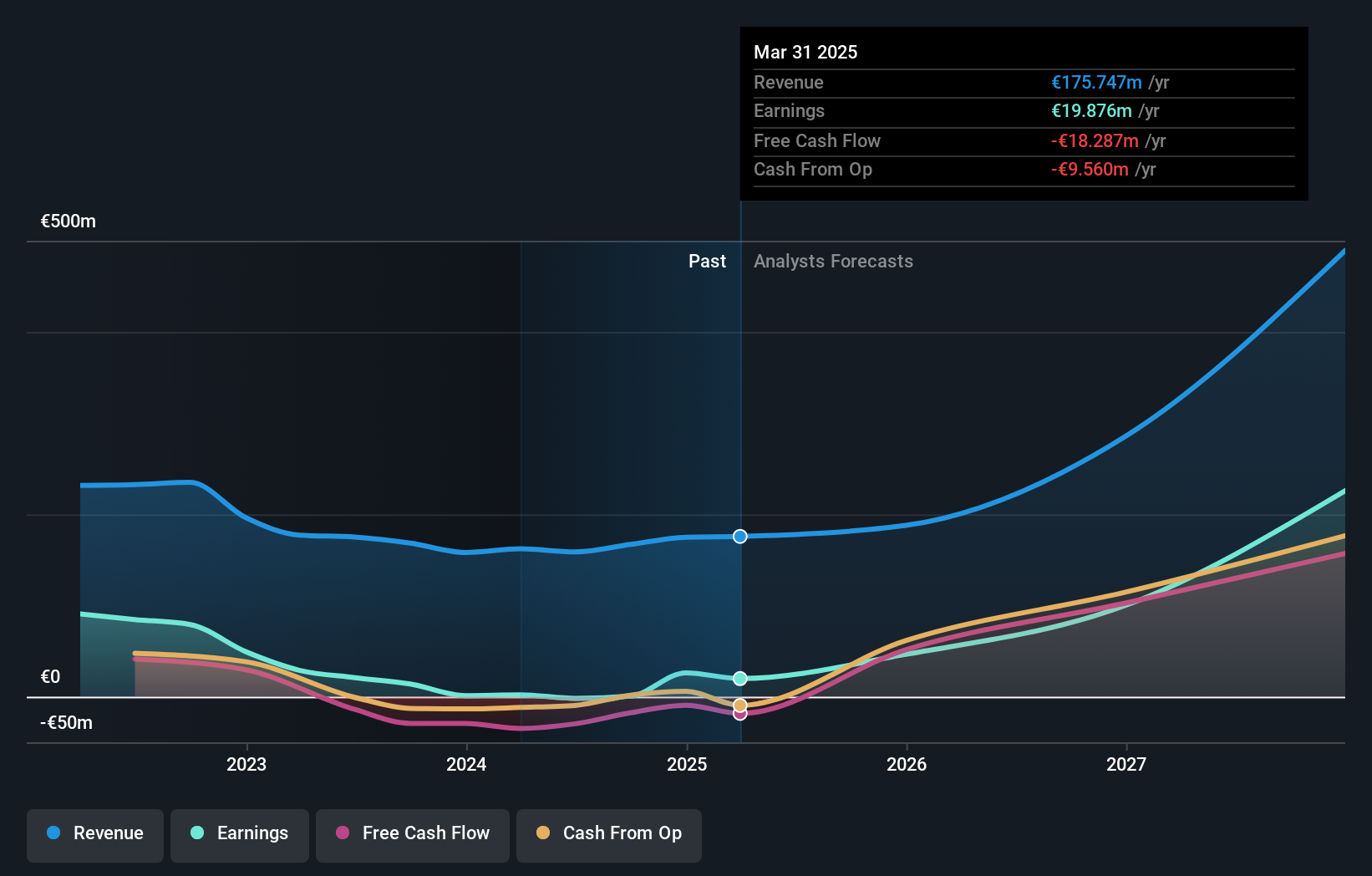

Overview: Pharma Mar, S.A. is a biopharmaceutical company engaged in the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of €1.47 billion.

Operations: Pharma Mar focuses on oncology, generating €178.70 million in revenue from this segment across several international markets. The company's operations span research, development, production, and commercialization of bio-active principles for cancer treatment.

Pharma Mar has demonstrated a significant leap in performance, with earnings surging by 881% over the past year, starkly outpacing the industry's growth rate of 44%. This surge is underpinned by robust R&D investments, aligning with its revenue growth forecast at 29.6% annually, which eclipses the broader Spanish market's expectation of just 4.6%. Recent breakthroughs like the Phase 3 IMforte study underscore Pharma Mar's potential in reshaping treatment standards in oncology, particularly with Zepzelca® showing substantial benefits in survival rates for lung cancer patients. This momentum is expected to sustain as earnings are projected to grow by another 44.9% annually, reflecting both Pharma Mar’s innovative edge and its strategic market positioning.

- Dive into the specifics of Pharma Mar here with our thorough health report.

Gain insights into Pharma Mar's past trends and performance with our Past report.

Intellego Technologies (OM:INT)

Simply Wall St Growth Rating: ★★★★★★

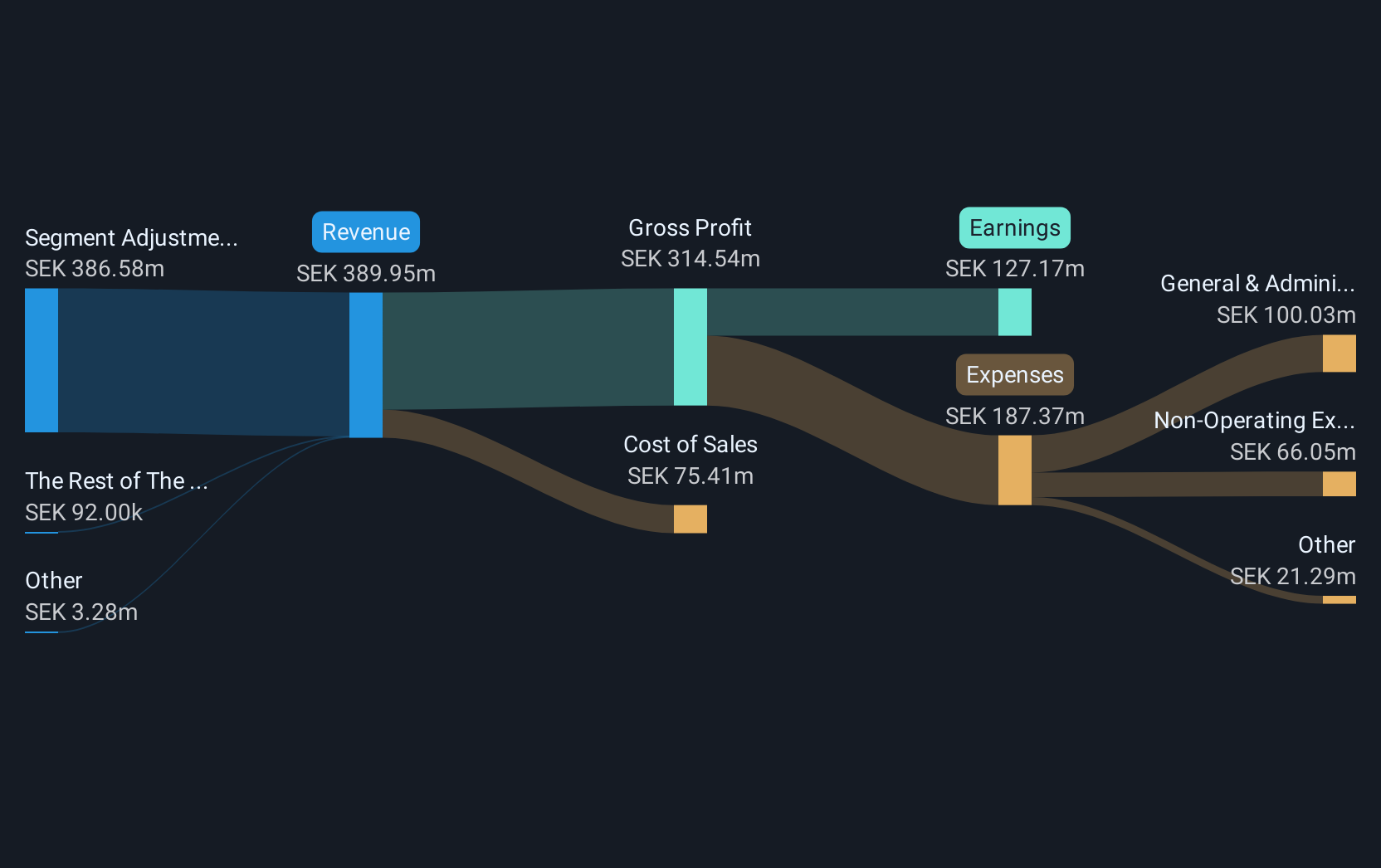

Overview: Intellego Technologies AB is a Swedish company that specializes in the manufacturing and sale of colorimetric ultraviolet indicators, with a market cap of SEK3.07 billion.

Operations: Intellego Technologies AB focuses on the production and distribution of colorimetric ultraviolet indicators, generating revenue primarily from electronic components and parts, totaling SEK389.95 million.

Intellego Technologies AB has recently demonstrated robust financial performance, with earnings surging by 56.3% over the past year, significantly outpacing its industry's average. This growth is supported by a strong R&D focus, as evidenced by their latest quarterly report showing R&D expenses reaching SEK 50 million, marking a substantial increase from the previous period. The firm's strategic emphasis on innovation is further highlighted by expected annual revenue and profit growth rates of 30.3% and 44.8%, respectively—figures that dwarf the broader Swedish market projections of 4.3% and 15.1%. With new CFO Hans Denovan at the helm, known for his expertise in scaling operations internationally through mergers and acquisitions, Intellego is poised to enhance its competitive edge in high-tech sectors across Europe.

- Click here and access our complete health analysis report to understand the dynamics of Intellego Technologies.

Assess Intellego Technologies' past performance with our detailed historical performance reports.

NCAB Group (OM:NCAB)

Simply Wall St Growth Rating: ★★★★★☆

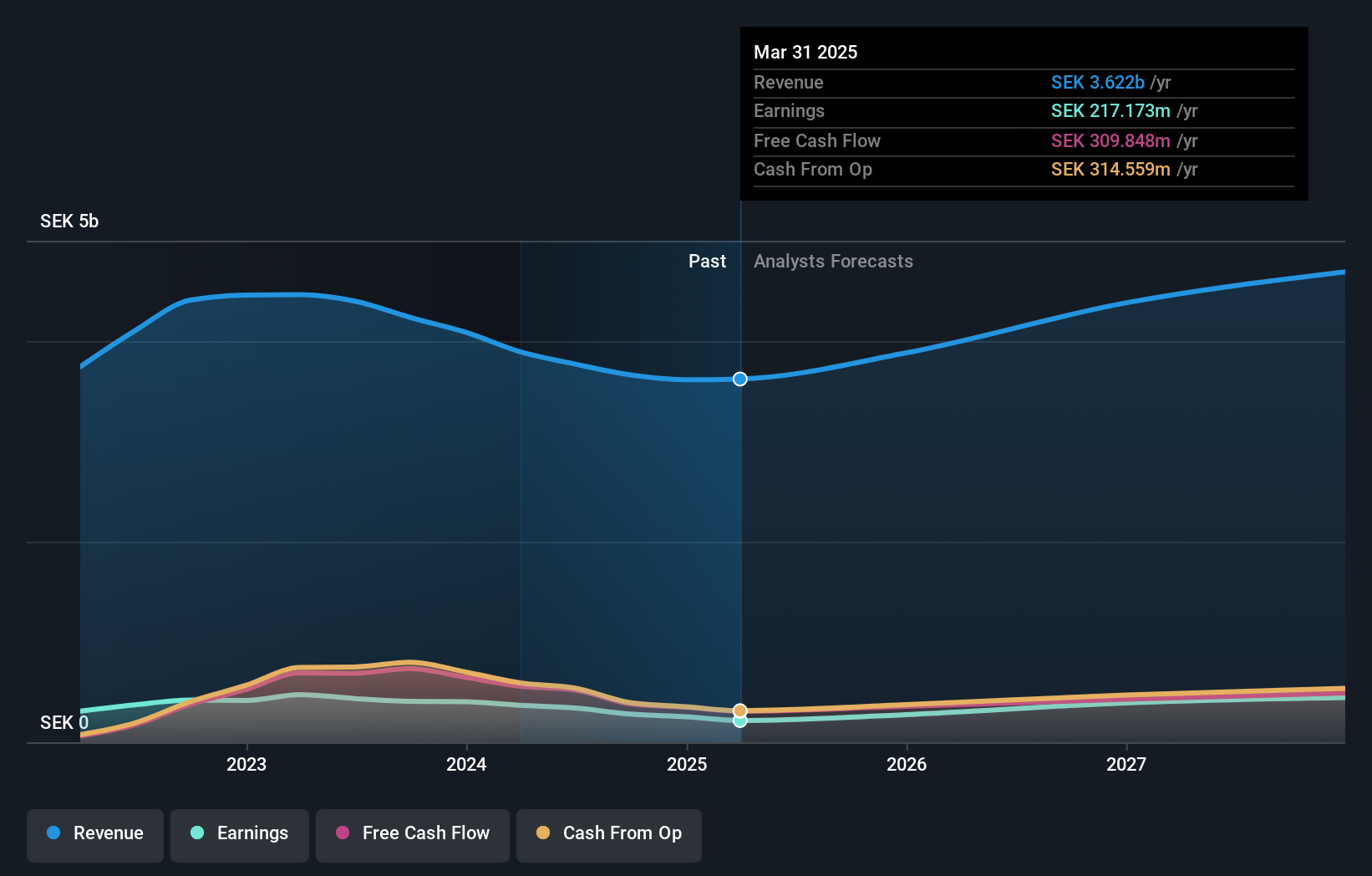

Overview: NCAB Group AB (publ) specializes in the manufacture and sale of printed circuit boards (PCBs) across Sweden, the Nordic region, Europe, North America, and Asia with a market cap of approximately SEK9.69 billion.

Operations: The company generates revenue primarily from the sale of printed circuit boards, with Europe contributing SEK1.77 billion and North America SEK797 million.

NCAB Group, navigating through a challenging fiscal environment, reported a slight increase in quarterly revenue to SEK 958.8 million from SEK 955.3 million year-over-year, despite a significant drop in net income from SEK 89.8 million to SEK 52.1 million over the same period. This downturn reflects broader market pressures yet contrasts with an optimistic earnings growth forecast of 26.3% annually, outpacing the Swedish market's expectation of 15.1%. The recent board reshuffle introduces fresh perspectives with the appointment of Marlene Forsell and Helen Blomqvist, potentially steering future strategic directions amidst high volatility in share price and a retracted dividend proposal signaling caution in capital distribution strategies.

- Navigate through the intricacies of NCAB Group with our comprehensive health report here.

Review our historical performance report to gain insights into NCAB Group's's past performance.

Taking Advantage

- Click this link to deep-dive into the 233 companies within our European High Growth Tech and AI Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INT

Intellego Technologies

Manufactures and sells colorimetric ultraviolet indicators in Sweden.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives