- Sweden

- /

- Communications

- /

- OM:INCOAX

InCoax Networks' (STO:INCOAX) Stock Price Has Reduced 28% In The Past Year

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by InCoax Networks AB (publ) (STO:INCOAX) shareholders over the last year, as the share price declined 28%. That contrasts poorly with the market return of 20%. Because InCoax Networks hasn't been listed for many years, the market is still learning about how the business performs. More recently, the share price has dropped a further 24% in a month.

Check out our latest analysis for InCoax Networks

InCoax Networks recorded just kr1,437,706 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that InCoax Networks will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

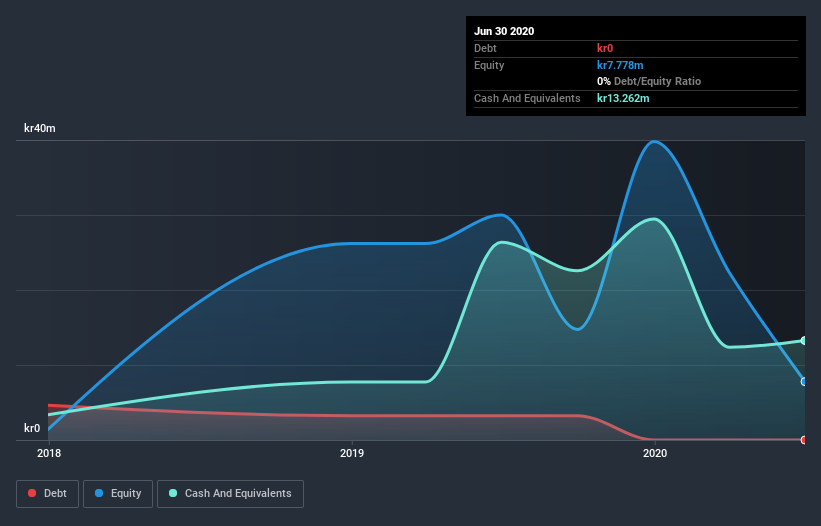

InCoax Networks had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. But since the share price has dived 28% in the last year , it looks like some investors think it's time to abandon ship, so to speak, even though the cash reserves look a little better with the capital raising. The image below shows how InCoax Networks' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. It costs nothing but a moment of your time to see if we are picking up on any insider selling.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between InCoax Networks' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that InCoax Networks' TSR, at -16% is higher than its share price return of -28%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Given that the market gained 20% in the last year, InCoax Networks shareholders might be miffed that they lost 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 15% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 5 warning signs we've spotted with InCoax Networks (including 3 which is can't be ignored) .

We will like InCoax Networks better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade InCoax Networks, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:INCOAX

InCoax Networks

InCoax Networks AB (publ) re-purposes existing property coaxial networks in fiber and fixed wireless access extension deployments for communication service providers in the European Union, North America, and internationally.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives