Upsales Technology AB (publ) (STO:UPSALE) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Upsales Technology AB (publ) (STO:UPSALE) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

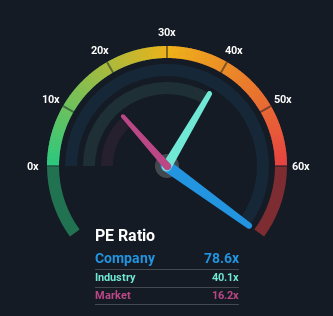

Even after such a large drop in price, Upsales Technology may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 78.6x, since almost half of all companies in Sweden have P/E ratios under 16x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

There hasn't been much to differentiate Upsales Technology's and the market's earnings growth lately. One possibility is that the P/E is high because investors think this modest earnings performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Upsales Technology

Is There Enough Growth For Upsales Technology?

In order to justify its P/E ratio, Upsales Technology would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. Pleasingly, EPS has also lifted 315% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 45% per year during the coming three years according to the lone analyst following the company. That's shaping up to be materially higher than the 17% per annum growth forecast for the broader market.

With this information, we can see why Upsales Technology is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Upsales Technology's P/E?

Even after such a strong price drop, Upsales Technology's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Upsales Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Upsales Technology is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If you're unsure about the strength of Upsales Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:UPSALE

Upsales Technology

Operates as a software-as-a-service company that develops and sells web-based business systems with a focus on sales, marketing, and analysis in Sweden and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026