European Stocks Possibly Trading Below Estimated Value In June 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of easing inflation and potential interest rate cuts by the European Central Bank, investor focus is increasingly turning towards stocks that might be trading below their estimated value. In this context, identifying undervalued stocks requires careful consideration of economic indicators such as inflation trends and trade negotiations, which can influence market sentiment and stock valuations.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.90 | €104.47 | 48.4% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.90 | €3.70 | 48.6% |

| CTT Systems (OM:CTT) | SEK213.50 | SEK416.33 | 48.7% |

| Séché Environnement (ENXTPA:SCHP) | €99.00 | €197.26 | 49.8% |

| Clemondo Group (OM:CLEM) | SEK10.80 | SEK21.25 | 49.2% |

| Lectra (ENXTPA:LSS) | €24.05 | €47.11 | 49% |

| Absolent Air Care Group (OM:ABSO) | SEK214.00 | SEK416.45 | 48.6% |

| Trøndelag Sparebank (OB:TRSB) | NOK114.50 | NOK226.55 | 49.5% |

| Nexstim (HLSE:NXTMH) | €7.98 | €15.71 | 49.2% |

| VIGO Photonics (WSE:VGO) | PLN522.00 | PLN1042.74 | 49.9% |

Here's a peek at a few of the choices from the screener.

Laboratorios Farmaceuticos Rovi (BME:ROVI)

Overview: Laboratorios Farmaceuticos Rovi, S.A. is a pharmaceutical company that manufactures, sells, and markets its products in Spain, the European Union, OECD countries, and internationally with a market cap of €2.76 billion.

Operations: Revenue Segments (in millions of €):

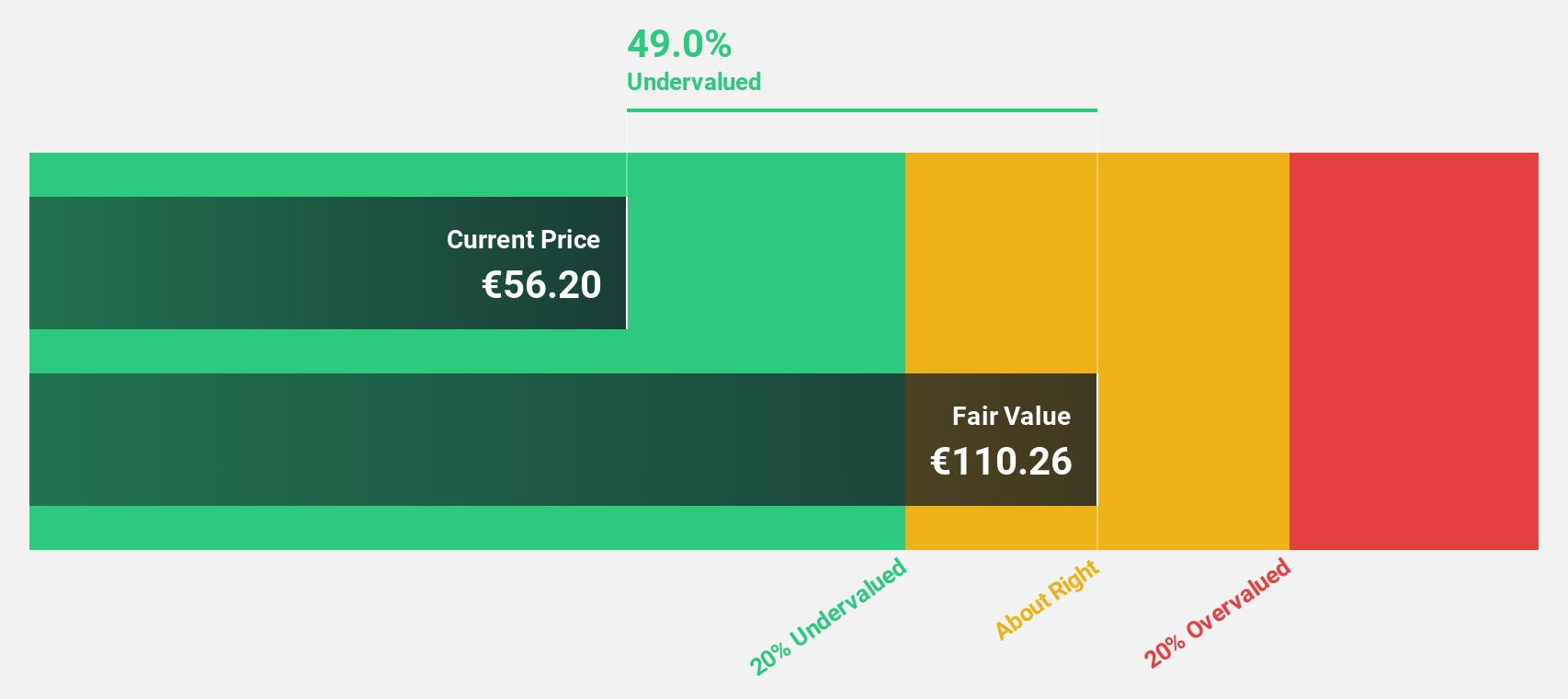

Estimated Discount To Fair Value: 48.4%

Laboratorios Farmaceuticos Rovi appears undervalued based on discounted cash flow analysis, trading at €53.9 versus a fair value estimate of €104.47. The company reported Q1 2025 sales of €154.89 million and net income of €18.1 million, both showing year-over-year growth. Analysts forecast revenue to grow faster than the Spanish market at 8.2% annually and earnings at 16.5%, suggesting strong future cash flows, supported by a high return on equity projection of 24.9%.

- Insights from our recent growth report point to a promising forecast for Laboratorios Farmaceuticos Rovi's business outlook.

- Take a closer look at Laboratorios Farmaceuticos Rovi's balance sheet health here in our report.

Truecaller (OM:TRUE B)

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK23.04 billion.

Operations: The company's revenue is primarily generated from its Communications Software segment, amounting to SEK1.95 billion.

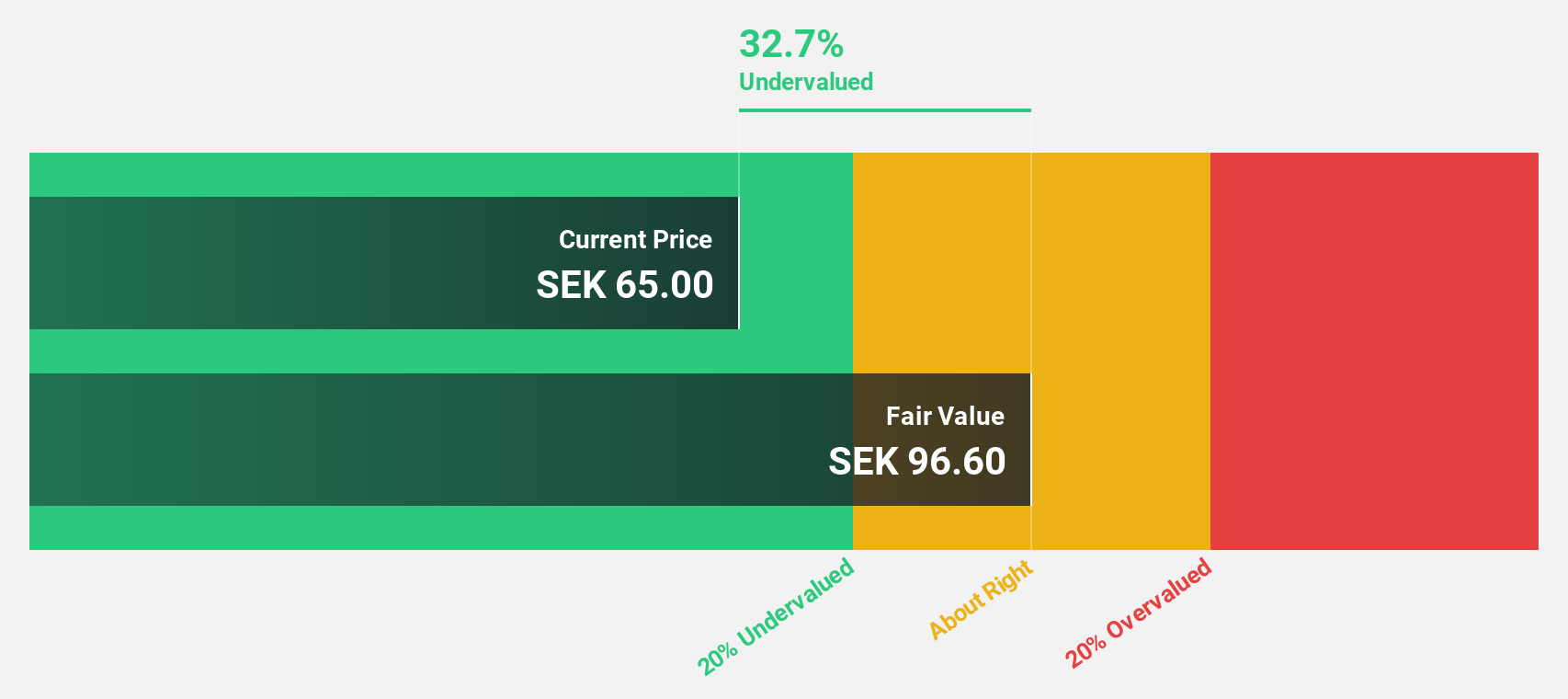

Estimated Discount To Fair Value: 37.8%

Truecaller is trading at SEK66.95, significantly below its fair value estimate of SEK107.67, highlighting potential undervaluation based on cash flows. Despite recent declines in net income to SEK101.73 million for Q1 2025 from last year's SEK133.05 million, earnings are forecasted to grow 24% annually over the next three years, outpacing the Swedish market growth rate of 15.9%. Additionally, Truecaller's strategic partnerships and business service expansions contribute positively to its financial outlook and cash flow generation capabilities.

- Upon reviewing our latest growth report, Truecaller's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Truecaller.

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry with a market capitalization of SEK23.27 billion.

Operations: The company's revenue is derived from its Medtech segment (€133 million), Specialty Pharma (€176.60 million), Diagnostics (€21.70 million), and Veterinary Services (€60 million).

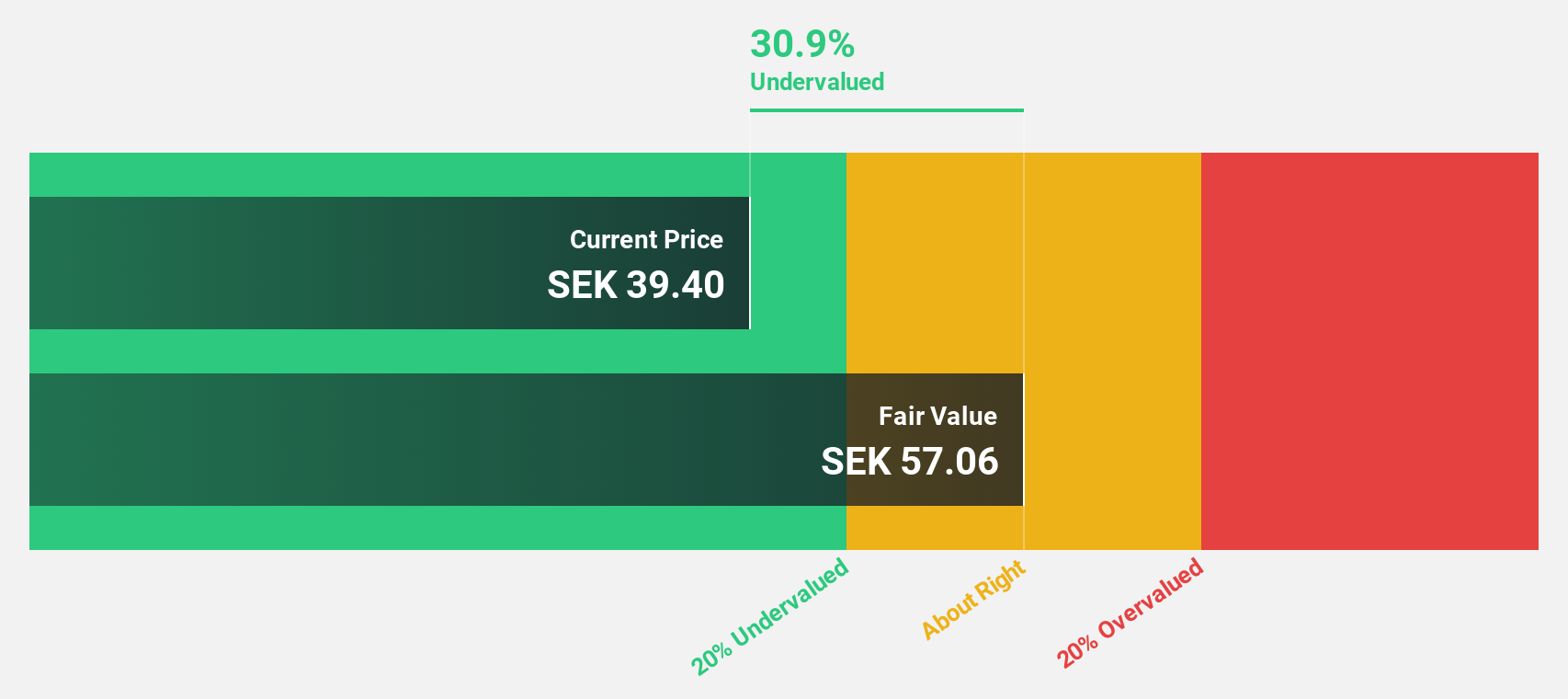

Estimated Discount To Fair Value: 19.8%

Vimian Group's stock, priced at SEK44.42, is undervalued relative to its fair value estimate of SEK55.37, presenting a potential opportunity based on cash flows. While the company's earnings grew by 144.5% last year and are forecasted to continue growing significantly at 46.8% annually over the next three years, its Return on Equity is expected to remain low at 8.5%. Recent board changes and inclusion in the OMX Nordic All-Share Index may influence future performance positively.

- Our expertly prepared growth report on Vimian Group implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Vimian Group here with our thorough financial health report.

Taking Advantage

- Delve into our full catalog of 187 Undervalued European Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ROVI

Laboratorios Farmaceuticos Rovi

Manufactures, sells, and markets pharmaceutical products in Spain, European Union, OECD countries, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives