Lime Technologies' (STO:LIME) Solid Earnings Have Been Accounted For Conservatively

Lime Technologies AB (publ)'s (STO:LIME) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. We did some digging, and we think that investors are missing some encouraging factors in the underlying numbers.

View our latest analysis for Lime Technologies

Examining Cashflow Against Lime Technologies' Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

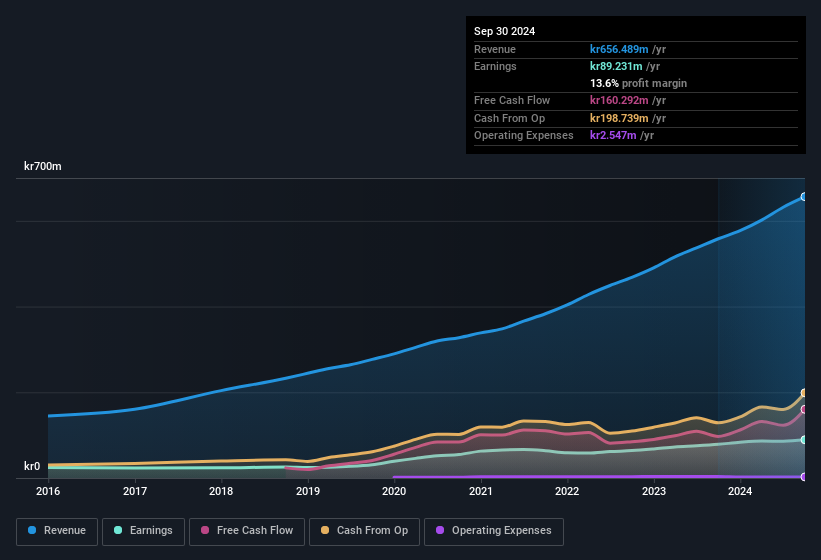

Lime Technologies has an accrual ratio of -0.16 for the year to September 2024. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. In fact, it had free cash flow of kr160m in the last year, which was a lot more than its statutory profit of kr89.2m. Lime Technologies' free cash flow improved over the last year, which is generally good to see.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Lime Technologies' Profit Performance

As we discussed above, Lime Technologies' accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Because of this, we think Lime Technologies' underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And on top of that, its earnings per share have grown at 40% per year over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example - Lime Technologies has 1 warning sign we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Lime Technologies' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

Outstanding track record and good value.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

30 Baggers Silver Miner with Gold/VTM Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks