- Sweden

- /

- Electronic Equipment and Components

- /

- OM:FING B

The Market Doesn't Like What It Sees From Fingerprint Cards AB (publ)'s (STO:FING B) Revenues Yet As Shares Tumble 28%

Unfortunately for some shareholders, the Fingerprint Cards AB (publ) (STO:FING B) share price has dived 28% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 96% share price decline.

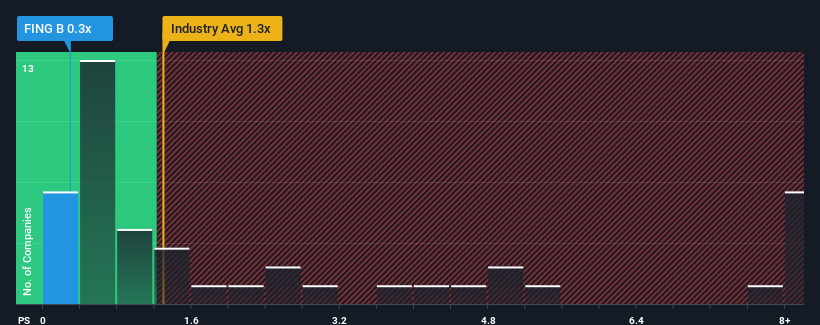

After such a large drop in price, Fingerprint Cards may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Electronic industry in Sweden have P/S ratios greater than 1.3x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Fingerprint Cards

How Has Fingerprint Cards Performed Recently?

Fingerprint Cards hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fingerprint Cards.Is There Any Revenue Growth Forecasted For Fingerprint Cards?

The only time you'd be truly comfortable seeing a P/S as low as Fingerprint Cards' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 1.5% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 51% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 32% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 6.8% growth, that's a disappointing outcome.

In light of this, it's understandable that Fingerprint Cards' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Fingerprint Cards' P/S Mean For Investors?

Fingerprint Cards' recently weak share price has pulled its P/S back below other Electronic companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Fingerprint Cards maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Fingerprint Cards' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Before you take the next step, you should know about the 3 warning signs for Fingerprint Cards (2 can't be ignored!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FING B

Fingerprint Cards

A biometrics company, engages in the development, production, and marketing of biometric systems in Sweden, France, Hong Kong, China, the United States, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives