Lime Technologies (OM:LIME) Margin Expansion Reinforces Bullish Narratives on Sustainable Profit Growth

Reviewed by Simply Wall St

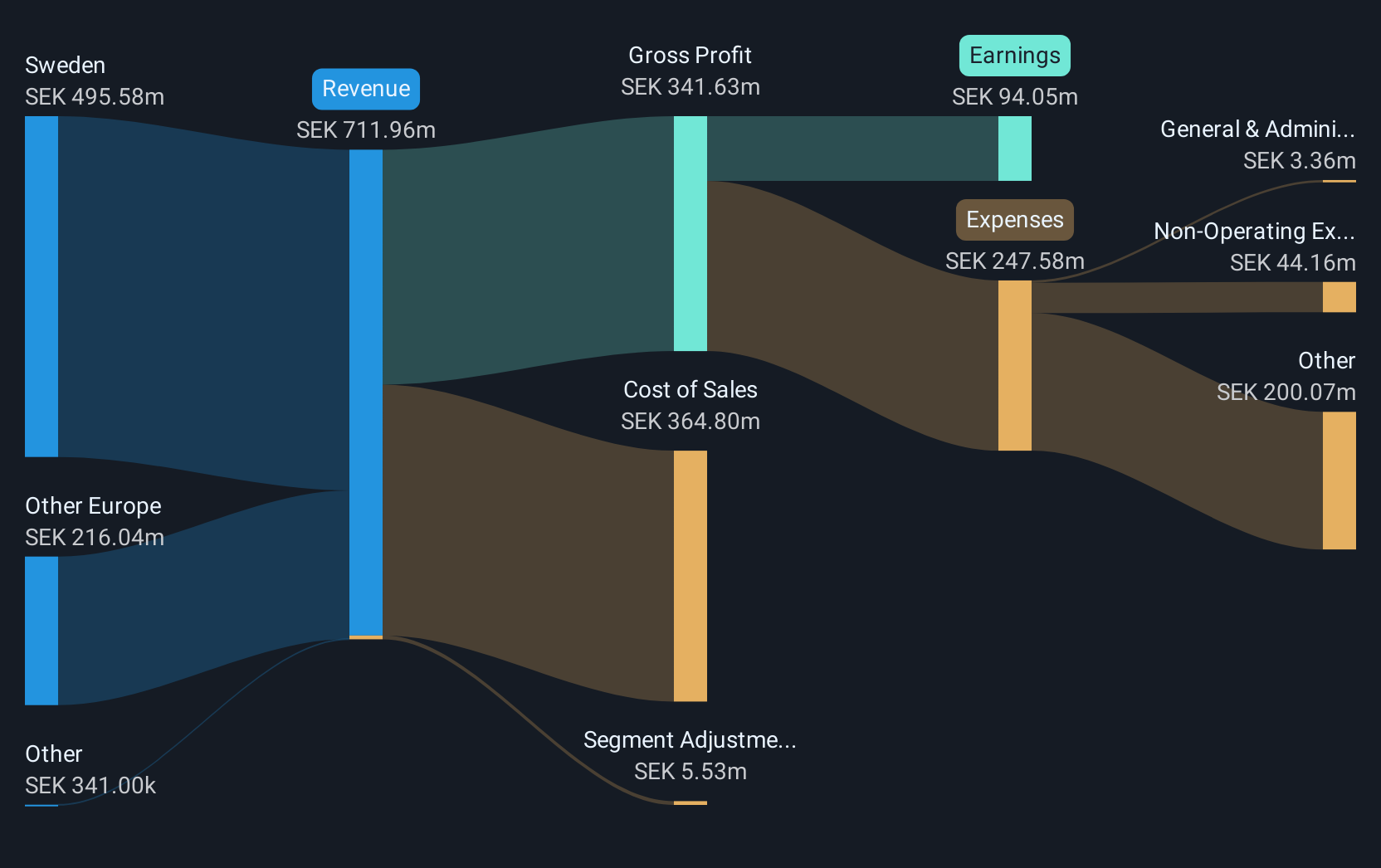

Lime Technologies (OM:LIME) posted net profit margins of 14.2%, up from 13.5% a year ago, as EPS grew 16.3% over the past year and has averaged 11.9% annual growth over the past five years. The company’s solid bottom line came alongside forecasts for 11.6% annual revenue growth and a projected 22.2% yearly increase in earnings, both well above Swedish market expectations. With no new risks identified and continuing signs of robust profit momentum, investors are seeing evidence that Lime is maintaining its operational edge in a competitive sector.

See our full analysis for Lime Technologies.Now let’s see how these results stack up against the prevailing market narratives. Some views may get reinforced, while others could be challenged.

See what the community is saying about Lime Technologies

Recurring Revenue Model Lifts Margins

- Net profit margins are projected to climb from 14.0% now to 19.4% in three years, an improvement that analysts directly tie to the company’s push towards subscription revenue and strategic investments.

- The analysts' consensus view highlights how Lime's subscription focus, together with low customer concentration and geographic expansion, is expected to sustain revenue growth and margin improvement.

- Analysts expect annual revenue growth of 11.9% over the next three years, outpacing the wider Swedish market’s 3.3% forecast.

- Diversified exposure across sectors and regions means a single sluggish market is less likely to drag down company-wide performance.

- Surprising in the consensus narrative is the emphasis on predictable income streams, which, if achieved, could make Lime’s earnings cycle less volatile than many competitors.

- The shift to subscriptions from service agreements is positioned as an engine for margin expansion, not just top-line growth.

- Consensus notes ongoing investment in product and employees as a cornerstone for both operational and financial resilience.

Fair Value Points to Upside

- Shares trade at SEK 351.50, which is below both the DCF fair value estimate of SEK 453.67 and the SEK 405.00 analyst target price. This implies a potential upside if current growth trends hold.

- The analysts' consensus view underscores that, although Lime carries a price-to-earnings ratio of 45.1x, above the Swedish software average of 31.4x, analysts forecast a compression to 32.2x by 2028 as earnings accelerate ahead of industry norms.

- This rerating would still leave Lime valued more attractively than direct peers, which trade at 94x. This reinforces a premium justified by higher quality and more reliable growth.

- Consensus cautions that these multiples are warranted only if subscription growth and management’s execution continue to deliver.

Expert Services Segment Faces Pressure

- The move to a subscription model sparked a sharp 31% drop in service agreement revenues, raising concerns about transitioning existing customers without a near-term revenue hit.

- The analysts' consensus view acknowledges that, while the service segment’s weakness could pressure short-term revenue, diversified geographic and vertical growth may offset this risk if ongoing investments drive effective customer conversion.

- Macroeconomic challenges and cautious decision-making among current clients may prolong the transition and impact overall earnings momentum.

- Analysts highlight this as the major hurdle Lime must clear to translate top-line growth into consistent profit gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lime Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? Share your unique view and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lime Technologies.

See What Else Is Out There

Lime Technologies faces short-term uncertainty as the transition to a subscription model pressures service revenues and puts earnings consistency at risk.

If you’re looking for steadier performance, use our stable growth stocks screener (2089 results) to find companies delivering consistent growth through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIME

Lime Technologies

Provides software as a service (SaaS) based customer relationship management (CRM) solutions in the Nordic region.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives