Further weakness as LC-Tec Holding (NGM:LCT) drops 38% this week, taking one-year losses to 42%

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the LC-Tec Holding AB (publ) (NGM:LCT) share price is down 63% in the last year. That's disappointing when you consider the market returned 21%. We note that it has not been easy for shareholders over three years, either; the share price is down 60% in that time. The last week also saw the share price slip down another 38%.

With the stock having lost 38% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for LC-Tec Holding

Because LC-Tec Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

LC-Tec Holding grew its revenue by 84% over the last year. That's a strong result which is better than most other loss making companies. In contrast the share price is down 63% over twelve months. Yes, the market can be a fickle mistress. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). Generally speaking investors would consider a stock like this less risky once it turns a profit. But when do you think that will happen?

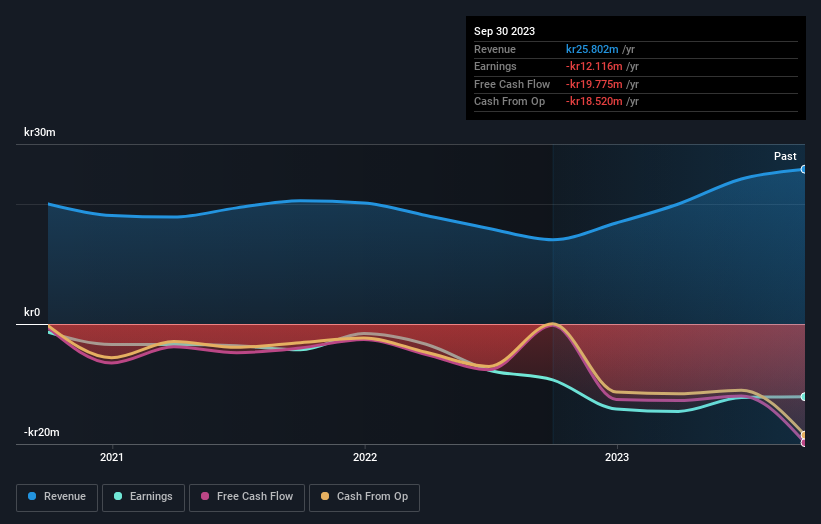

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling LC-Tec Holding stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered LC-Tec Holding's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. LC-Tec Holding hasn't been paying dividends, but its TSR of -42% exceeds its share price return of -63%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 21% in the last year, LC-Tec Holding shareholders lost 42%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand LC-Tec Holding better, we need to consider many other factors. Take risks, for example - LC-Tec Holding has 5 warning signs (and 3 which are significant) we think you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NGM:LCT

LC-Tec Holding

Designs, manufactures, and sells liquid crystal (LC)-based products in Sweden and internationally.

Medium-low with mediocre balance sheet.

Market Insights

Community Narratives