- China

- /

- Electronic Equipment and Components

- /

- SHSE:688025

Exploring 3 High Growth Tech Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets react to political developments and economic indicators, U.S. stocks are marching toward record highs, driven by optimism surrounding trade policies and advancements in artificial intelligence. In this context of positive market sentiment, identifying high-growth tech stocks can be a strategic move for investors looking to capitalize on sectors poised for expansion amid these dynamic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

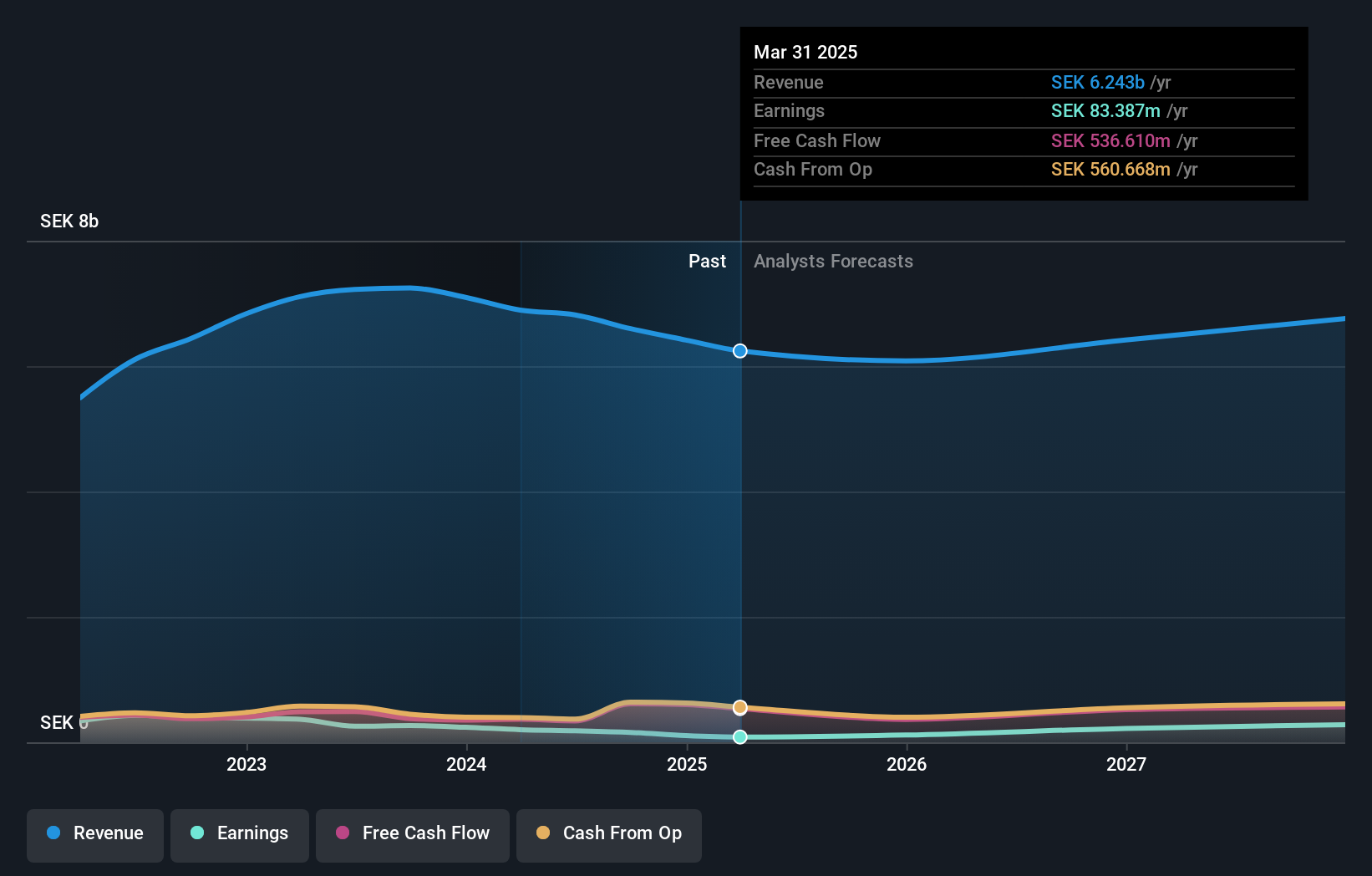

Knowit (OM:KNOW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company focused on developing digital solutions, with a market capitalization of SEK3.66 billion.

Operations: Knowit AB (publ) derives its revenue primarily from four segments: Solutions (SEK3.80 billion), Experience (SEK1.35 billion), Insight (SEK907.25 million), and Connectivity (SEK982.19 million).

Despite recent board changes with Chairman Jon Risfelt stepping down, Knowit remains poised for significant growth, with earnings expected to surge by 34.9% annually over the next three years, outpacing the Swedish market's 13.9%. This robust growth projection contrasts sharply with its modest revenue increase of 1.3% per year and a challenging past year where earnings declined by 40.8%. While profit margins dipped from last year's 3.7% to 2.4%, Knowit's strong forecast in earnings growth and high-quality past earnings underscore its potential resilience and adaptability in the evolving tech landscape.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing intelligent training, testing, and application systems for motor vehicle drivers in China and has a market cap of approximately CN¥5.57 billion.

Operations: The company generates revenue primarily from its electronic security devices segment, which contributes CN¥527.80 million.

DuoLun Technology, amidst a dynamic tech landscape, is poised for notable growth with its revenue projected to increase by 18.3% annually. This figure notably outpaces the broader Chinese market's growth rate of 13.4%. The recent strategic acquisition by Zhang Aoxing, who purchased a 5% stake for CNY 270 million, underscores confidence in DuoLun’s potential and aligns with its robust earnings forecast of an 89.2% annual increase. Moreover, the company's transition towards profitability over the next three years complements its positive free cash flow status, highlighting effective management and promising financial health in a competitive sector.

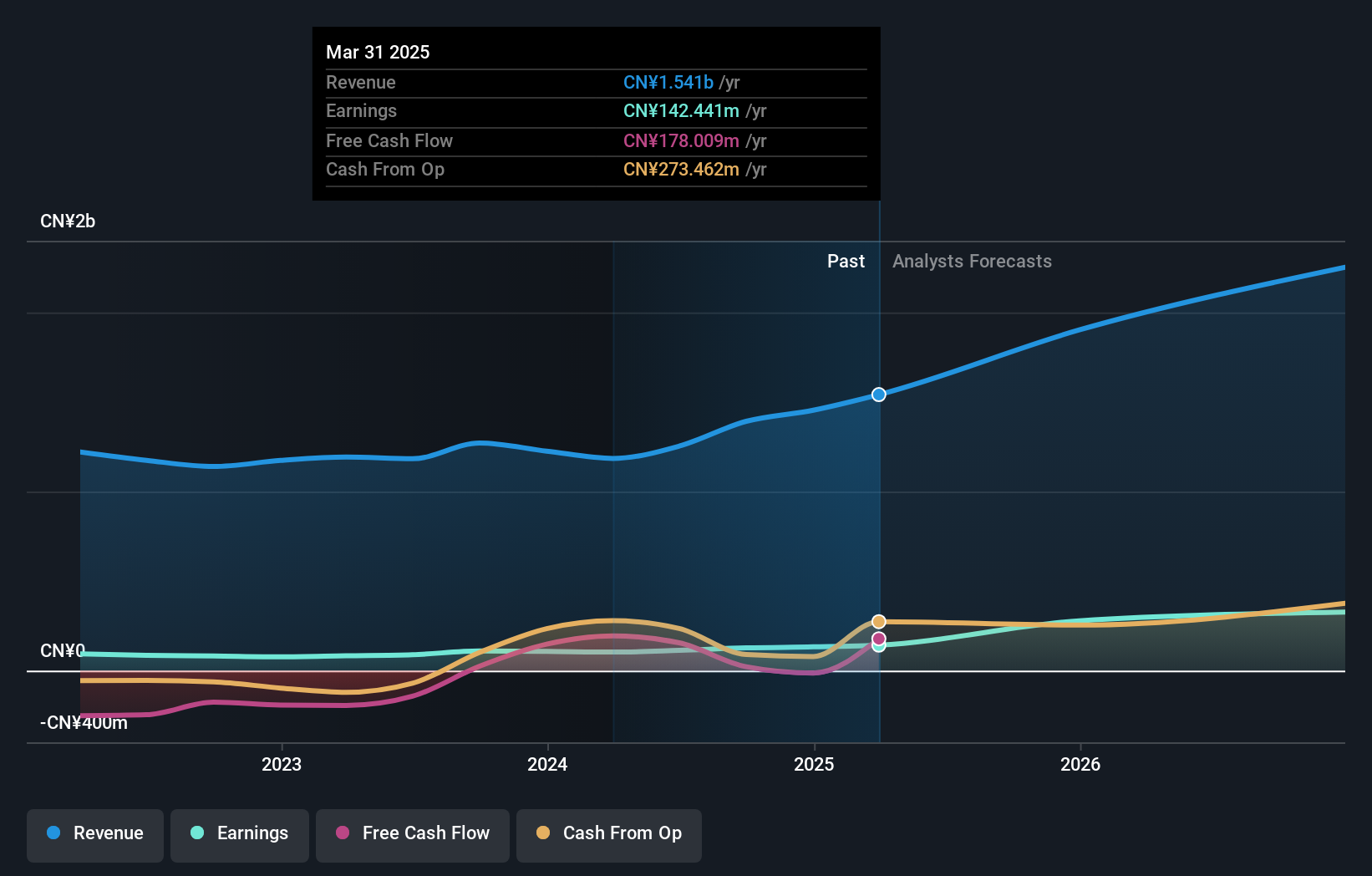

Shenzhen JPT Opto-Electronics (SHSE:688025)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen JPT Opto-Electronics Co., Ltd. focuses on the R&D, production, sale, and technical services of laser technology, intelligent equipment, and optical devices with a market cap of CN¥4.55 billion.

Operations: JPT Opto-Electronics generates revenue primarily from the computer communications and electronic equipment segment, totaling CN¥1.39 billion. The company is involved in the development and commercialization of laser technology, intelligent equipment, and optical devices.

Shenzhen JPT Opto-Electronics has demonstrated robust financial performance, with its earnings growing by 15.7% over the past year, outpacing the electronic industry's average of 2.3%. This growth trajectory is expected to accelerate with earnings forecasted to expand by 36% annually. The firm's strategic focus on R&D, which aligns with a revenue increase of 20.5% per year—surpassing the broader Chinese market rate of 13.4%—suggests a strong commitment to innovation and market leadership in opto-electronic solutions. Despite recent setbacks like being dropped from the S&P Global BMI Index, its substantial investment in technology development and increasing market demand position it well for future growth.

Next Steps

- Click here to access our complete index of 1225 High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688025

Shenzhen JPT Opto-Electronics

Engages in the research and development, production, sale, and technical services of laser, intelligent equipment, and optical devices.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives