- Sweden

- /

- Communications

- /

- OM:HMS

3 European Growth Companies With Up To 24% Insider Ownership

Reviewed by Simply Wall St

As the European markets experience a notable upswing, with the pan-European STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns, investors are keenly observing growth opportunities within this positive economic environment. In such times, companies with high insider ownership often draw attention as they suggest strong internal confidence and alignment of interests between shareholders and management, making them potentially attractive to those seeking robust growth prospects.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.4% | 66.1% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 51% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

Let's explore several standout options from the results in the screener.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bittium Oyj is a company that offers communications and connectivity solutions, healthcare technology products and services, and biosignal measuring and monitoring across Finland, Germany, and the United States with a market cap of €228.89 million.

Operations: The company's revenue segments include €29.80 million from medical solutions, €51.60 million from defense and security, and €14.32 million from engineering services.

Insider Ownership: 12.2%

Bittium Oyj, with its substantial insider ownership, is experiencing a phase of growth, highlighted by its recent profitability and forecasted earnings growth of 20.45% annually. Despite a volatile share price in recent months, the company trades at 26.2% below estimated fair value, suggesting potential undervaluation. Bittium's revenue is expected to grow faster than the Finnish market average and has reaffirmed guidance for increased net sales in 2025 between €95 million and €105 million.

- Dive into the specifics of Bittium Oyj here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Bittium Oyj's current price could be inflated.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

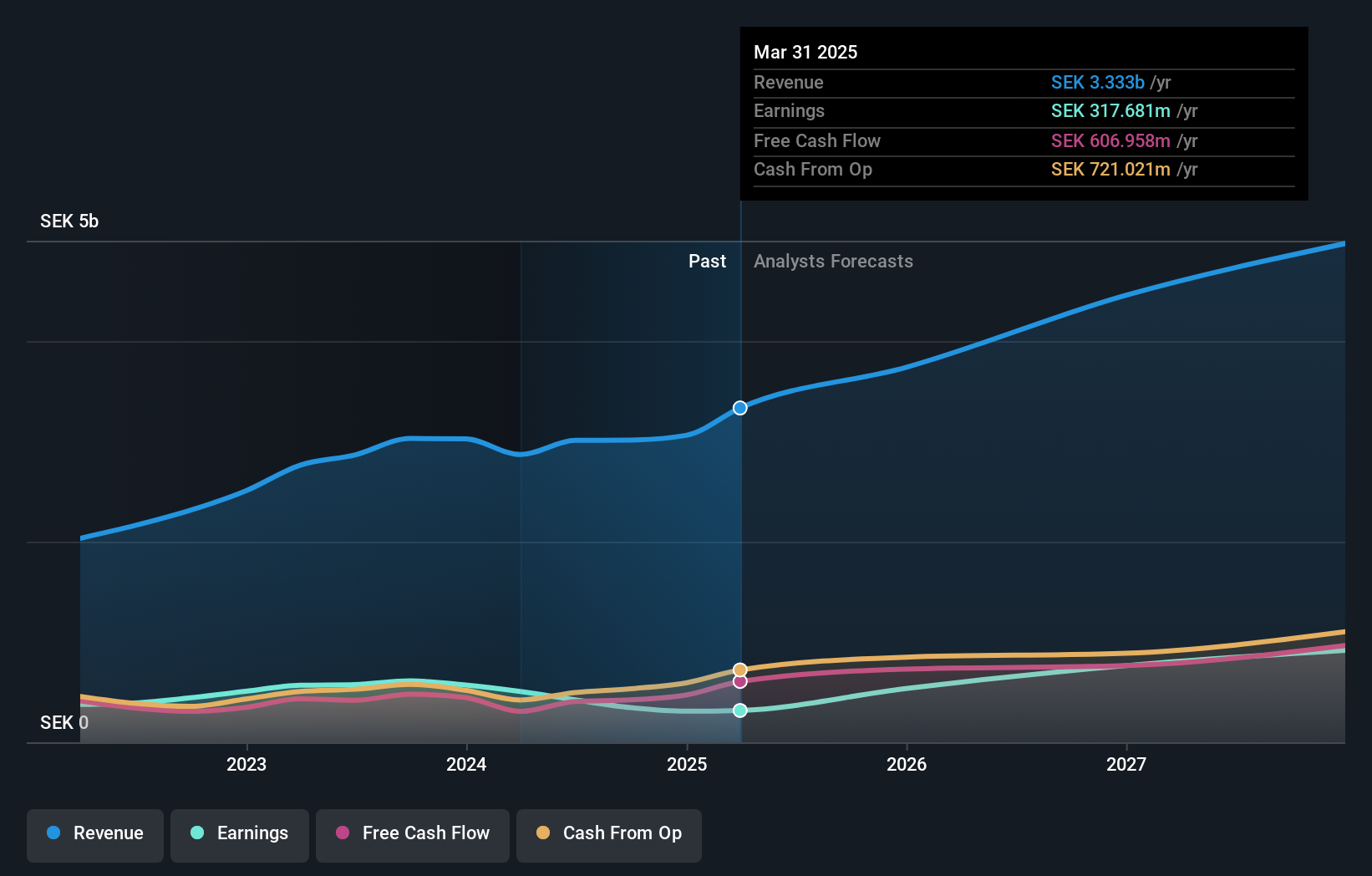

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK21.58 billion.

Operations: HMS Networks generates revenue through its products that enable communication and information sharing for industrial equipment worldwide.

Insider Ownership: 24.5%

HMS Networks, with notable insider ownership and minimal recent insider selling, is positioned for growth despite a decrease in profit margins from 17.6% to 9.5%. The company trades at 18.2% below estimated fair value, with earnings forecasted to grow significantly by 34.3% annually, outpacing the Swedish market average of 16.5%. Recent earnings reports show sales increased to SEK 890 million from SEK 616 million year-on-year; however, no dividend will be paid for the previous financial year.

- Click to explore a detailed breakdown of our findings in HMS Networks' earnings growth report.

- Our expertly prepared valuation report HMS Networks implies its share price may be too high.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★☆☆

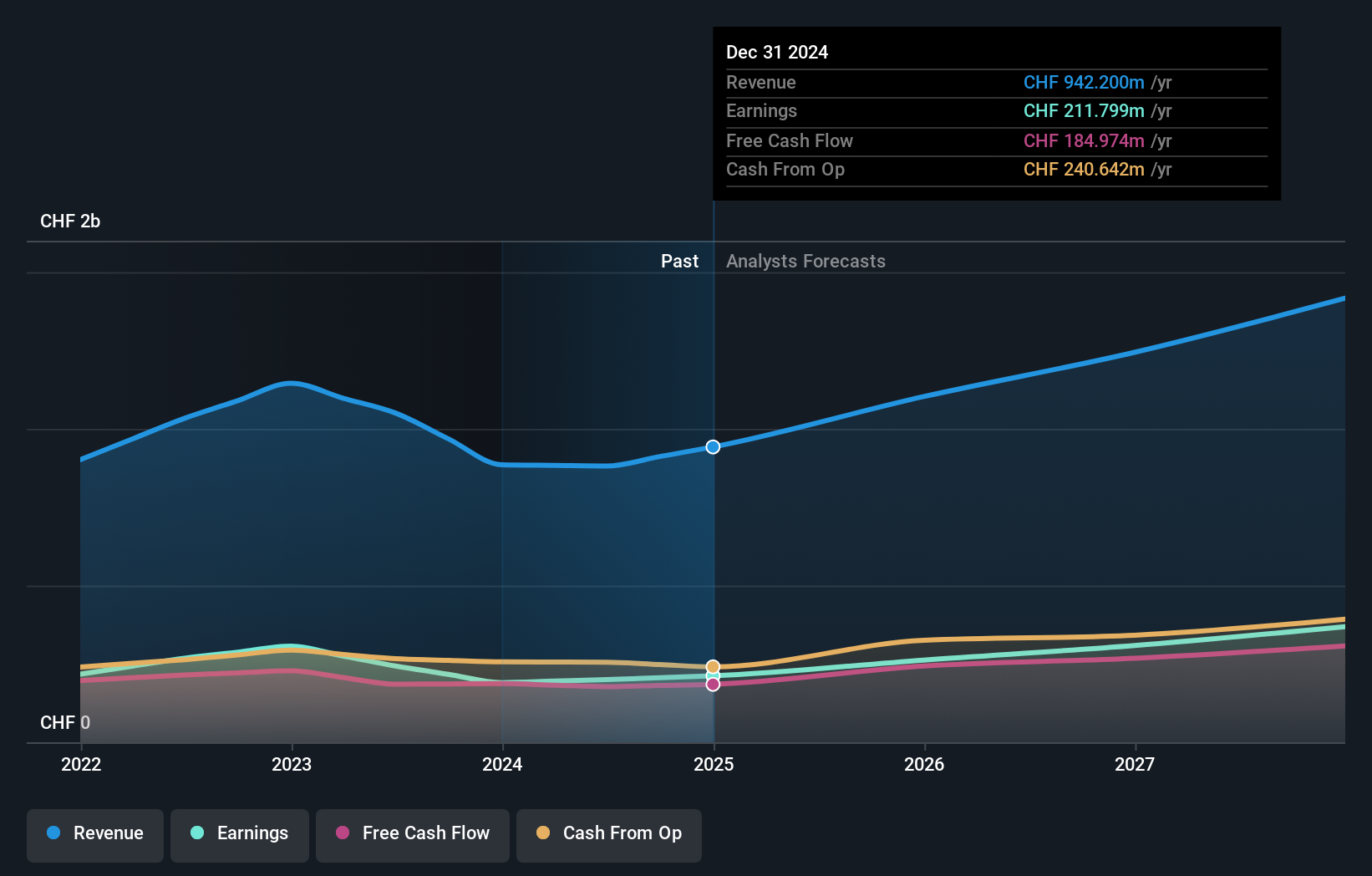

Overview: VAT Group AG, with a market cap of CHF9.05 billion, specializes in the development, manufacturing, and sale of vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows through its subsidiaries.

Operations: The company's revenue is primarily derived from its Valves segment, generating CHF842.76 million, and its Global Service segment, contributing CHF167.53 million.

Insider Ownership: 10.2%

VAT Group's high insider ownership aligns with its growth trajectory, despite a volatile share price recently. Its earnings grew by 11.3% last year, with forecasts suggesting further annual profit growth of 17.34%, outpacing the Swiss market average of 10.8%. The company trades slightly below its estimated fair value and reported CHF 942.2 million in sales for 2024, up from CHF 885.32 million the prior year, though dividend sustainability remains a concern due to cash flow coverage issues.

- Click here and access our complete growth analysis report to understand the dynamics of VAT Group.

- Insights from our recent valuation report point to the potential overvaluation of VAT Group shares in the market.

Key Takeaways

- Explore the 209 names from our Fast Growing European Companies With High Insider Ownership screener here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade HMS Networks, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HMS Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives