As global markets react to the recent U.S. election results, with major benchmarks reaching new highs on expectations of growth-friendly policies, investors are closely watching how these developments might impact inflation and interest rates. Amid this backdrop, stocks with high insider ownership offer a compelling angle for growth-focused investors, as they often signal strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

Here's a peek at a few of the choices from the screener.

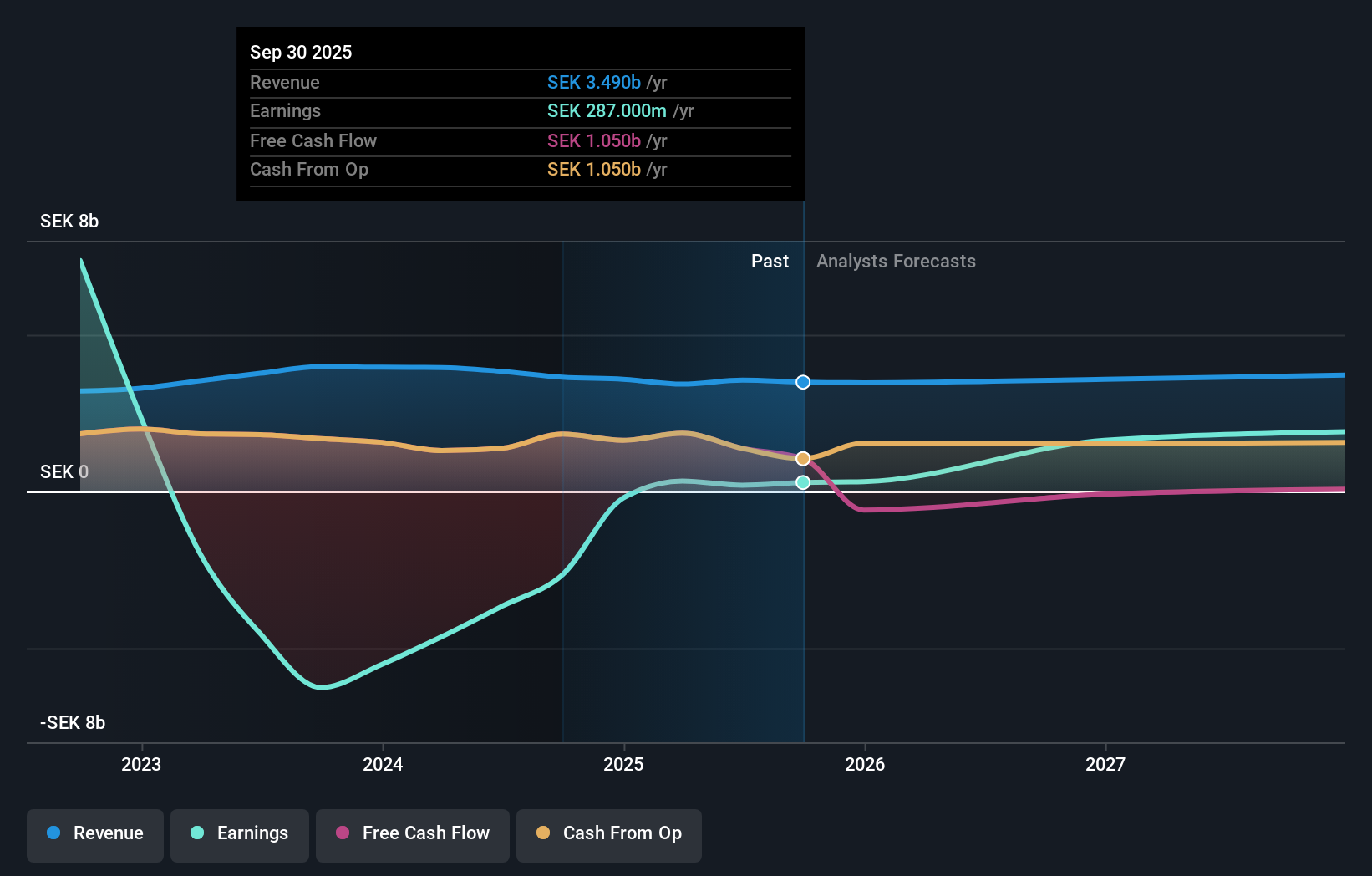

Fabege (OM:FABG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fabege AB (publ) is a property company that specializes in the development, investment, and management of commercial premises in Sweden, with a market cap of SEK27.02 billion.

Operations: The company's revenue segments include Management at SEK3.05 billion, Birger Bostad at SEK319 million, Improvement at SEK253 million, and Project at SEK26 million.

Insider Ownership: 26%

Fabege AB's recent earnings report shows a significant improvement, with net income of SEK 14 million for Q3 2024 compared to a substantial loss the previous year. Despite modest revenue growth forecasts of 2.8% annually, which surpasses the Swedish market average, insider ownership remains high with more shares bought than sold recently. However, challenges include low return on equity projections and interest payments not well covered by earnings, impacting financial stability.

- Click here and access our complete growth analysis report to understand the dynamics of Fabege.

- In light of our recent valuation report, it seems possible that Fabege is trading beyond its estimated value.

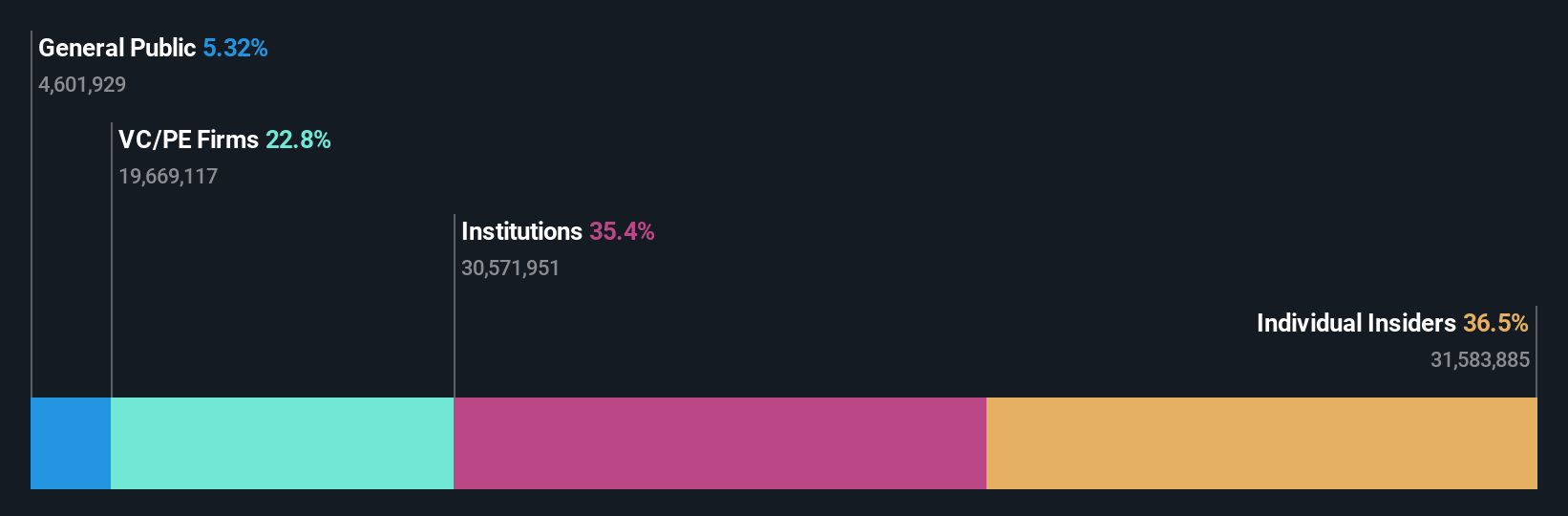

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services and has a market cap of SEK23.04 billion.

Operations: The company generates revenue of SEK2.09 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Yubico's strong growth trajectory is underscored by expected annual earnings growth of over 42%, significantly outpacing the Swedish market. Revenue is also projected to grow at a robust rate, exceeding 20% annually. Despite recent volatility in its share price and lower profit margins compared to last year, Yubico remains strategically positioned with high insider ownership. Recent partnerships, like with PKO Bank Polski for secure authentication solutions, highlight its expanding market influence and product relevance.

- Click here to discover the nuances of Yubico with our detailed analytical future growth report.

- Our valuation report unveils the possibility Yubico's shares may be trading at a premium.

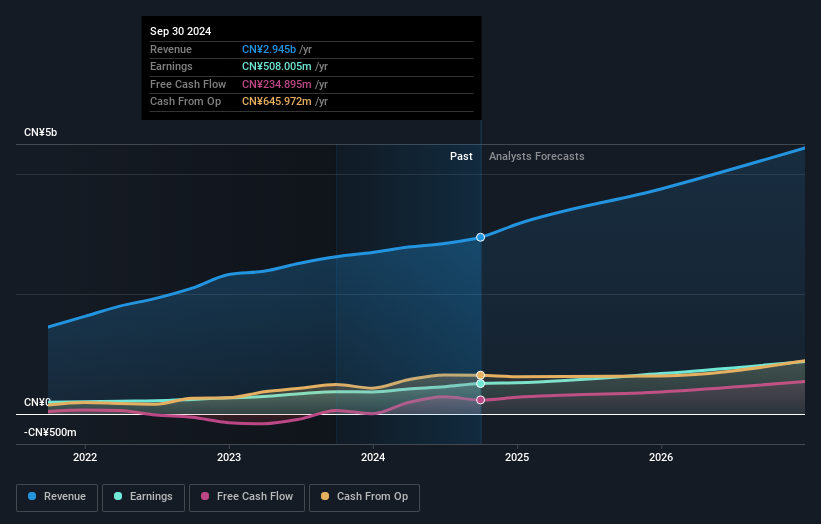

Hunan Jiudian Pharmaceutical (SZSE:300705)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. engages in the research, development, production, and sale of pharmaceutical products both in China and internationally, with a market cap of CN¥12.09 billion.

Operations: The company's revenue is primarily derived from its Medicine Manufacturing segment, which generated CN¥2.95 billion.

Insider Ownership: 14.9%

Hunan Jiudian Pharmaceutical's growth prospects are highlighted by its forecasted earnings increase of 25.5% annually, although slightly below the Chinese market average. Revenue growth is projected at 18.1% per year, surpassing the market rate but under 20%. Recent financials show substantial progress, with nine-month sales reaching CNY 2.15 billion and net income rising to CNY 449.73 million from CNY 309.99 million last year, reflecting solid operational performance despite an unstable dividend history.

- Delve into the full analysis future growth report here for a deeper understanding of Hunan Jiudian Pharmaceutical.

- According our valuation report, there's an indication that Hunan Jiudian Pharmaceutical's share price might be on the cheaper side.

Seize The Opportunity

- Investigate our full lineup of 1530 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Jiudian Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300705

Hunan Jiudian Pharmaceutical

Researches, develops, produces, and sells pharmaceutical products in China and internationally.

Very undervalued with flawless balance sheet.