Does Mycronic (STO:MYCR) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Mycronic (STO:MYCR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Mycronic Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Mycronic has grown EPS by 49% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

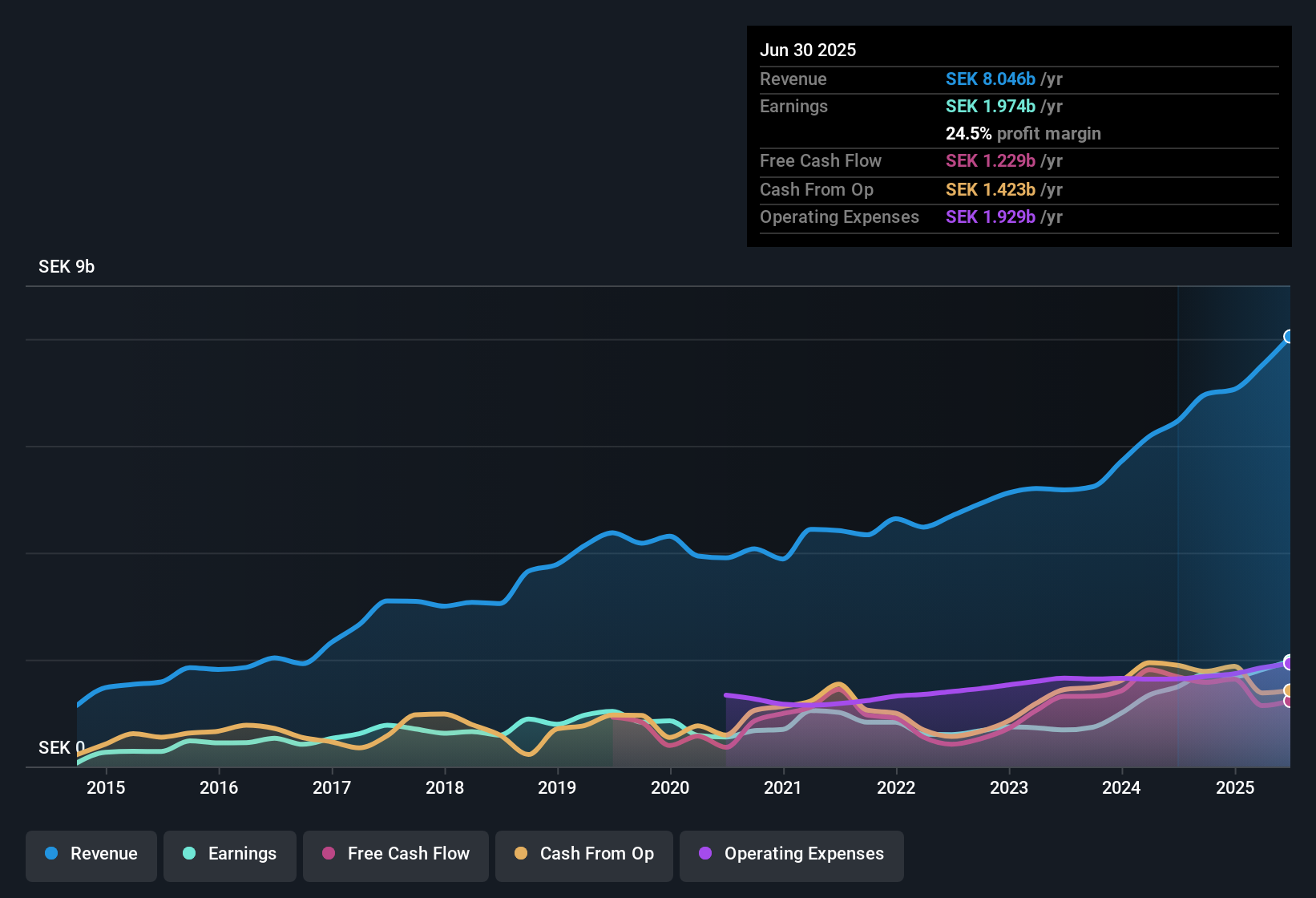

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Mycronic remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 25% to kr8.0b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Check out our latest analysis for Mycronic

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Mycronic's forecast profits?

Are Mycronic Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Mycronic insiders did net kr2.5m selling stock over the last year, they invested kr4.5m, a much higher figure. This overall confidence in the company at current the valuation signals their optimism. We also note that it was the President & CEO, Anders Lindqvist, who made the biggest single acquisition, paying kr2.1m for shares at about kr186 each.

Should You Add Mycronic To Your Watchlist?

Mycronic's earnings per share growth have been climbing higher at an appreciable rate. Growth investors should find it difficult to look past that strong EPS move. And may very well signal a significant inflection point for the business. If this is the case, then keeping a watch over Mycronic could be in your best interest. You still need to take note of risks, for example - Mycronic has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Mycronic, you'll probably love this curated collection of companies in SE that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MYCR

Mycronic

Develops, manufactures, and sells production equipment for electronics industry in Sweden, rest of Europe, the United States, other Americas, China, South Korea, rest of Asia, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.