What Can We Learn About Firefly's (STO:FIRE) CEO Compensation?

Lennart Jansson has been the CEO of Firefly AB (publ) (STO:FIRE) since 2000, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Firefly

How Does Total Compensation For Lennart Jansson Compare With Other Companies In The Industry?

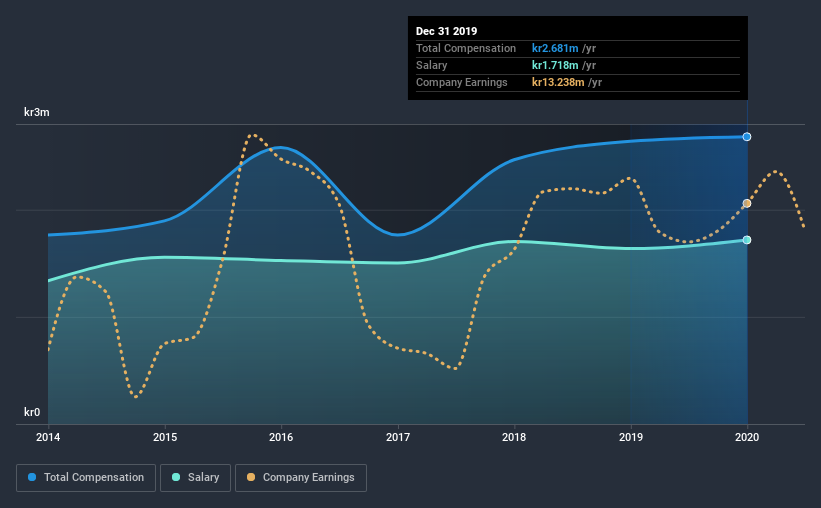

According to our data, Firefly AB (publ) has a market capitalization of kr342m, and paid its CEO total annual compensation worth kr2.7m over the year to December 2019. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at kr1.72m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below kr1.7b, reported a median total CEO compensation of kr3.4m. From this we gather that Lennart Jansson is paid around the median for CEOs in the industry. Moreover, Lennart Jansson also holds kr4.6m worth of Firefly stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | kr1.7m | kr1.6m | 64% |

| Other | kr963k | kr1.0m | 36% |

| Total Compensation | kr2.7m | kr2.6m | 100% |

Talking in terms of the industry, salary represented approximately 63% of total compensation out of all the companies we analyzed, while other remuneration made up 37% of the pie. Our data reveals that Firefly allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Firefly AB (publ)'s Growth Numbers

Firefly AB (publ)'s earnings per share (EPS) grew 52% per year over the last three years. In the last year, its revenue is up 3.0%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Firefly AB (publ) Been A Good Investment?

Boasting a total shareholder return of 66% over three years, Firefly AB (publ) has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As previously discussed, Lennart is compensated close to the median for companies of its size, and which belong to the same industry. Investors would surely be happy to see that returns have been great, and that EPS is up. So one could argue that CEO compensation is quite modest, if you consider company performance! In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Firefly (1 is concerning!) that you should be aware of before investing here.

Important note: Firefly is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Firefly, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:FIRE

Firefly

Develops and sells industrial fire prevention and protection systems for the process industry worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion