Top Swedish Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

As global markets react to the recent Federal Reserve rate cut, investors are closely watching European indices for signs of stability and growth. In this context, Sweden's market has shown resilience, making it an opportune time to explore growth companies with high insider ownership. High insider ownership often indicates strong confidence from those closest to the company, which can be particularly appealing during periods of economic adjustment and market volatility.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.2% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Below we spotlight a couple of our favorites from our exclusive screener.

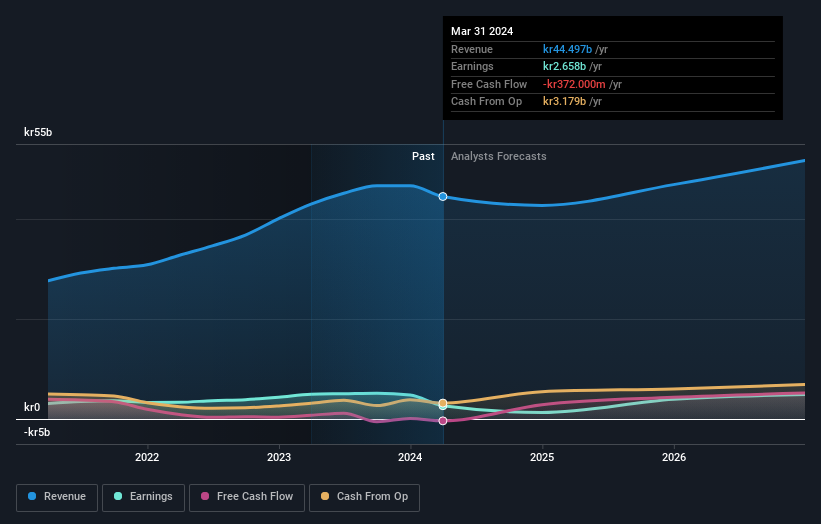

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) and its subsidiaries develop, manufacture, market, and sell energy-efficient solutions for indoor climate comfort as well as components and solutions for intelligent heating and control across the Nordic countries, Europe, North America, and internationally; the company has a market cap of SEK111.69 billion.

Operations: Revenue segments for NIBE Industrier AB (publ) include SEK5.33 billion from Stoves, SEK13.48 billion from Element, and SEK35.22 billion from Climate Solutions.

Insider Ownership: 20.2%

NIBE Industrier, a Swedish growth company with high insider ownership, faces mixed prospects. Despite a significant forecasted annual earnings growth of 42.55%, recent financials show declining performance with Q2 sales at SEK 10.04 billion, down from SEK 11.83 billion last year, and net income plummeting to SEK 219 million from SEK 1.32 billion. Revenue is expected to grow slower than the ideal rate but faster than the Swedish market average at 6.8% per year.

- Click here and access our complete growth analysis report to understand the dynamics of NIBE Industrier.

- The valuation report we've compiled suggests that NIBE Industrier's current price could be inflated.

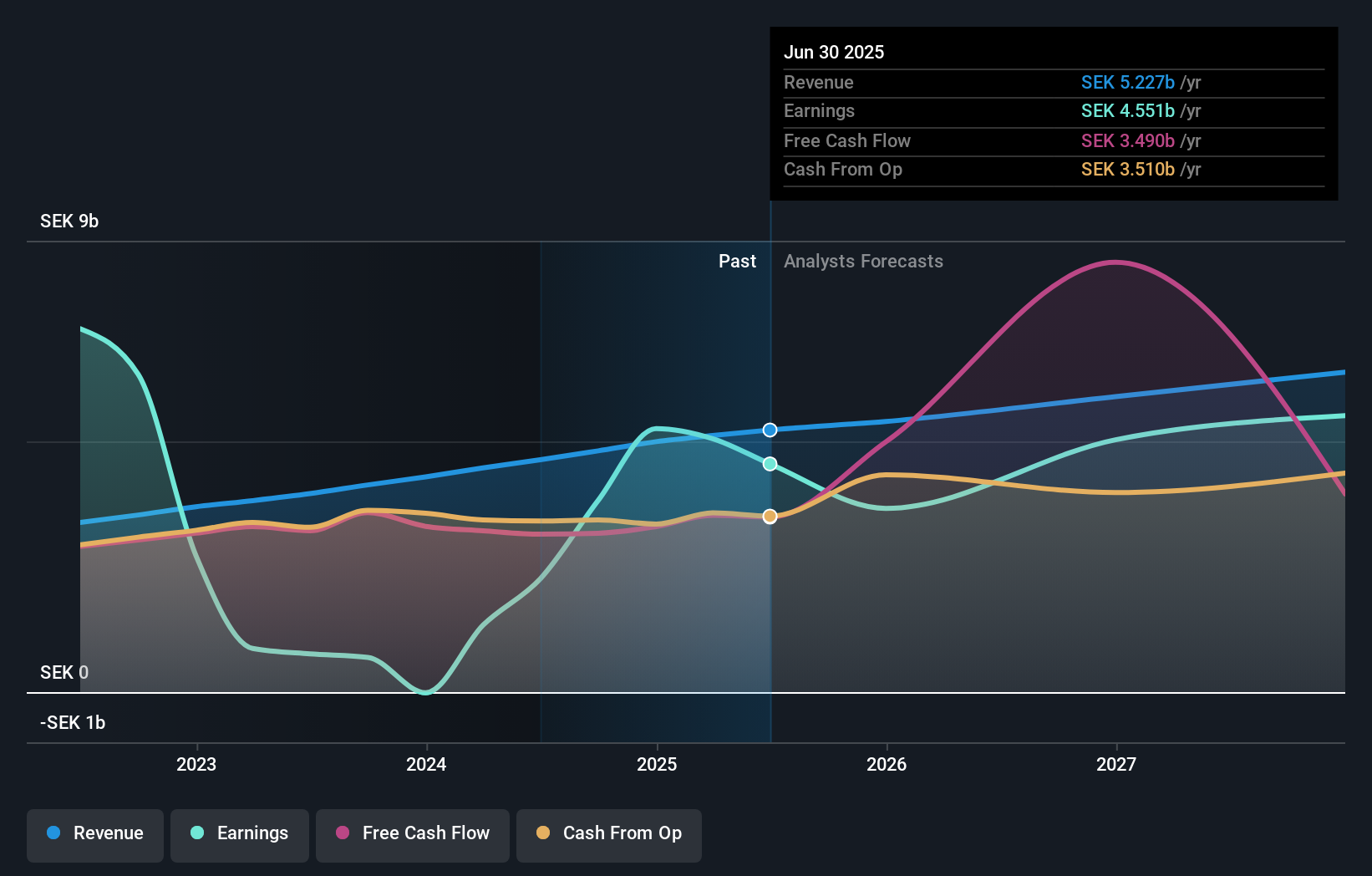

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany and other European countries with a market cap of SEK100.28 billion.

Operations: AB Sagax generates SEK4.63 billion in revenue from its Real Estate - Rental segment.

Insider Ownership: 28.6%

AB Sagax, a Swedish growth company with high insider ownership, shows promising earnings prospects despite some concerns. Earnings are forecast to grow 29.07% annually over the next three years, significantly outpacing the Swedish market's average growth rate of 15%. However, shareholders faced dilution in the past year and debt coverage by operating cash flow remains inadequate. Recent financials reveal strong performance with Q2 sales at SEK 1.20 billion and net income surging to SEK 978 million from SEK 53 million last year.

- Navigate through the intricacies of AB Sagax with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that AB Sagax's share price might be on the expensive side.

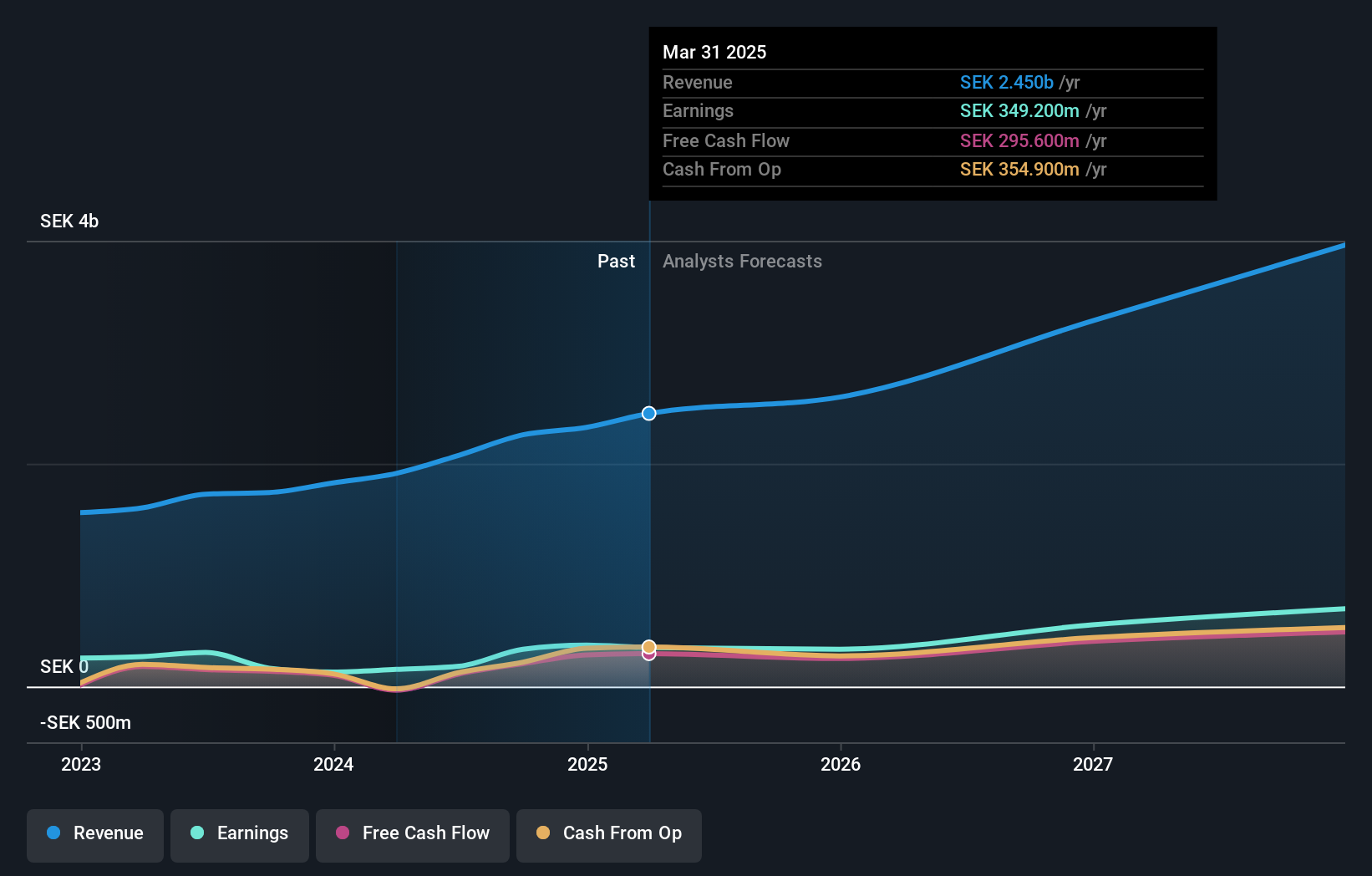

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services, with a market cap of SEK22.00 billion.

Operations: Yubico's revenue from Security Software & Services is SEK2.09 billion.

Insider Ownership: 37.5%

Yubico's earnings are expected to grow 42.35% annually, significantly outpacing the Swedish market's average of 15%. Despite high volatility in its share price and lower profit margins (9.3%) compared to last year (17.8%), the company shows strong revenue growth, with recent Q2 sales at SEK 614.4 million and net income at SEK 103.6 million. The recent appointment of a new Nomination Committee reflects substantial insider ownership, potentially aligning management interests with shareholders'.

- Take a closer look at Yubico's potential here in our earnings growth report.

- The analysis detailed in our Yubico valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Click here to access our complete index of 91 Fast Growing Swedish Companies With High Insider Ownership.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Exceptional growth potential with excellent balance sheet.