- Switzerland

- /

- Semiconductors

- /

- SWX:UBXN

European Stocks: Uncovering 3 Companies Estimated Below Intrinsic Value

Reviewed by Simply Wall St

Amid heightened global trade tensions and a sharp decline in European stock indices, the pan-European STOXX Europe 600 Index recently experienced its most significant drop in five years due to unexpected U.S. tariffs. As investors navigate this volatile environment, identifying stocks that are estimated to be trading below their intrinsic value can present opportunities for those looking to capitalize on potential market mispricings.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mips (OM:MIPS) | SEK343.60 | SEK684.22 | 49.8% |

| Etteplan Oyj (HLSE:ETTE) | €10.90 | €21.62 | 49.6% |

| Stille (OM:STIL) | SEK203.00 | SEK403.54 | 49.7% |

| 3U Holding (XTRA:UUU) | €1.41 | €2.78 | 49.3% |

| SFC Energy (XTRA:F3C) | €18.88 | €37.21 | 49.3% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.3299 | €0.65 | 49.2% |

| Dino Polska (WSE:DNP) | PLN439.70 | PLN875.60 | 49.8% |

| PSI Software (XTRA:PSAN) | €22.50 | €44.68 | 49.6% |

| Siemens Energy (XTRA:ENR) | €48.56 | €96.39 | 49.6% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.45 | €6.80 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

Troax Group (OM:TROAX)

Overview: Troax Group AB (publ) is a company that manufactures and distributes mesh panels across various regions including the Nordic countries, the United Kingdom, North America, Continental Europe, and globally; it has a market cap of SEK9.48 billion.

Operations: The company's revenue segment is primarily composed of mesh panels, generating €278.50 million.

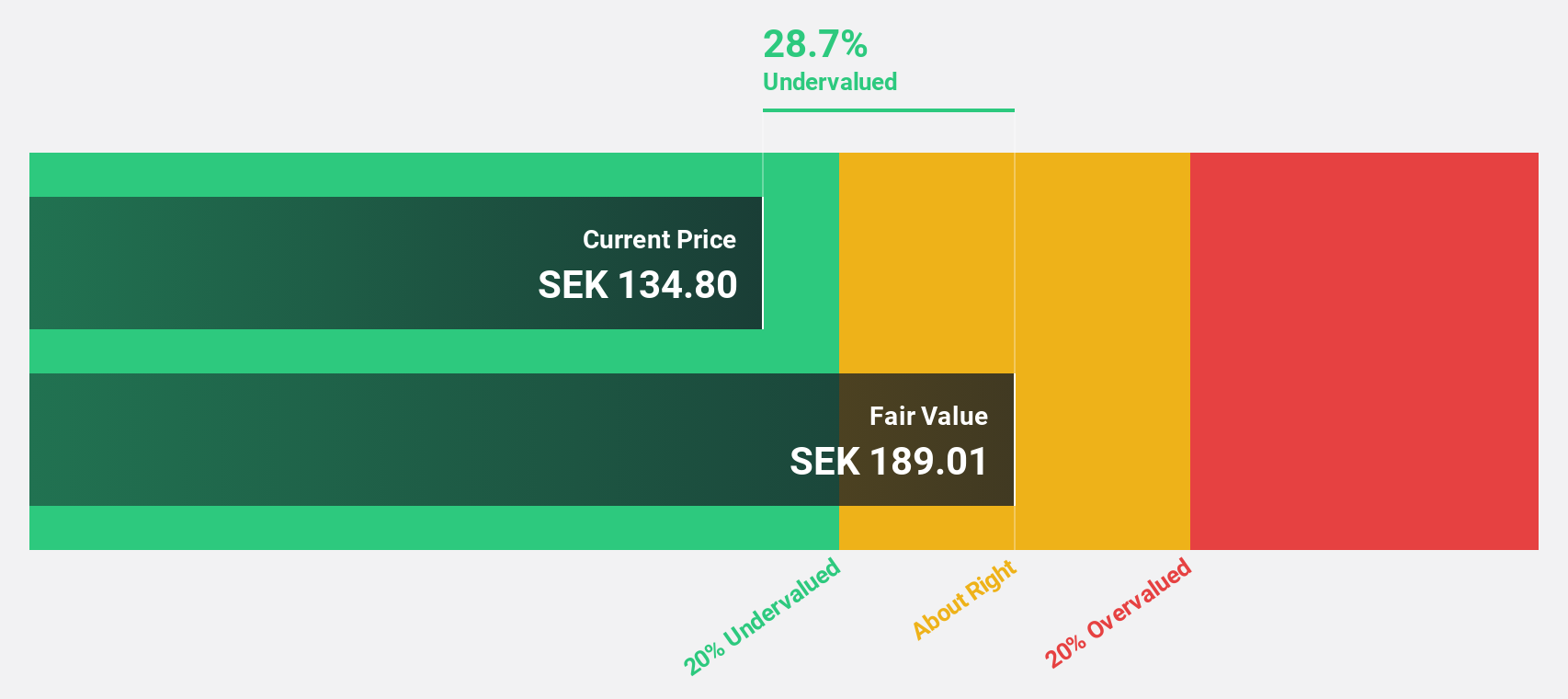

Estimated Discount To Fair Value: 29.1%

Troax Group is trading at SEK158.4, significantly below its estimated fair value of SEK223.41, indicating potential undervaluation based on discounted cash flow analysis. Despite a slight decline in net income for 2024, the company maintains a stable revenue growth forecast of 8.9% annually, surpassing the Swedish market average. Troax's earnings are expected to grow by 19.1% per year, outpacing the market and supporting analyst consensus for a price increase of nearly 58%.

- According our earnings growth report, there's an indication that Troax Group might be ready to expand.

- Take a closer look at Troax Group's balance sheet health here in our report.

Yubico (OM:YUBICO)

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK14.77 billion.

Operations: The company's revenue segment is Security Software & Services, totaling SEK2.33 billion.

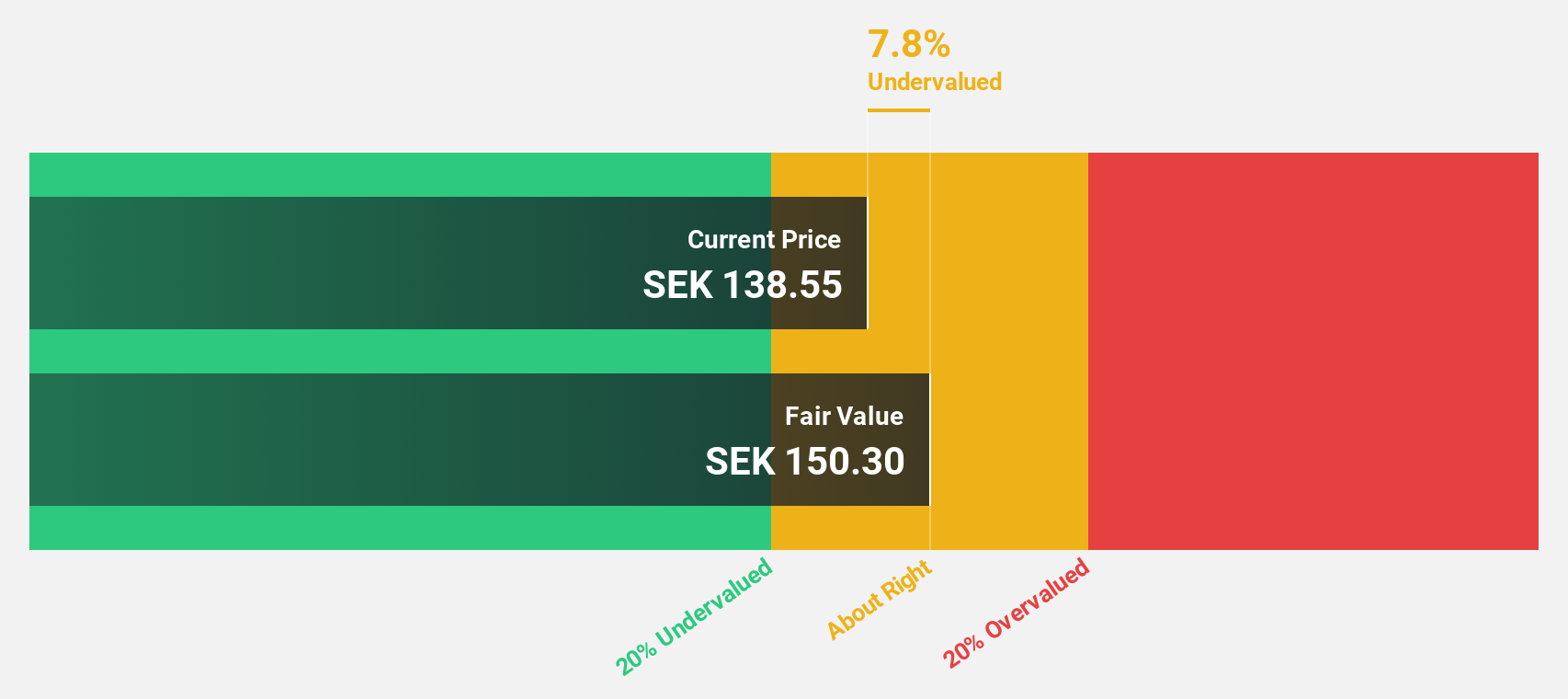

Estimated Discount To Fair Value: 13.2%

Yubico, trading at SEK171.2, is valued below its estimated fair value of SEK197.33 based on discounted cash flow analysis. The company reports robust revenue and earnings growth forecasts of 20.9% and 26.7% annually, respectively, outpacing the Swedish market averages. Recent earnings showed increased sales and net income year-over-year, while strategic partnerships like the T-Mobile deployment enhance its position in cybersecurity solutions amidst executive transitions with a new CFO search underway.

- Our earnings growth report unveils the potential for significant increases in Yubico's future results.

- Navigate through the intricacies of Yubico with our comprehensive financial health report here.

u-blox Holding (SWX:UBXN)

Overview: u-blox Holding AG develops, manufactures, and markets products and services for GPS/GNSS satellite positioning systems across various sectors including automotive, healthcare, and industrial automation with a market capitalization of CHF491 million.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, totaling CHF262.88 million.

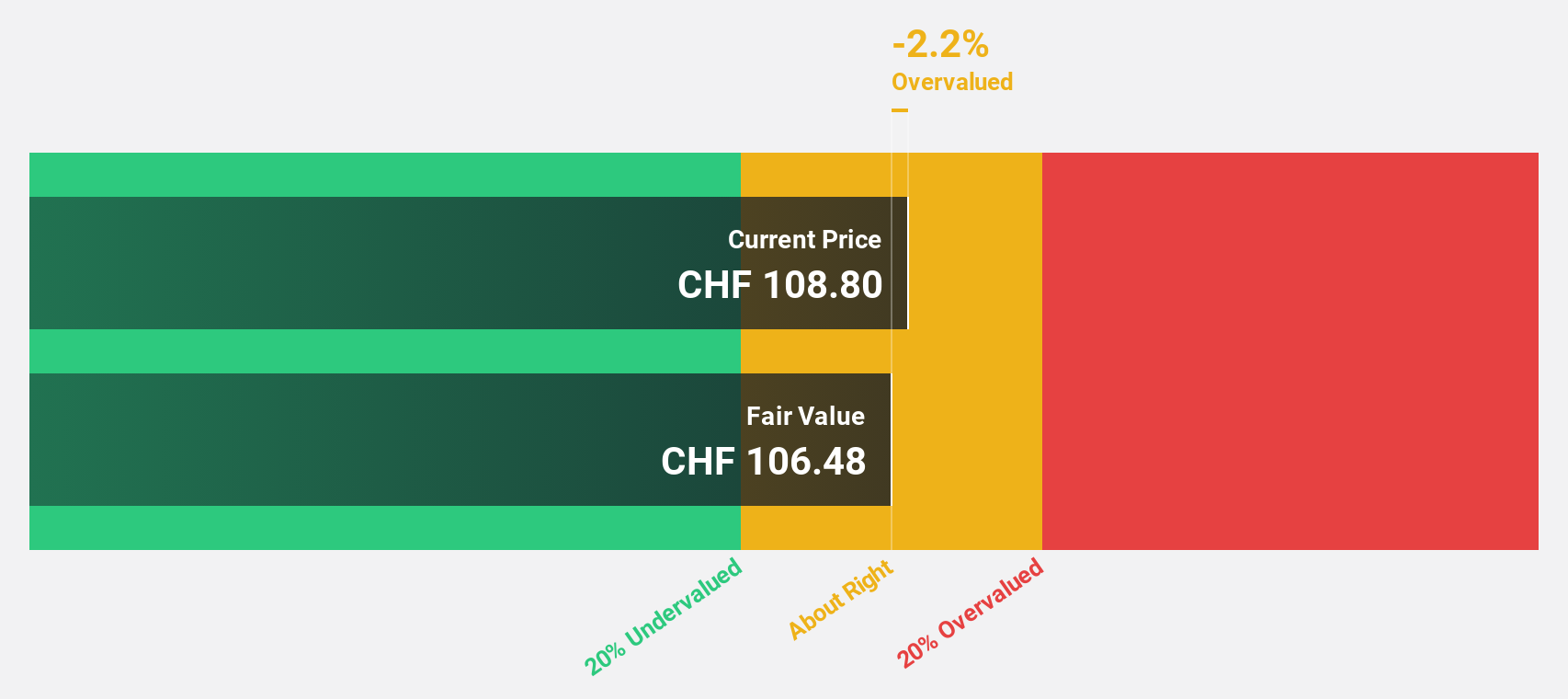

Estimated Discount To Fair Value: 36.1%

u-blox Holding is trading at CHF 65.8, significantly below its estimated fair value of CHF 103.02, suggesting it may be undervalued based on cash flows. Despite a challenging year with sales dropping to CHF 262.88 million and a net loss of CHF 88.91 million, the company expects profitability within three years and forecasts revenue growth of 18% annually, outpacing the Swiss market average. Collaborations like the one with Intel support its strategic positioning in advanced telecommunications solutions.

- Our growth report here indicates u-blox Holding may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in u-blox Holding's balance sheet health report.

Next Steps

- Navigate through the entire inventory of 189 Undervalued European Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if u-blox Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UBXN

u-blox Holding

Develops, manufactures, and markets products and services supporting GPS/GNSS satellite positioning systems for the automotive and transport, healthcare, asset tracking and management, industrial automation and monitoring, and consumer markets.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives