3 European Growth Companies With High Insider Ownership And 17% Revenue Growth

Reviewed by Simply Wall St

Amid concerns about global growth and a stronger euro, the pan-European STOXX Europe 600 Index recently edged slightly lower, reflecting mixed performances across major European stock indexes. In this environment, identifying growth companies with high insider ownership can be particularly appealing, as these stocks often demonstrate strong alignment between management and shareholders' interests—a key factor in navigating uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Absolent Air Care Group (OM:ABSO)

Simply Wall St Growth Rating: ★★★★☆☆

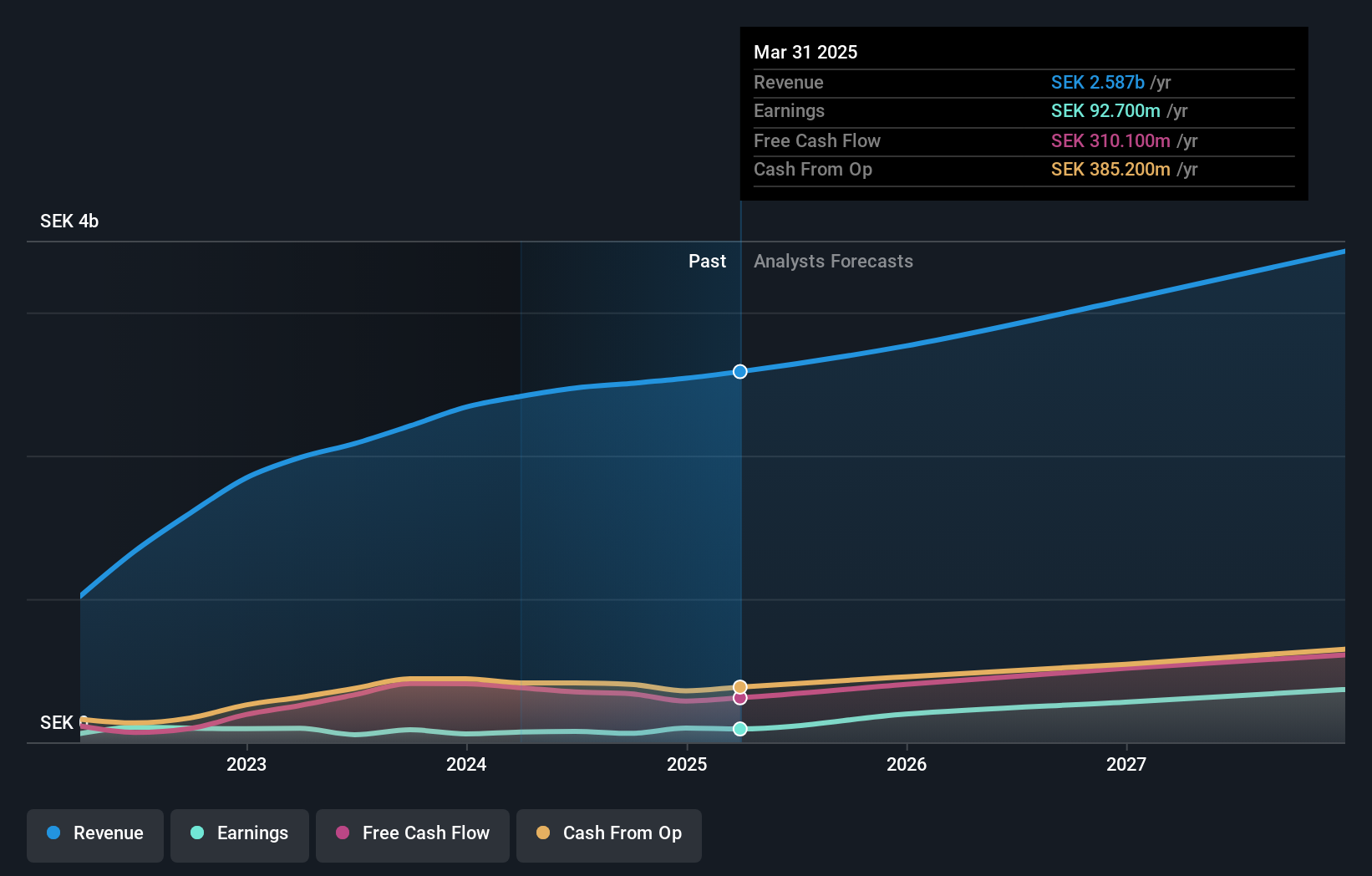

Overview: Absolent Air Care Group AB (publ) specializes in the design, development, sale, installation, and maintenance of air filtration units and has a market capitalization of approximately SEK2.84 billion.

Operations: The company's revenue is primarily derived from its Industrial segment, which accounts for SEK1067.05 million, and its Commercial Kitchen segment, contributing SEK235.28 million.

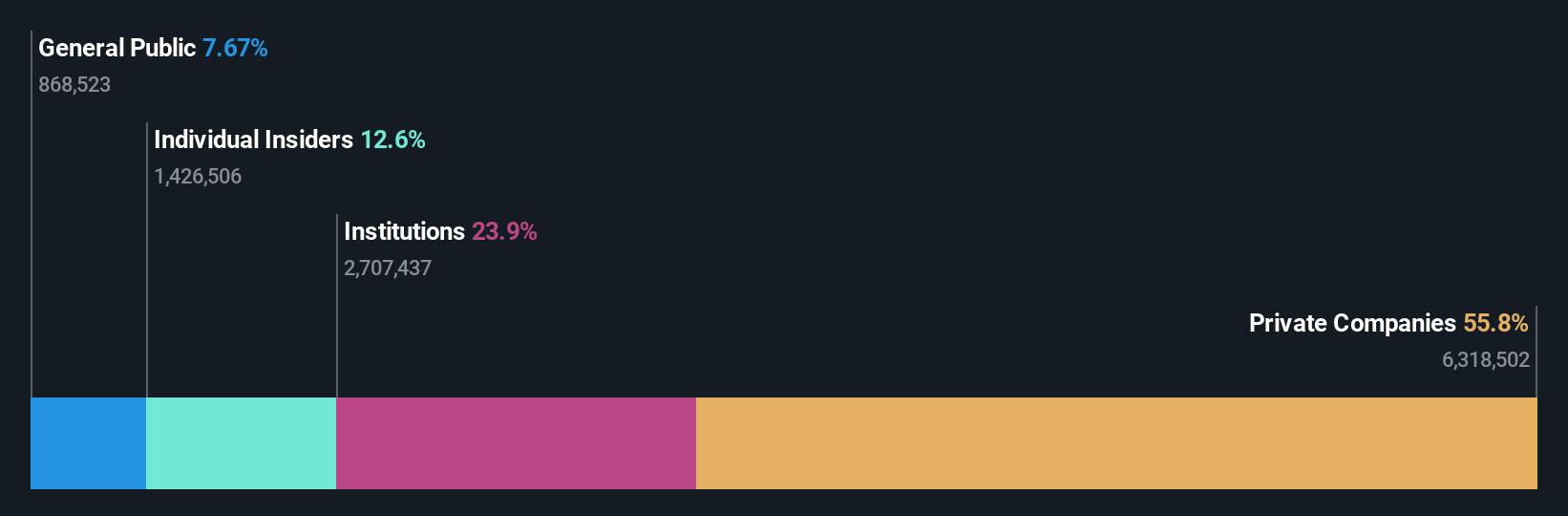

Insider Ownership: 12.6%

Revenue Growth Forecast: 10.6% p.a.

Absolent Air Care Group is experiencing challenges with declining sales and profit margins, as seen in its recent earnings report. Despite this, the company's earnings are forecast to grow significantly at 40.19% annually, outpacing the Swedish market's growth expectations. Revenue is also expected to grow faster than the market average. The appointment of Peter Unelind as CEO may drive future growth given his extensive leadership experience. Currently trading below estimated fair value, Absolent presents potential for long-term investors focused on growth companies with insider ownership considerations.

- Unlock comprehensive insights into our analysis of Absolent Air Care Group stock in this growth report.

- Upon reviewing our latest valuation report, Absolent Air Care Group's share price might be too pessimistic.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

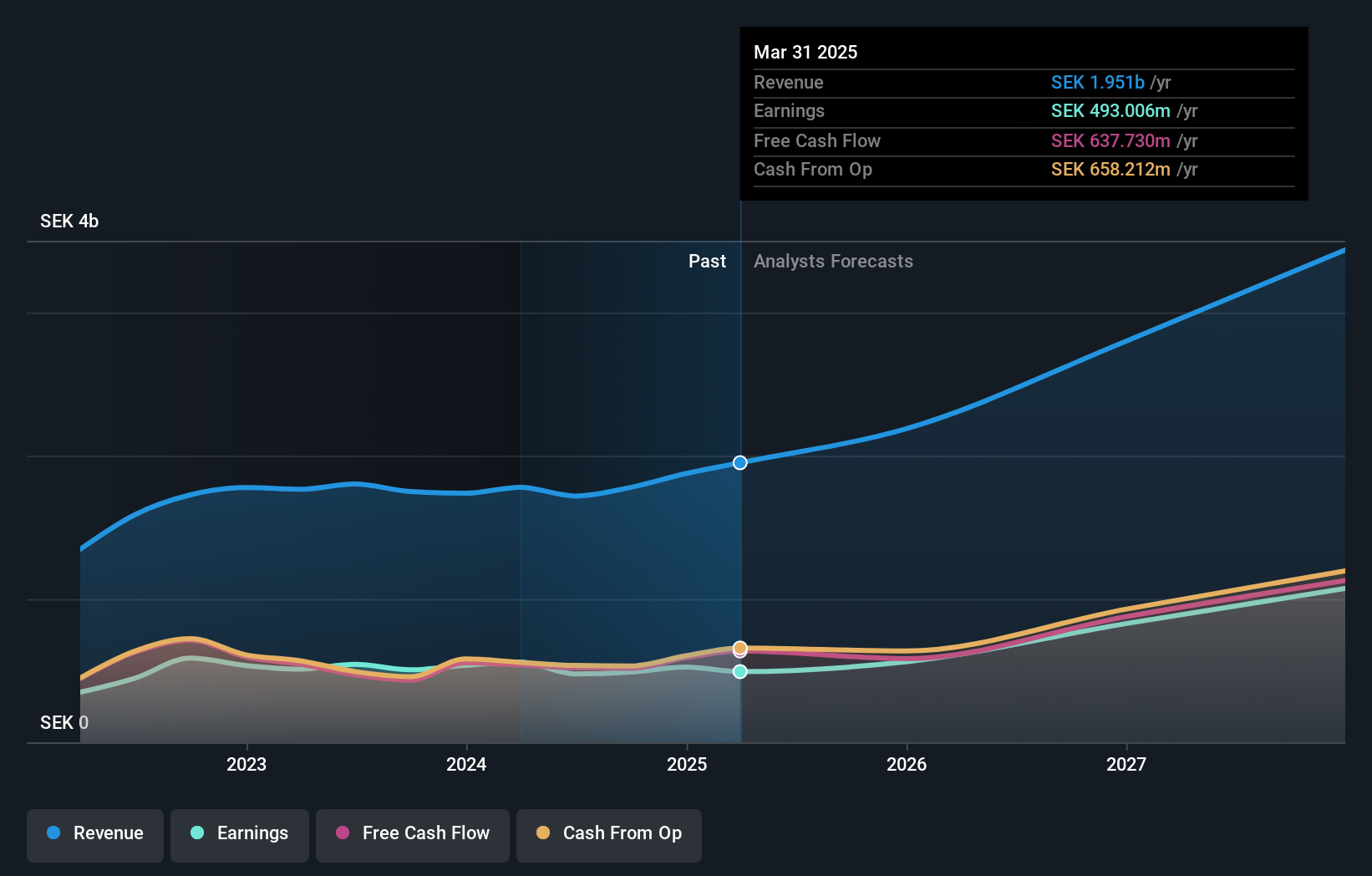

Overview: Swedencare AB (publ) develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses across North America, Europe, and internationally with a market cap of SEK6.51 billion.

Operations: The company's revenue segments are comprised of SEK557.60 million from Europe, SEK687.30 million from Production, and SEK1.59 billion from North America, with Group-Wide Functions accounting for -SEK230.40 million.

Insider Ownership: 11.5%

Revenue Growth Forecast: 10.1% p.a.

Swedencare's recent earnings report shows a net loss for Q2 2025, contrasting with the previous year's profit. Despite this, the company's earnings are forecast to grow significantly at 64% annually over the next three years, outpacing Swedish market expectations. Revenue growth is expected to be faster than the market average but slower than high-growth benchmarks. Insiders have bought more shares recently, although not in substantial volumes. The stock trades well below its estimated fair value.

- Click here to discover the nuances of Swedencare with our detailed analytical future growth report.

- Our valuation report unveils the possibility Swedencare's shares may be trading at a discount.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK15.61 billion.

Operations: Truecaller generates revenue primarily from its Communications Software segment, which accounted for SEK1.99 billion.

Insider Ownership: 16.1%

Revenue Growth Forecast: 17.7% p.a.

Truecaller's recent developments highlight its growth potential, driven by innovative product offerings like Secure Calls and strategic partnerships such as with JoAcademy. Despite a slight dip in net income for Q2 2025, revenue continues to grow, outpacing the Swedish market. The appointment of Saraswati Agarwal aims to strengthen Truecaller's presence in the MEA region. Although there has been significant insider selling recently, analysts forecast robust earnings growth at 24.42% annually over the next three years.

- Click here and access our complete growth analysis report to understand the dynamics of Truecaller.

- Our expertly prepared valuation report Truecaller implies its share price may be lower than expected.

Seize The Opportunity

- Embark on your investment journey to our 215 Fast Growing European Companies With High Insider Ownership selection here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives