- Poland

- /

- Capital Markets

- /

- WSE:PRA

Promising Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate economic complexities, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge and small-cap stocks trailing behind. Amid this backdrop, penny stocks—often seen as relics of past market eras—still hold potential for investors seeking affordability and growth opportunities. Typically representing smaller or newer companies, these stocks can offer significant returns when supported by strong financial health, making them worth considering for those looking to uncover hidden value in the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.875 | £480.06M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.05 | £331.23M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.94 | HK$45.23B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.942 | £149.49M | ★★★★★★ |

| Seng Fong Holdings Berhad (KLSE:SENFONG) | MYR0.88 | MYR635.06M | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.07 | £313.29M | ★★★★☆☆ |

Click here to see the full list of 5,685 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

KebNi (OM:KEBNI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: KebNi AB (publ) develops, manufactures, markets, and sells 4-axes stabilizing VSAT antennas for maritime applications under the KebNi Maritime brand, with a market cap of SEK322.67 million.

Operations: The company's revenue is primarily derived from its unclassified services segment, totaling SEK137.69 million.

Market Cap: SEK322.67M

KebNi AB has shown promising financial improvements, recently achieving profitability with a net income of SEK 2 million for the full year. The company secured a significant supplier agreement with ACE Antenna, potentially generating SEK 50 million annually. Despite its high volatility and low return on equity at 3.2%, KebNi's debt-free status and substantial short-term assets exceeding liabilities offer financial stability. Trading at a notable discount to estimated fair value, the stock presents potential for growth, supported by forecasted earnings increase of over 54% per year. However, the board's inexperience remains a consideration for investors.

- Unlock comprehensive insights into our analysis of KebNi stock in this financial health report.

- Evaluate KebNi's prospects by accessing our earnings growth report.

Ningbo Xianfeng New MaterialLtd (SZSE:300163)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ningbo Xianfeng New Material Co., Ltd specializes in the development and manufacturing of screen fabrics globally, with a market cap of CN¥1.26 billion.

Operations: Ningbo Xianfeng New Material Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥1.26B

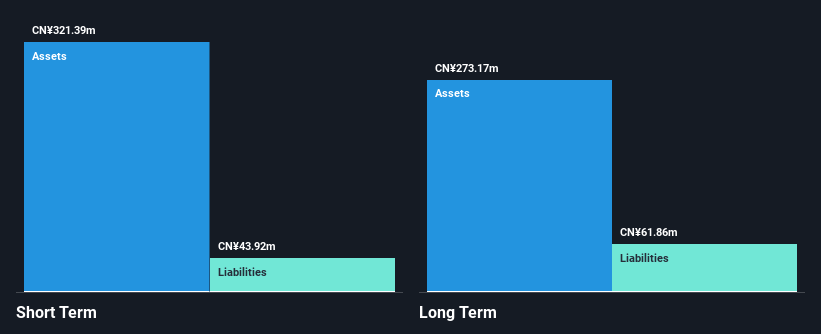

Ningbo Xianfeng New Material Co., Ltd, with a market cap of CN¥1.26 billion, is currently unprofitable and pre-revenue, making it challenging to assess its earnings growth compared to industry standards. The company benefits from a stable weekly volatility of 7% over the past year and maintains a healthy financial position with short-term assets (CN¥321.4M) exceeding both short-term (CN¥43.9M) and long-term liabilities (CN¥61.9M). Additionally, the firm is debt-free and has not experienced significant shareholder dilution recently, indicating potential financial resilience despite management's relatively low tenure experience of 2.3 years on average.

- Click here and access our complete financial health analysis report to understand the dynamics of Ningbo Xianfeng New MaterialLtd.

- Assess Ningbo Xianfeng New MaterialLtd's previous results with our detailed historical performance reports.

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna (WSE:PRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, trading under the ticker WSE:PRA, operates as a publicly owned investment manager with a market capitalization of PLN170.55 million.

Operations: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna has not reported any revenue segments.

Market Cap: PLN170.55M

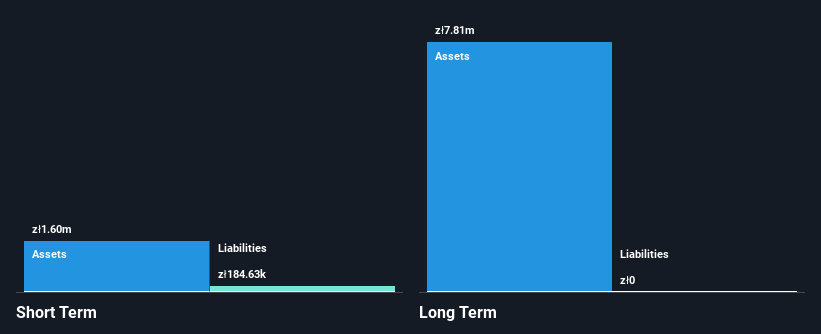

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, with a market cap of PLN170.55 million, is pre-revenue and currently unprofitable, reporting a net loss of PLN0.89 million for Q4 2024. The company has no debt and its short-term assets (PLN1.6M) significantly exceed short-term liabilities (PLN184.6K), indicating some financial stability despite having less than a year of cash runway if current cash flow trends persist. The board's average tenure is only 1.4 years, suggesting limited experience, while the stock has experienced high volatility over the past three months without significant shareholder dilution recently.

- Get an in-depth perspective on Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's performance by reading our balance sheet health report here.

- Learn about Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's historical performance here.

Taking Advantage

- Jump into our full catalog of 5,685 Penny Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PRA

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna

SPARK VC S.A. is a publicly owned investment manager.

Adequate balance sheet slight.

Market Insights

Community Narratives