- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

European Growth Companies With Insider Ownership Up To 36%

Reviewed by Simply Wall St

As the European markets navigate a landscape of mixed performances and monetary policy decisions, investors are keenly assessing growth opportunities amid these shifting economic conditions. In this environment, companies with high insider ownership often attract attention, as such stakes can indicate confidence in the company's potential to thrive despite broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.8% |

| KebNi (OM:KEBNI B) | 38% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 13.3% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's uncover some gems from our specialized screener.

Paratus Energy Services (OB:PLSV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paratus Energy Services Ltd. operates through its subsidiaries to provide drilling services with a fleet of jack-up rigs under contracts in Mexico, and has a market cap of NOK6.73 billion.

Operations: The company's revenue segments include Fontis generating $176 million and Seagems contributing $209.20 million.

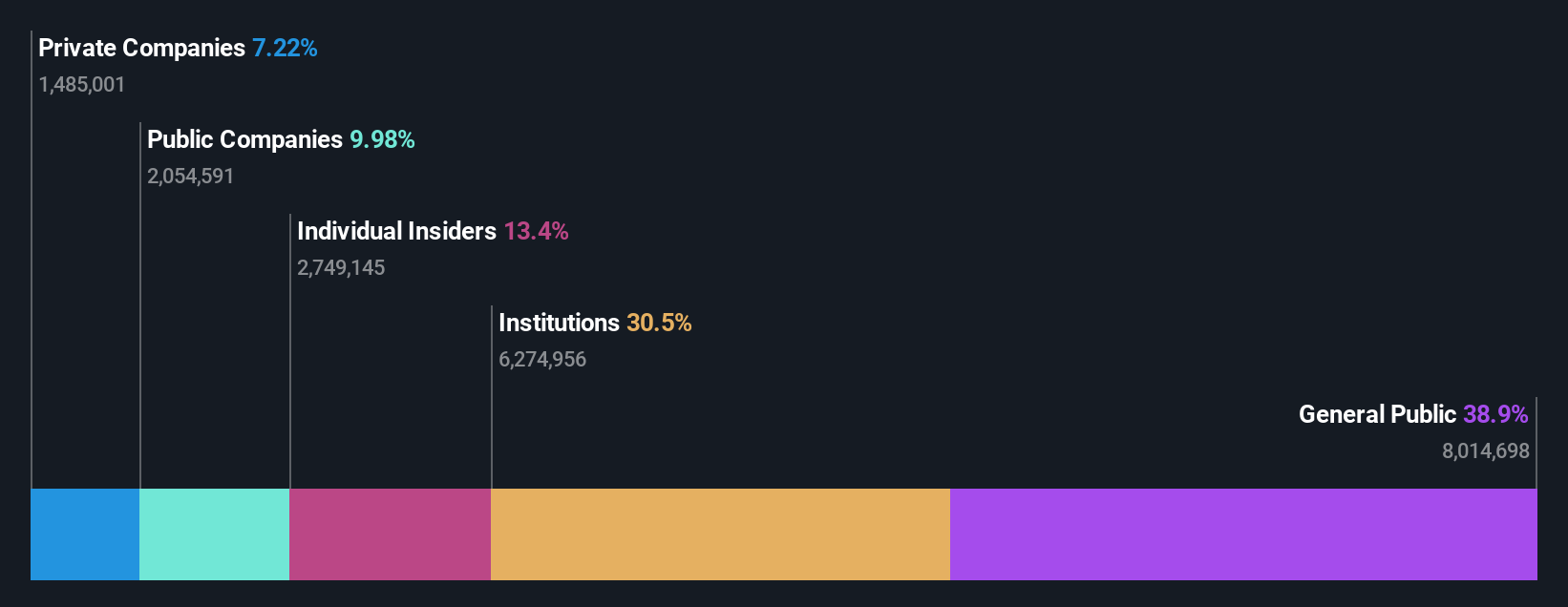

Insider Ownership: 30.3%

Paratus Energy Services, with substantial insider ownership, is positioned for significant profit growth, forecasted at 53.07% annually. Despite a recent decline in sales and net income—US$35.2 million and US$5.6 million respectively for Q2 2025—the company is trading at a notable discount to its estimated fair value. Recent share buybacks totaling US$24.8 million reflect management's confidence in long-term prospects, though revenue growth remains modest at an expected 3.8% per year.

- Unlock comprehensive insights into our analysis of Paratus Energy Services stock in this growth report.

- Our valuation report here indicates Paratus Energy Services may be undervalued.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK11.27 billion.

Operations: The company's revenue is derived entirely from its Security Software & Services segment, amounting to SEK2.34 billion.

Insider Ownership: 36.6%

Yubico, with significant insider ownership and no substantial insider selling recently, is poised for notable growth. Despite a decline in Q2 2025 sales to SEK 499.1 million and net income to SEK 8.9 million, the company's earnings are forecasted to grow significantly at 33.06% annually, outpacing the Swedish market's expected growth of 16.5%. Revenue is anticipated to increase by 15.5% per year, indicating robust potential despite recent financial challenges.

- Navigate through the intricacies of Yubico with our comprehensive analyst estimates report here.

- The analysis detailed in our Yubico valuation report hints at an inflated share price compared to its estimated value.

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates an online pharmacy business across several European countries, including the Netherlands, Germany, and France, with a market cap of €1.61 billion.

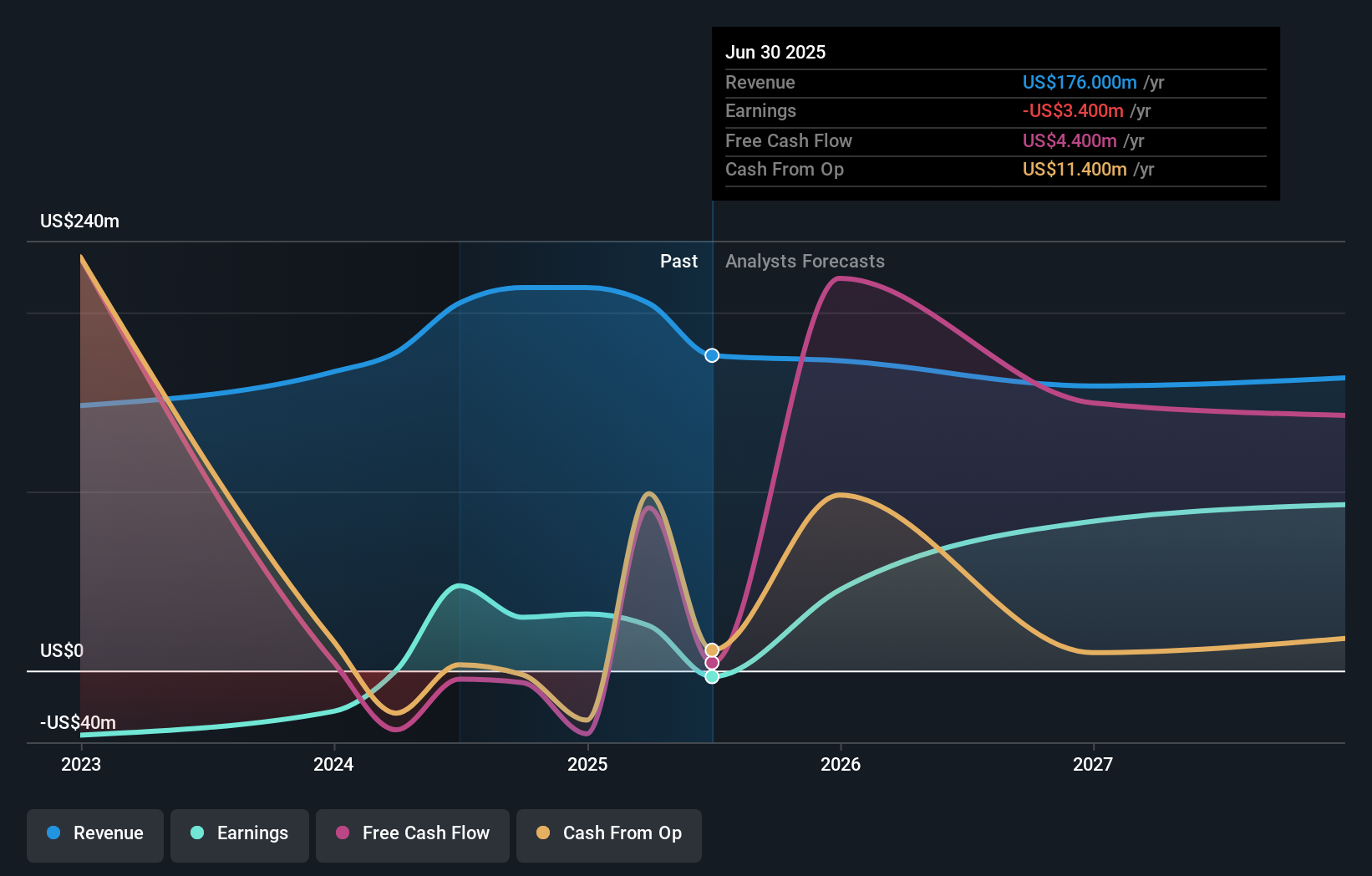

Operations: The company's revenue is divided into two segments: DACH, contributing €2.18 billion, and International, generating €492.32 million.

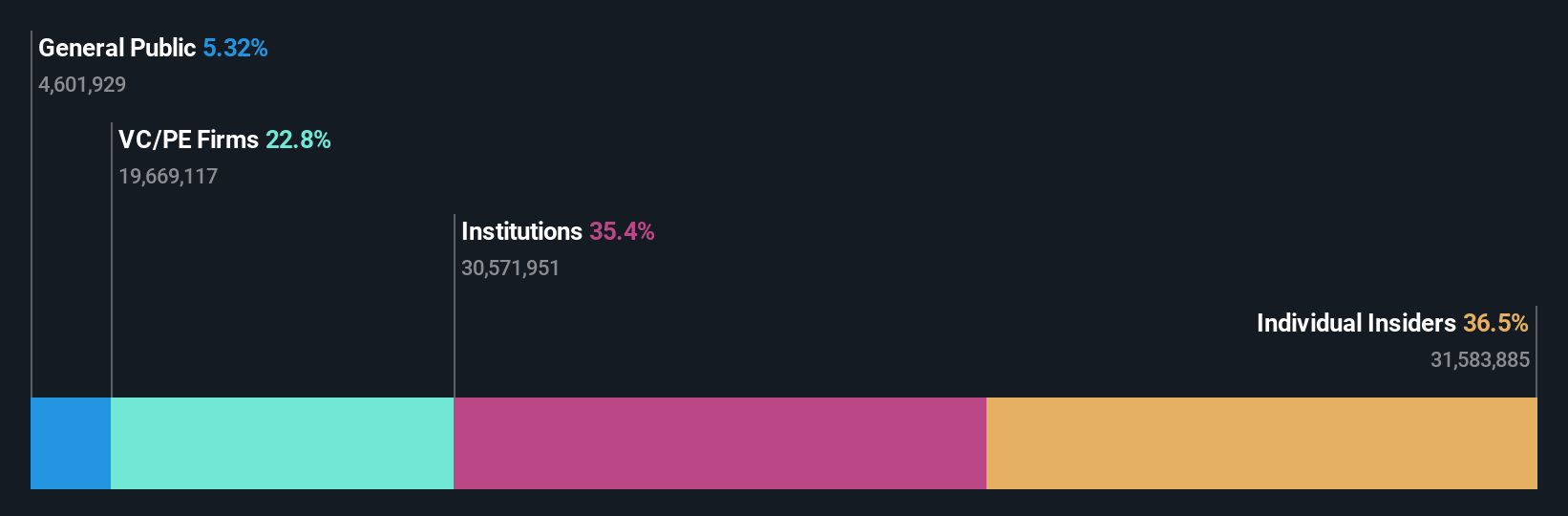

Insider Ownership: 13.5%

Redcare Pharmacy, with substantial insider ownership and more shares bought than sold recently, is forecasted to grow earnings by 54.47% annually, surpassing the German market's growth rate. Despite recent share price volatility and insider selling, the company reported significant sales growth of 26.4% in Q2 2025 to €709 million. Expected revenue growth of 15.9% per year indicates strong potential as it navigates regulatory advancements like the CardLink extension in Germany's e-prescription market until January 2027.

- Delve into the full analysis future growth report here for a deeper understanding of Redcare Pharmacy.

- According our valuation report, there's an indication that Redcare Pharmacy's share price might be on the expensive side.

Key Takeaways

- Embark on your investment journey to our 218 Fast Growing European Companies With High Insider Ownership selection here.

- Seeking Other Investments? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates the online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives