- Sweden

- /

- Electronic Equipment and Components

- /

- OM:FING B

Fingerprint Cards AB (publ) (STO:FING B) Just Reported And Analysts Have Been Lifting Their Price Targets

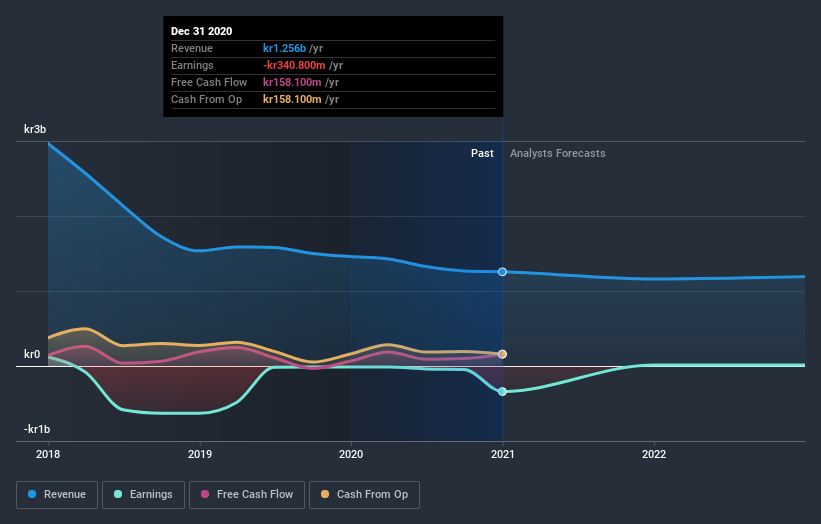

Shareholders will be ecstatic, with their stake up 25% over the past week following Fingerprint Cards AB (publ)'s (STO:FING B) latest full-year results. The results don't look great, especially considering that statutory losses grew 1,019% tokr1.10 per share. Revenues of kr1.3b did beat expectations by 7.3%, but it looks like a bit of a cold comfort. This is an important time for investors, as they can track a company's performance in its report, look at what expert is forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimate to see what could be in store for next year.

View our latest analysis for Fingerprint Cards

Following last week's earnings report, Fingerprint Cards' sole analyst are forecasting 2021 revenues to be kr1.26b, approximately in line with the last 12 months. Fingerprint Cards is also expected to turn profitable, with statutory earnings of kr0.013 per share. Yet prior to the latest earnings, the analyst had been anticipated revenues of kr1.16b and earnings per share (EPS) of kr0.045 in 2021. So it's pretty clear the analyst has mixed opinions on Fingerprint Cards after the latest results; even though they upped their revenue numbers, it came at the cost of a large cut to per-share earnings expectations.

Curiously, the consensus price target rose 237% to kr33.00. We can only conclude that the forecast revenue growth is expected to offset the impact of the expected fall in earnings.

Of course, another way to look at these forecasts is to place them into context against the industry itself. One thing that stands out from these estimates is that shrinking revenues are expected to moderate from the historical decline of 33% per annum over the past five years.

The Bottom Line

The biggest concern is that the analyst reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Fingerprint Cards. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. We note an upgrade to the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Fingerprint Cards , and understanding this should be part of your investment process.

If you’re looking to trade Fingerprint Cards, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:FING B

Fingerprint Cards

A high-technology company, engages in the development, production, and marketing of biometric systems and technologies in Sweden, France, Hong Kong, China, the United States, and internationally.

Flawless balance sheet and good value.