Dustin Group (OM:DUST): Losses Grew 67.2% Annually, Profit Forecast Upswing Sets Stage Ahead of Earnings

Reviewed by Simply Wall St

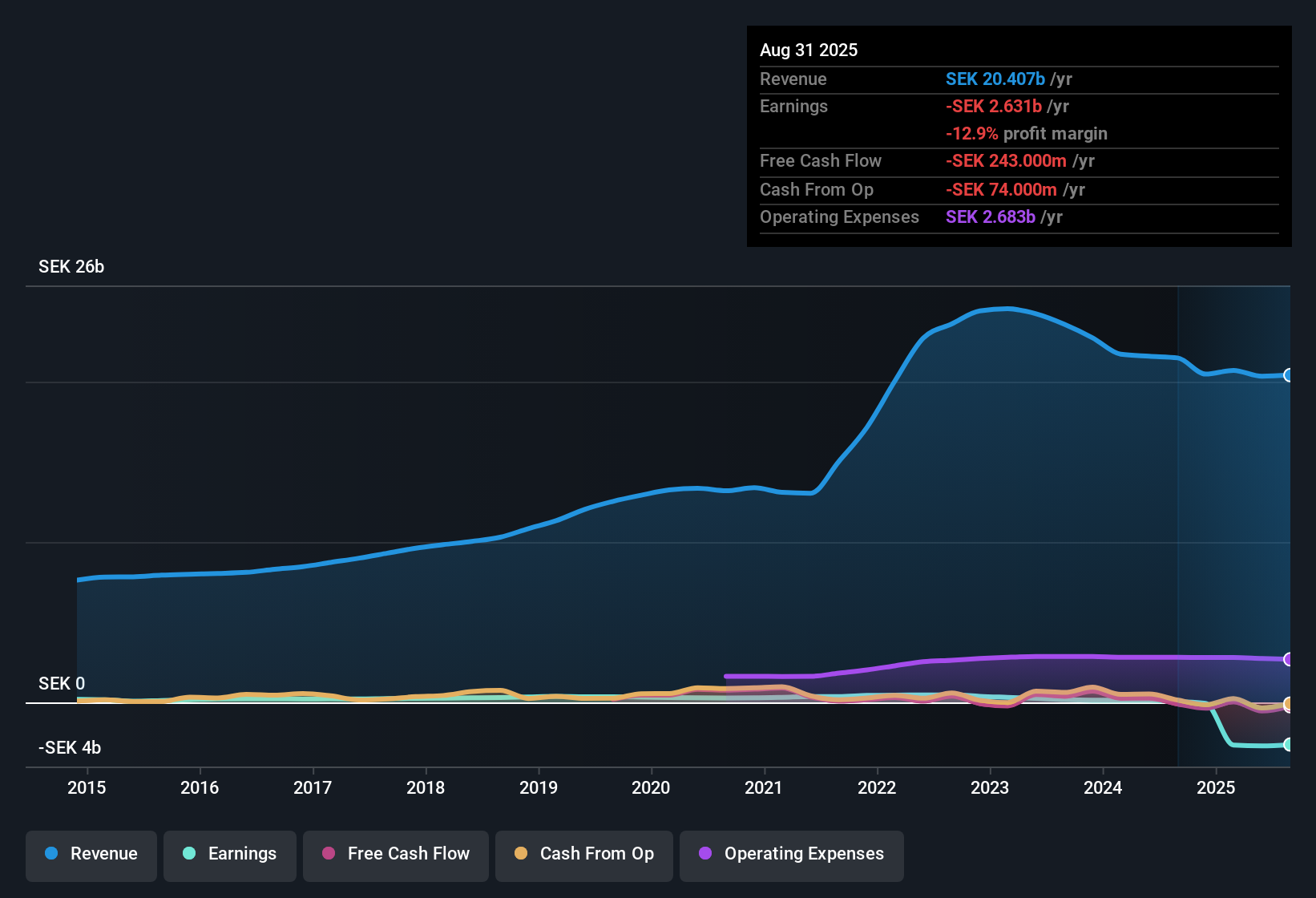

Dustin Group (OM:DUST) has seen losses deepen by 67.2% per year over the past five years, but the picture is beginning to shift. Earnings are forecast to jump 109.3% annually, putting the company on a path to profitability within the next three years. While revenue growth is projected at 4.2% per year, lagging the Swedish market’s 5%, the company trades at a Price-To-Sales Ratio of just 0.1x, well below peers. With shares at SEK2.05, significantly under an estimated fair value of SEK8.19, the focus is now on Dustin’s transition toward positive earnings and what that could mean for its valuation.

See our full analysis for Dustin Group.We’re taking these latest results and holding them up to the prevailing market narratives for Dustin. Expect some consensus, but also a few surprises as the numbers tell their own story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Accelerate, but Profitability Horizon Nears

- Dustin’s annual losses have deepened by 67.2% per year for the last five years. However, earnings are forecast to grow 109.3% annually, putting the company on track to reach profitability within three years.

- The projected swing to positive earnings within such a short timeframe heavily supports the view that Dustin’s operational strategies are gaining traction, even as historical losses challenge bullish investor confidence.

- Analysts expect that above-average future earnings growth could signal to bulls that the company’s turnaround is credible and not just wishful thinking.

- However, the pace of past losses serves as a warning that execution risks remain, with little margin for further missteps on the path to profitability.

Revenue Growth Trails Sector Momentum

- With revenue anticipated to grow at 4.2% per year, Dustin is forecast to lag behind the broader Swedish market’s 5% annual growth.

- The relatively modest sales outlook raises a tension with optimistic narratives that expect stronger revenue catalysts to accompany the company’s improving bottom line.

- Slower-than-market revenue expansion challenges aggressive growth cases and casts doubt on whether profitability will translate into share price outperformance.

- Still, the predicted return to profitability may temper some of these concerns if margin gains materialize even amid slower top-line growth.

Valuation Sits Far Below Industry Peers

- Dustin trades at a Price-To-Sales Ratio of 0.1x, which is significantly below the Swedish electronic industry’s 2x average and its peers’ 0.9x. Its SEK2.05 share price is considerably under the DCF fair value of 9.30.

- This steep valuation discount creates a scenario where investor patience may be rewarded if Dustin delivers on its profitability targets, as even incremental progress could lead to a major rerating.

- The wide gap below sector norms offers a margin of safety that could attract value-focused investors, particularly as risks appear limited by the absence of recent share dilution.

- The current undervaluation stands out even more given the improving losses trend and the short runway to projected profits.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Dustin Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Dustin’s slower-than-market revenue growth and history of deepening losses raise concerns about the sustainability and consistency of its long-term performance.

If steady results are your priority, focus on stable growth stocks screener to find companies consistently delivering reliable growth and earnings regardless of changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DUST

Dustin Group

Engages in online information technology business in Sweden, Finland, Denmark, the Netherlands, Norway, and Belgium.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)