- Canada

- /

- Metals and Mining

- /

- TSX:MND

3 Stocks Estimated To Be Up To 49.6% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to navigate the evolving economic landscape, U.S. stocks are reaching new record highs fueled by optimism over potential trade deals and advancements in artificial intelligence. Amidst this buoyant environment, investors are increasingly on the lookout for undervalued stocks that could offer significant upside potential. In today's market, identifying a good stock often involves assessing its intrinsic value compared to its current market price, especially when broader indices are performing well.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.73 | 49.8% |

| Berkshire Hills Bancorp (NYSE:BHLB) | US$28.32 | US$56.60 | 50% |

| Guangdong Mingyang ElectricLtd (SZSE:301291) | CN¥50.90 | CN¥101.71 | 50% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| Vertiseit (OM:VERT B) | SEK50.20 | SEK99.93 | 49.8% |

| TF Bank (OM:TFBANK) | SEK377.00 | SEK750.28 | 49.8% |

| J Trust (TSE:8508) | ¥521.00 | ¥1039.68 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.03 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5862.00 | ¥11678.51 | 49.8% |

| Tenable Holdings (NasdaqGS:TENB) | US$43.39 | US$86.65 | 49.9% |

Let's uncover some gems from our specialized screener.

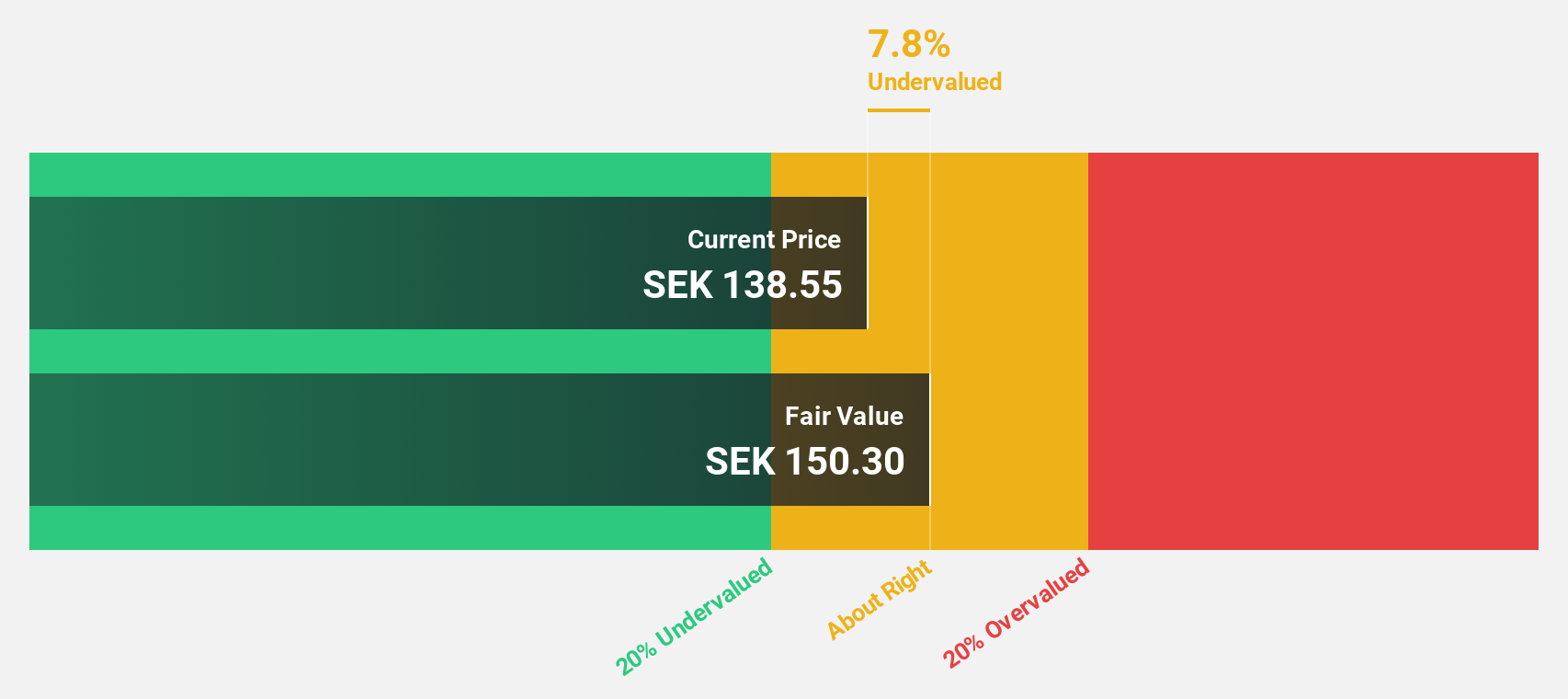

Yubico (OM:YUBICO)

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK21.14 billion.

Operations: The company generates revenue from its Security Software & Services segment, amounting to SEK2.28 billion.

Estimated Discount To Fair Value: 30.6%

Yubico is trading at SEK245.5, significantly below its estimated fair value of SEK353.83, indicating potential undervaluation based on cash flows. Despite recent insider selling, Yubico's earnings and revenue are forecast to grow substantially above the Swedish market average. The company's strategic partnerships with major firms like T-Mobile and Microsoft bolster its position in the cybersecurity sector, enhancing its growth prospects and supporting a strong financial performance trajectory with high-quality earnings reported recently.

- The analysis detailed in our Yubico growth report hints at robust future financial performance.

- Get an in-depth perspective on Yubico's balance sheet by reading our health report here.

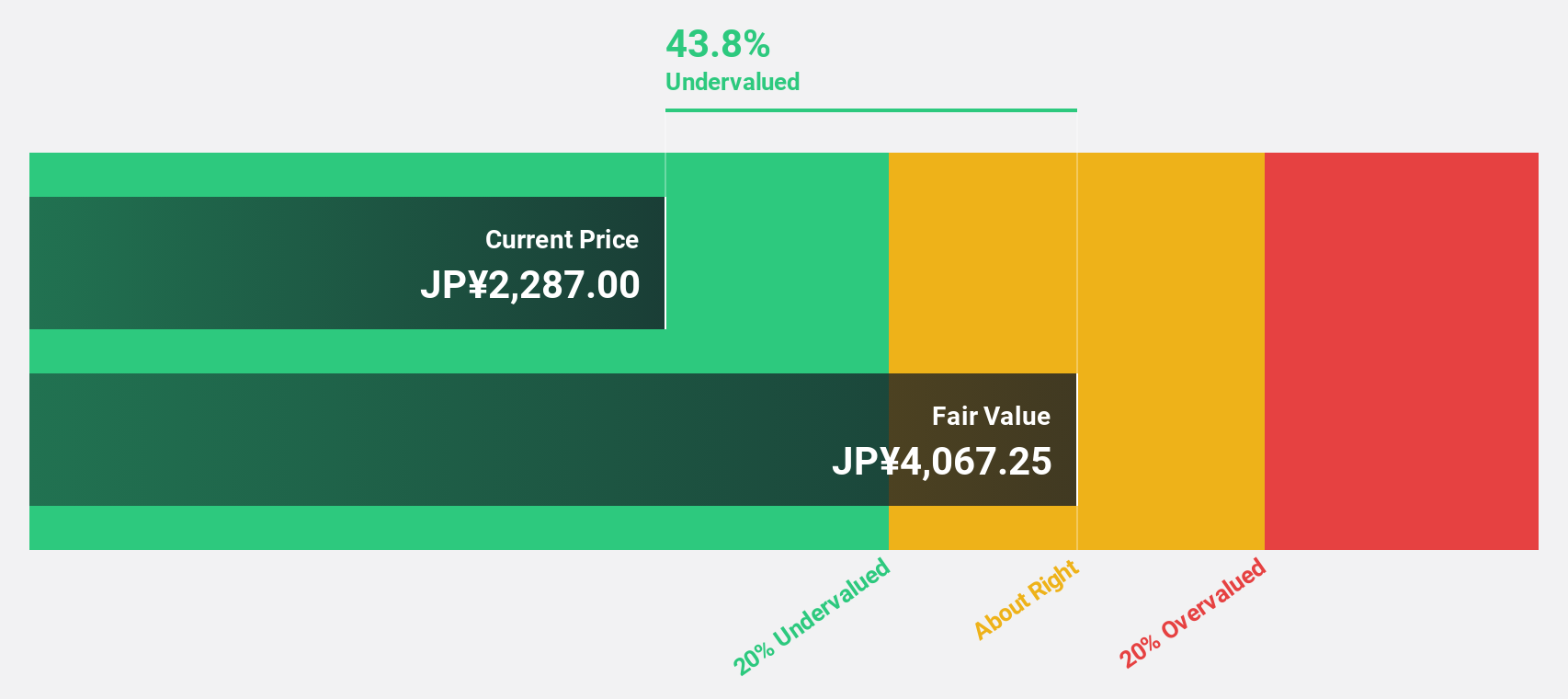

DIP (TSE:2379)

Overview: DIP Corporation is a labor force solution company that provides personnel recruiting services in Japan, with a market cap of ¥121.99 billion.

Operations: The company generates revenue through two main segments: the DX Business, which contributes ¥6.63 billion, and the Human Resources Services Business, which accounts for ¥49.55 billion.

Estimated Discount To Fair Value: 38.6%

DIP is trading at ¥2,380, considerably below its estimated fair value of ¥3,876.83, highlighting potential undervaluation based on cash flows. Earnings are projected to grow 15.8% annually, outpacing the Japanese market's average growth rate of 8.1%. Revenue is expected to increase by 8.5% per year, also above market averages. However, the company has an unstable dividend track record despite being well-positioned relative to peers and industry standards in terms of value.

- Our expertly prepared growth report on DIP implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of DIP with our detailed financial health report.

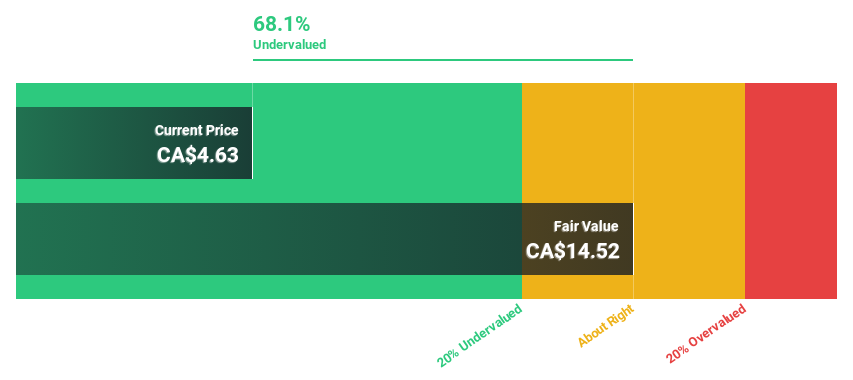

Mandalay Resources (TSX:MND)

Overview: Mandalay Resources Corporation is involved in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Canada, Australia, Sweden, and Chile with a market cap of CA$432.92 million.

Operations: The company's revenue is primarily derived from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to $224.44 million.

Estimated Discount To Fair Value: 49.6%

Mandalay Resources is trading at CA$4.61, significantly under its estimated fair value of CA$9.15, suggesting it may be undervalued based on cash flows. Despite a forecasted revenue decline of 3.1% annually over the next three years, earnings are expected to grow substantially at 45.5% per year, surpassing Canadian market averages. Recent exploration success at Björkdal could extend mine life and enhance future cash flows; however, notable insider selling raises caution about potential risks.

- In light of our recent growth report, it seems possible that Mandalay Resources' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Mandalay Resources.

Next Steps

- Navigate through the entire inventory of 890 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MND

Mandalay Resources

Engages in the acquisition, exploration, extraction, processing, and reclamation of mineral properties in Australia, Sweden, Chile, and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion