- Sweden

- /

- Electronic Equipment and Components

- /

- OM:HEXA B

Here's Why Hexagon (STO:HEXA B) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Hexagon (STO:HEXA B). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Hexagon

Hexagon's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Hexagon managed to grow EPS by 11% per year, over three years. That's a good rate of growth, if it can be sustained.

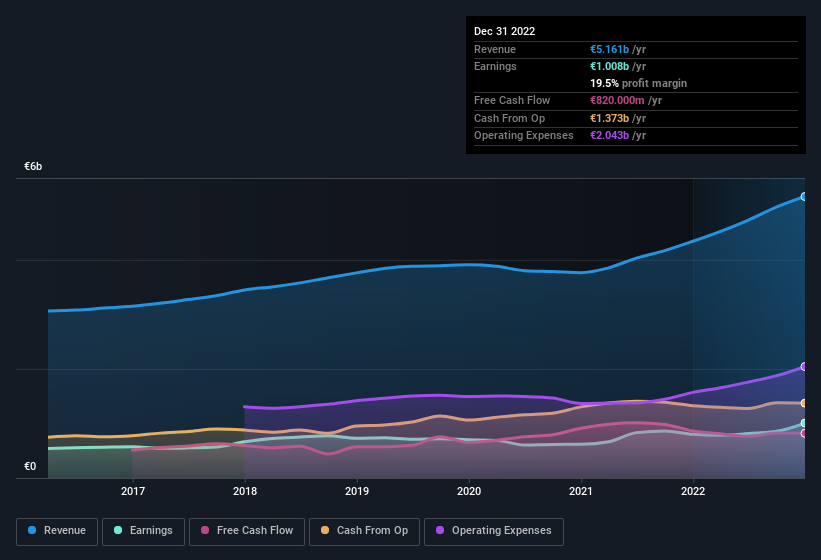

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Hexagon has done well over the past year, growing revenue by 19% to €5.2b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Hexagon's future profits.

Are Hexagon Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But the real excitement comes from the €956k that President of Asset Lifecycle Intelligence division Mattias Stenberg spent buying shares (at an average price of about €120). Strong buying like that could be a sign of opportunity.

The good news, alongside the insider buying, for Hexagon bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have €386m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Hexagon Worth Keeping An Eye On?

As previously touched on, Hexagon is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. If you think Hexagon might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

The good news is that Hexagon is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hexagon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HEXA B

Hexagon

Provides geospatial and industrial enterprise solutions worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives