As global markets grapple with economic uncertainties and European indices reflect renewed fears about growth, investors are increasingly turning their attention to stable income sources. In this context, Swedish dividend stocks stand out as potential safe havens, offering both steady returns and resilience amidst market volatility.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.76% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.86% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.68% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.66% | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.37% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.04% | ★★★★★☆ |

| Duni (OM:DUNI) | 5.09% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.46% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.87% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.09% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

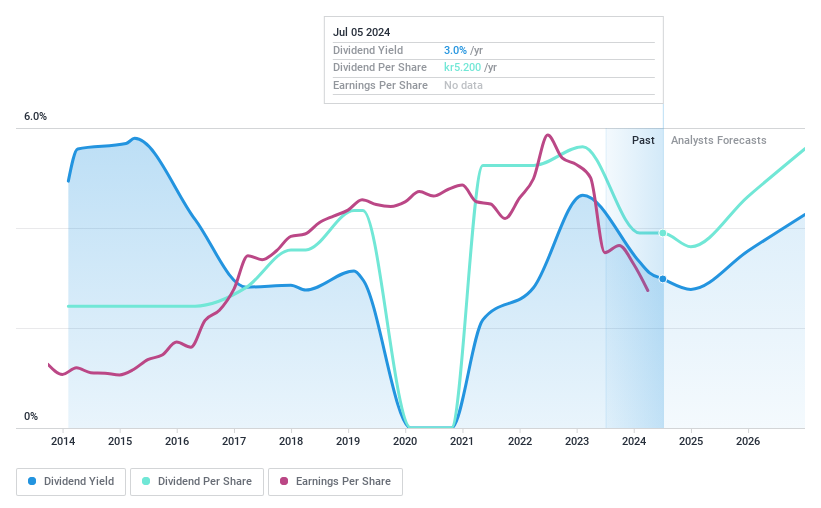

Knowit (OM:KNOW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company that develops digital solutions and has a market cap of SEK 4.51 billion.

Operations: Knowit AB (publ) generates revenue from four main segments: Insight (SEK 898.95 million), Solutions (SEK 3.90 billion), Experience (SEK 1.44 billion), and Connectivity (SEK 1.02 billion).

Dividend Yield: 3.2%

Knowit's dividend payments are well covered by both earnings (77.3% payout ratio) and free cash flow (41.6% cash payout ratio), though the dividend yield of 3.15% is lower than the top 25% in Sweden. The company has a history of volatile dividends over the past decade, making reliability a concern. Recent earnings show a decline, with Q2 net income at SEK 3 million compared to SEK 19.5 million last year, impacting overall financial stability for dividends.

- Navigate through the intricacies of Knowit with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Knowit's share price might be too pessimistic.

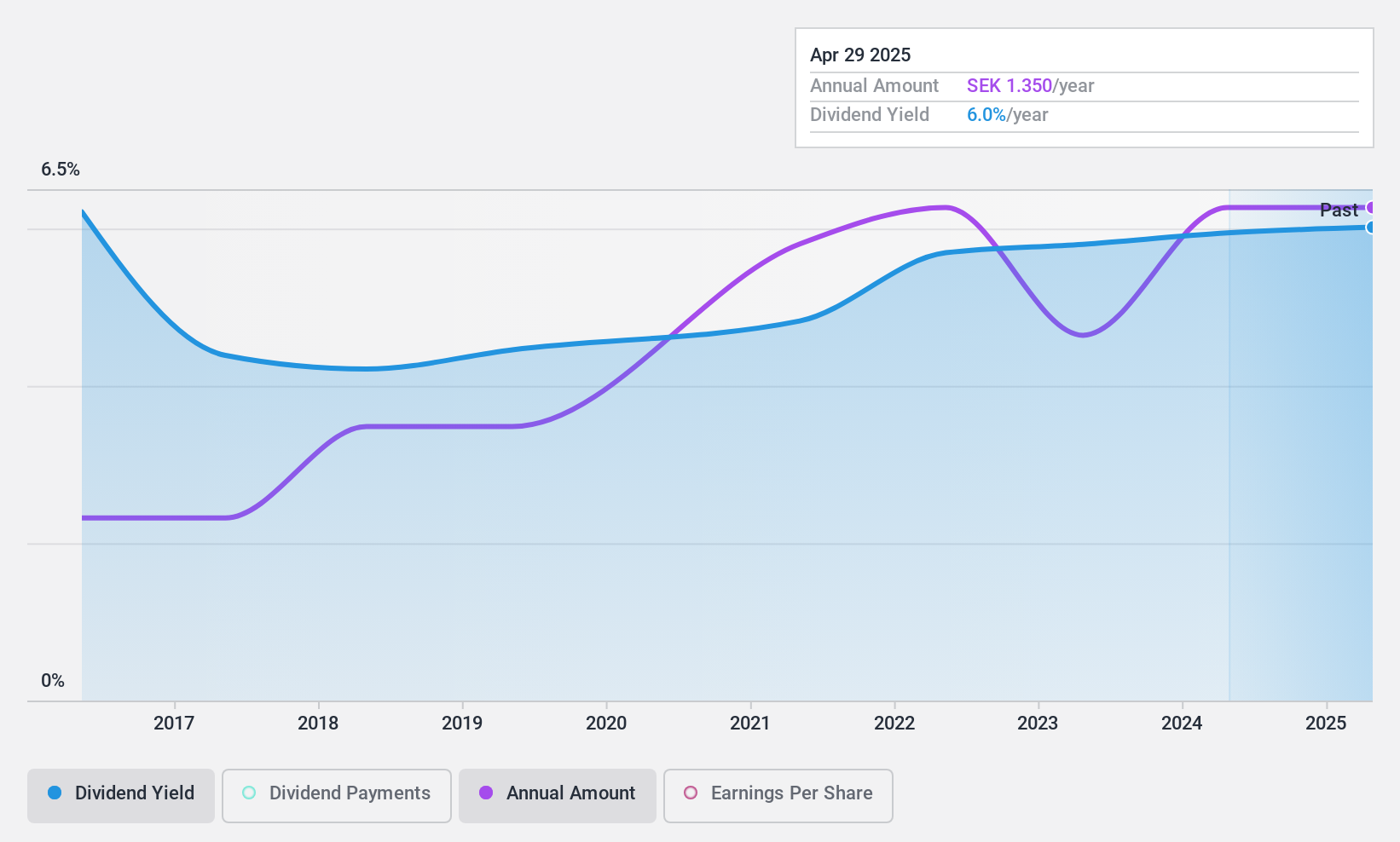

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (OM:SFAB) offers non-life insurance to private and business customers across Sweden, Denmark, Norway, Finland, Germany, Switzerland, and internationally with a market cap of SEK1.59 billion.

Operations: Solid Försäkringsaktiebolag's revenue segments include Product (SEK320.51 million), Assistance (SEK351.63 million), and Personal Safety (SEK435.09 million).

Dividend Yield: 5.2%

Solid Försäkringsaktiebolag's dividend payments are well covered by earnings (49.1% payout ratio) and cash flows (73.7% cash payout ratio). The company's recent buyback program, repurchasing 122,188 shares for SEK 10.19 million, aims to improve capital structure and shareholder value. Despite a strong dividend yield of 5.18%, it's too early to assess the reliability or growth of dividends as they have only recently been initiated.

- Delve into the full analysis dividend report here for a deeper understanding of Solid Försäkringsaktiebolag.

- Insights from our recent valuation report point to the potential undervaluation of Solid Försäkringsaktiebolag shares in the market.

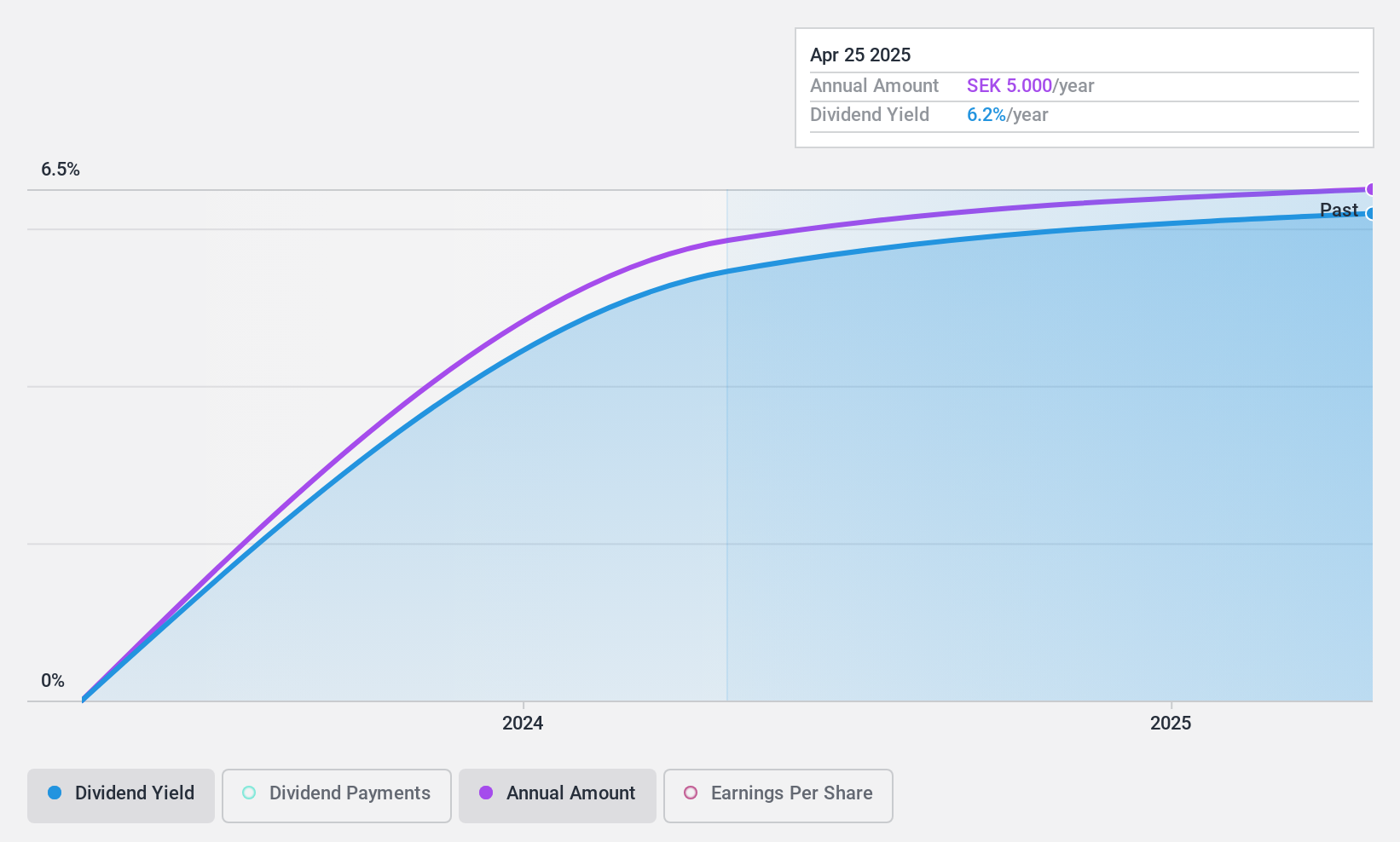

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) provides IT and management services primarily in Sweden and has a market cap of SEK1.14 billion.

Operations: Softronic AB (publ) generates SEK838.92 million in revenue from its Computer Services segment.

Dividend Yield: 6.2%

Softronic AB's recent earnings report showed modest growth, with second-quarter sales at SEK 206.8 million and net income of SEK 14.6 million. However, its dividend sustainability is concerning; the high cash payout ratio (94.5%) indicates dividends are not well covered by cash flows, despite a solid payout ratio (85.5%). While the dividend yield of 6.21% is attractive and among the top in Sweden, past payments have been volatile and unreliable over ten years.

- Get an in-depth perspective on Softronic's performance by reading our dividend report here.

- Our valuation report unveils the possibility Softronic's shares may be trading at a premium.

Summing It All Up

- Take a closer look at our Top Swedish Dividend Stocks list of 22 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SOF B

Outstanding track record with flawless balance sheet and pays a dividend.