- Sweden

- /

- Communications

- /

- OM:ERIC B

Take Care Before Diving Into The Deep End On Telefonaktiebolaget LM Ericsson (publ) (STO:ERIC B)

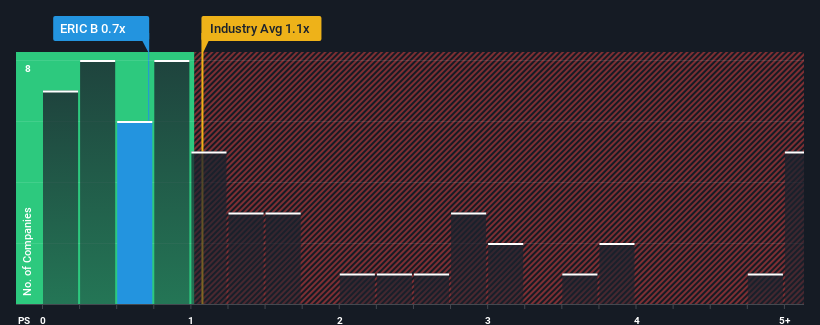

With a price-to-sales (or "P/S") ratio of 0.7x Telefonaktiebolaget LM Ericsson (publ) (STO:ERIC B) may be sending very bullish signals at the moment, given that almost half of all the Communications companies in Sweden have P/S ratios greater than 2.8x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Telefonaktiebolaget LM Ericsson

What Does Telefonaktiebolaget LM Ericsson's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Telefonaktiebolaget LM Ericsson's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Telefonaktiebolaget LM Ericsson.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Telefonaktiebolaget LM Ericsson's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.0%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 13% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.2% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 1.6% each year, which is not materially different.

With this in consideration, we find it intriguing that Telefonaktiebolaget LM Ericsson's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Telefonaktiebolaget LM Ericsson remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Telefonaktiebolaget LM Ericsson that you should be aware of.

If these risks are making you reconsider your opinion on Telefonaktiebolaget LM Ericsson, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions for telcom operators and enterprise customers in various sectors in North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives