3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 23.3%

Reviewed by Simply Wall St

In the closing weeks of the year, global markets experienced mixed signals with U.S. consumer confidence declining and major stock indexes showing moderate gains, led by large-cap growth stocks. Amid these fluctuating conditions, identifying undervalued stocks becomes crucial as they may present opportunities for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lundin Gold (TSX:LUG) | CA$31.92 | CA$63.81 | 50% |

| Tourmaline Oil (TSX:TOU) | CA$67.37 | CA$134.34 | 49.9% |

| Bank BTPN Syariah (IDX:BTPS) | IDR935.00 | IDR1869.73 | 50% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7284.35 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.25 | US$84.44 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.76 | €5.50 | 49.8% |

| Elekta (OM:EKTA B) | SEK61.80 | SEK123.12 | 49.8% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.87 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

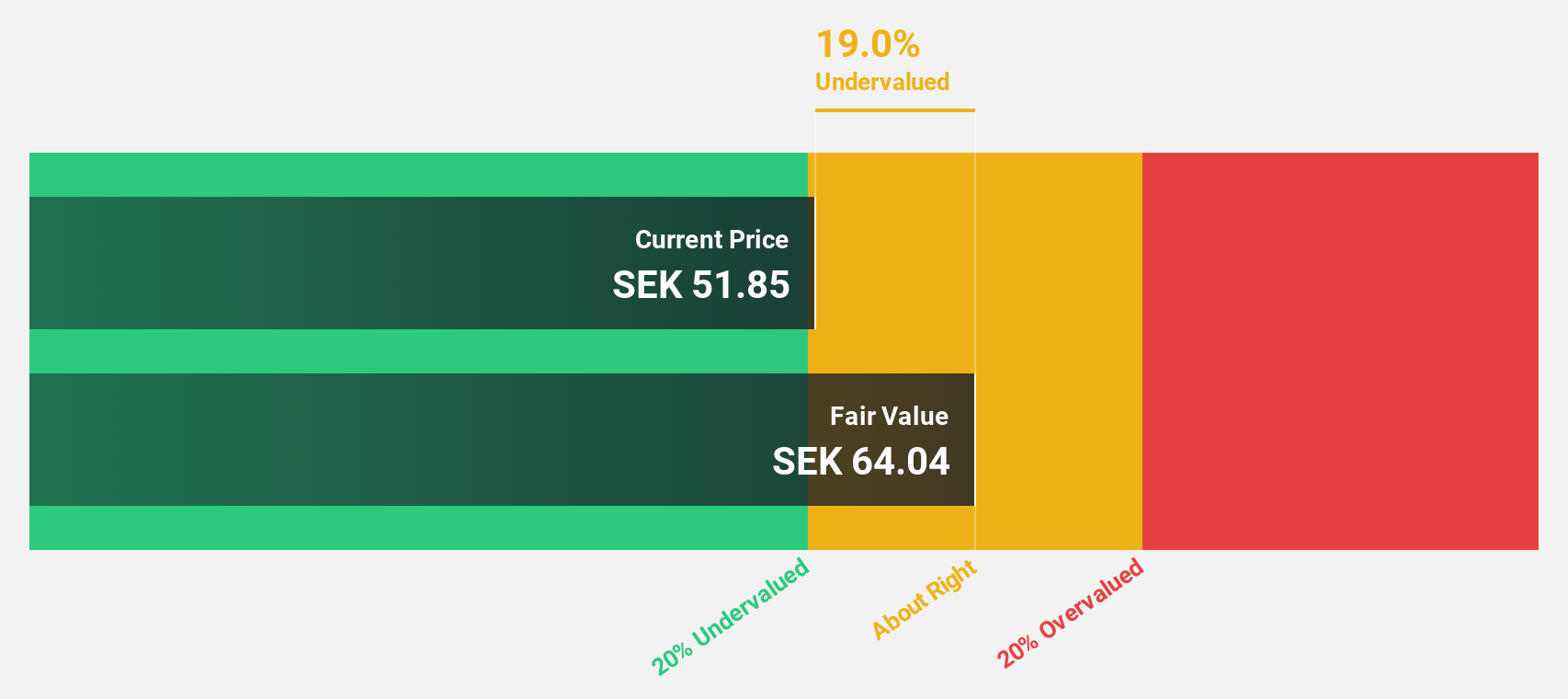

NCAB Group (OM:NCAB)

Overview: NCAB Group AB (publ) is a company that manufactures and sells printed circuit boards across Sweden, the Nordic region, the rest of Europe, North America, and Asia, with a market cap of SEK12.19 billion.

Operations: The company's revenue segments are distributed as follows: East at SEK210.60 million, Europe at SEK1.91 billion, Nordic at SEK756.10 million, and North America at SEK786.70 million.

Estimated Discount To Fair Value: 11.4%

NCAB Group is trading at SEK65.2, approximately 11.4% below its estimated fair value of SEK73.6, indicating potential undervaluation based on cash flows. Despite recent declines in sales and net income, NCAB's earnings are expected to grow significantly at 24.21% annually, outpacing the Swedish market's growth rate of 14.6%. However, the company has seen substantial insider selling recently and maintains an unstable dividend track record, which may warrant caution for investors.

- Our expertly prepared growth report on NCAB Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of NCAB Group here with our thorough financial health report.

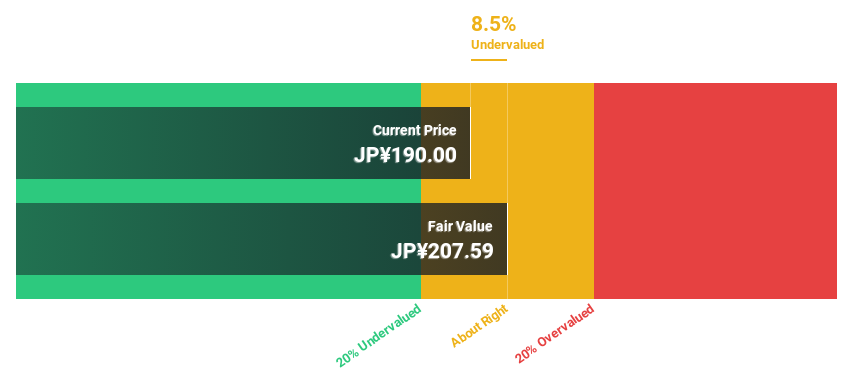

Polaris Holdings (TSE:3010)

Overview: Polaris Holdings Co., Ltd. operates a chain of hotels in Japan and has a market cap of ¥43.01 billion.

Operations: Polaris Holdings Co., Ltd. generates its revenue primarily from operating a chain of hotels across Japan.

Estimated Discount To Fair Value: 11.9%

Polaris Holdings is trading at ¥184, about 11.9% below its fair value estimate of ¥208.88, suggesting undervaluation based on cash flows. Despite high debt levels and recent share price volatility, earnings are forecast to grow significantly at 23.79% annually, surpassing the JP market's growth rate. Recent management integration with Minacia has led to upward revisions in financial guidance and strategic restructuring aimed at enhancing operational efficiency and shareholder value through synergy effects.

- Our growth report here indicates Polaris Holdings may be poised for an improving outlook.

- Navigate through the intricacies of Polaris Holdings with our comprehensive financial health report here.

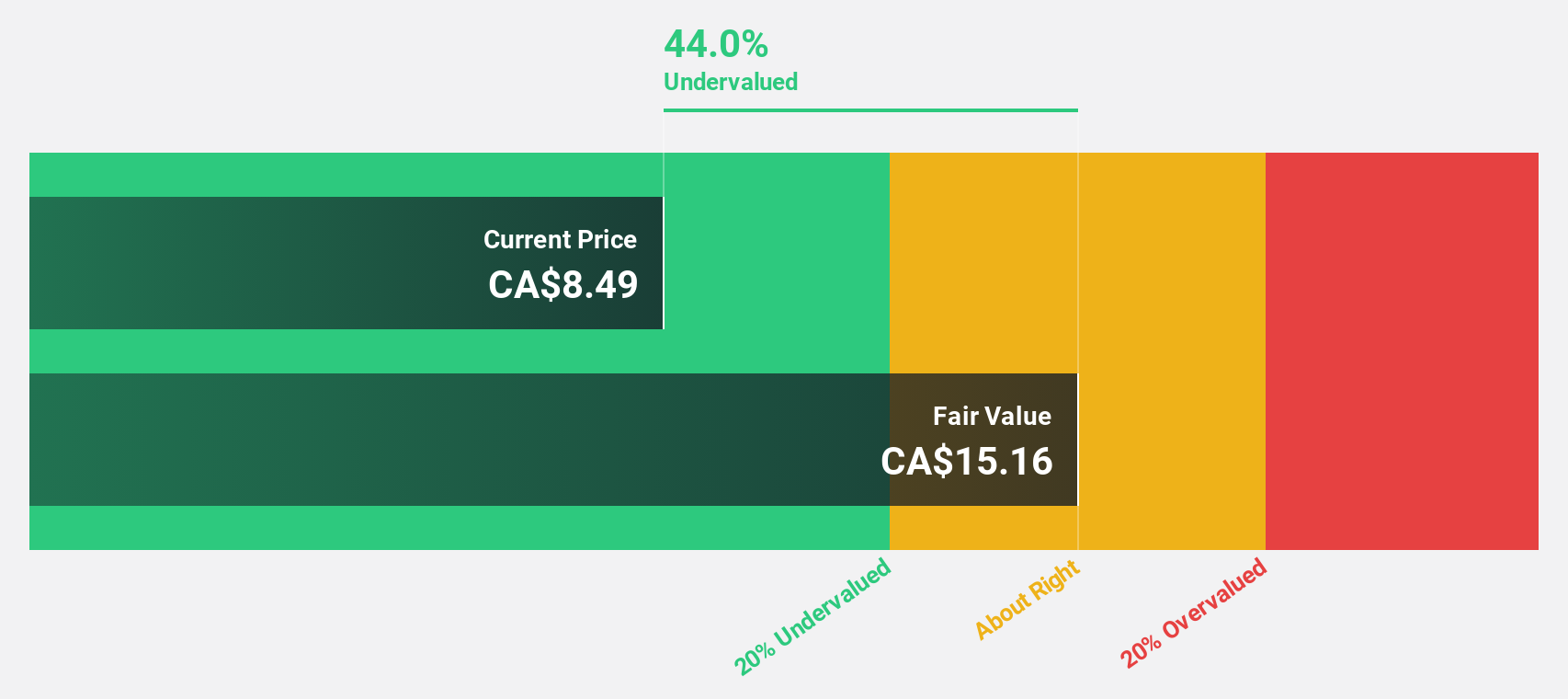

Montage Gold (TSXV:MAU)

Overview: Montage Gold Corp. focuses on the acquisition, exploration, and development of mineral properties in Africa and has a market cap of CA$719.69 million.

Operations: Montage Gold Corp. does not report any revenue segments in its financial disclosures.

Estimated Discount To Fair Value: 23.3%

Montage Gold is trading at CA$2.20, over 20% below its fair value estimate of CA$2.87, indicating potential undervaluation based on cash flows. Despite a significant net loss reported recently, the company is fully funded for its Koné project in Côte d'Ivoire with US$900 million in liquidity against an upfront capex of US$835 million. Earnings are expected to grow substantially as the project progresses towards production by 2027.

- Our comprehensive growth report raises the possibility that Montage Gold is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Montage Gold stock in this financial health report.

Make It Happen

- Delve into our full catalog of 897 Undervalued Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCAB Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCAB

NCAB Group

Manufactures and sells printed circuit boards (PCBs) in Sweden, Nordic region, rest of Europe, North America, and Asia.

High growth potential with excellent balance sheet.