3 Swedish Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index shows modest gains amid hopes for quicker interest rate cuts by the European Central Bank, investors are closely examining opportunities within individual markets like Sweden. In this context, identifying stocks that may be trading below their estimated value can offer potential benefits, especially when market conditions suggest a cautious yet optimistic outlook.

Top 10 Undervalued Stocks Based On Cash Flows In Sweden

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| CTT Systems (OM:CTT) | SEK267.00 | SEK490.82 | 45.6% |

| Truecaller (OM:TRUE B) | SEK45.08 | SEK89.03 | 49.4% |

| Lindab International (OM:LIAB) | SEK270.40 | SEK526.12 | 48.6% |

| Nolato (OM:NOLA B) | SEK52.15 | SEK102.63 | 49.2% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK87.50 | SEK174.61 | 49.9% |

| Wall to Wall Group (OM:WTW A) | SEK53.80 | SEK103.86 | 48.2% |

| TF Bank (OM:TFBANK) | SEK314.00 | SEK612.49 | 48.7% |

| Securitas (OM:SECU B) | SEK130.35 | SEK258.71 | 49.6% |

| BHG Group (OM:BHG) | SEK13.91 | SEK26.29 | 47.1% |

| Bactiguard Holding (OM:BACTI B) | SEK46.00 | SEK86.28 | 46.7% |

Underneath we present a selection of stocks filtered out by our screen.

Fortnox (OM:FNOX)

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK35.83 billion.

Operations: The company generates revenue from several segments, including Core Products (SEK734 million), Businesses (SEK378 million), Accounting Firms (SEK352 million), Financial Services (SEK249 million), and Marketplaces (SEK160 million).

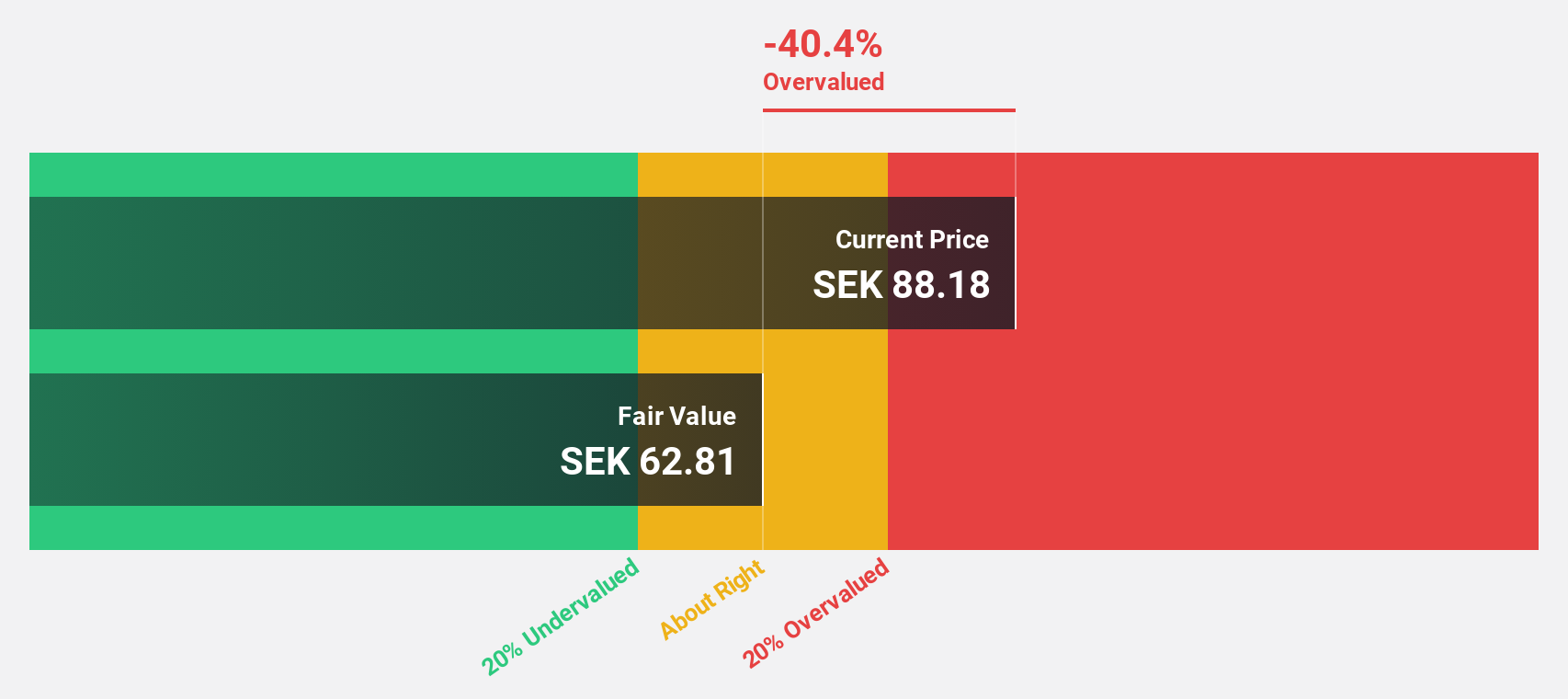

Estimated Discount To Fair Value: 30.7%

Fortnox is trading at SEK58.74, significantly below its estimated fair value of SEK84.74, indicating it may be undervalued based on discounted cash flow analysis. Analysts agree the stock price could rise by 31.9%. Its earnings are expected to grow at 23.69% annually over the next three years, outpacing the Swedish market's growth rate of 15.7%. However, revenue growth is forecasted slightly below 20% per year but remains above market expectations.

- The growth report we've compiled suggests that Fortnox's future prospects could be on the up.

- Click here to discover the nuances of Fortnox with our detailed financial health report.

HMS Networks (OM:HMS)

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK18.90 billion.

Operations: The company's revenue primarily comes from Wireless Communications Equipment, totaling SEK3.01 billion.

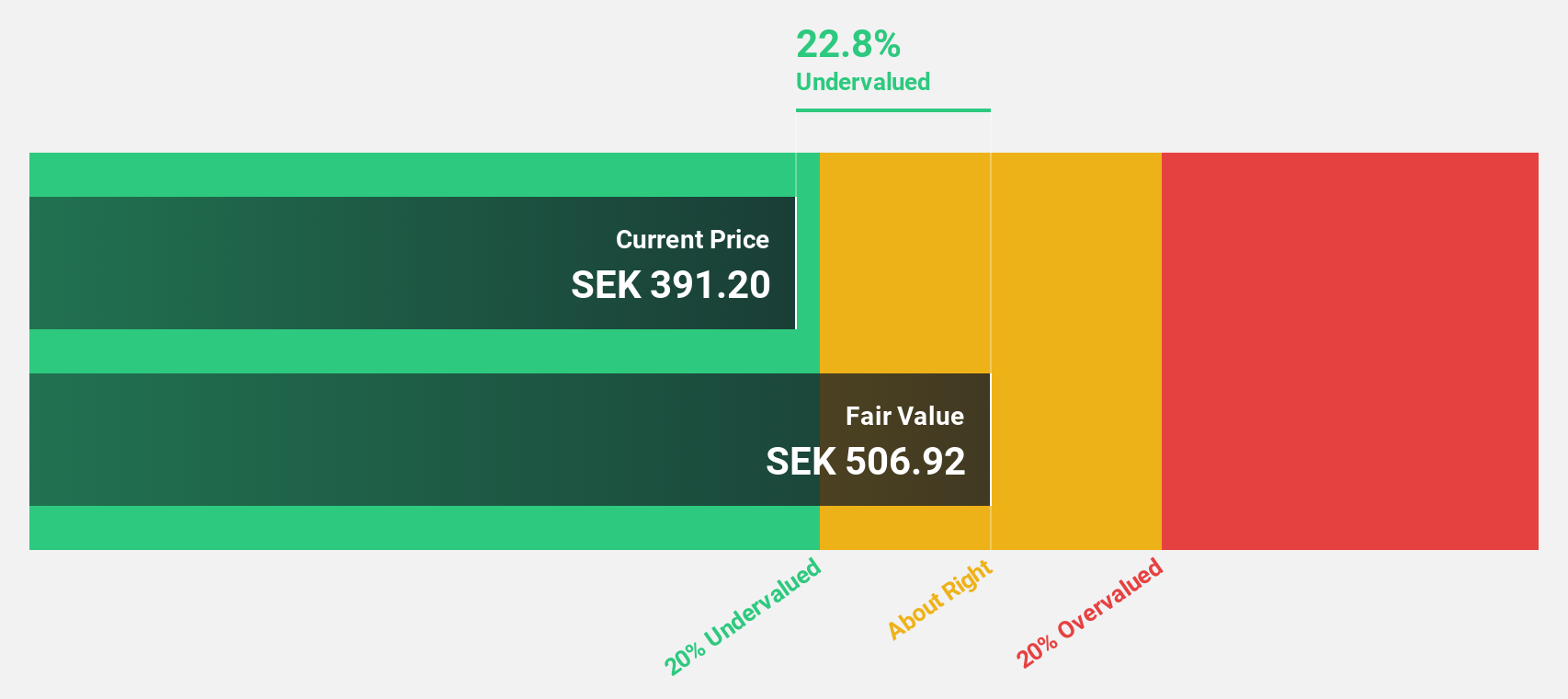

Estimated Discount To Fair Value: 13.6%

HMS Networks, trading at SEK378.6, is undervalued compared to its estimated fair value of SEK438.38. The company anticipates significant earnings growth of 28.6% annually over the next three years, surpassing the Swedish market's 15.7%. Recent restructuring into three divisions aims to enhance operational efficiency and customer focus, potentially boosting cash flows despite a high debt level and reduced profit margins from last year’s 20.1% to 14%.

- In light of our recent growth report, it seems possible that HMS Networks' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in HMS Networks' balance sheet health report.

Husqvarna (OM:HUSQ B)

Overview: Husqvarna AB (publ) is a company that produces and sells outdoor power products, watering products, and lawn care power equipment, with a market cap of approximately SEK39.32 billion.

Operations: The company's revenue segments include Gardena with SEK12.59 billion, Husqvarna Construction with SEK8.14 billion, and Husqvarna Forest & Garden with SEK28.37 billion, along with Group Common contributing SEK157 million.

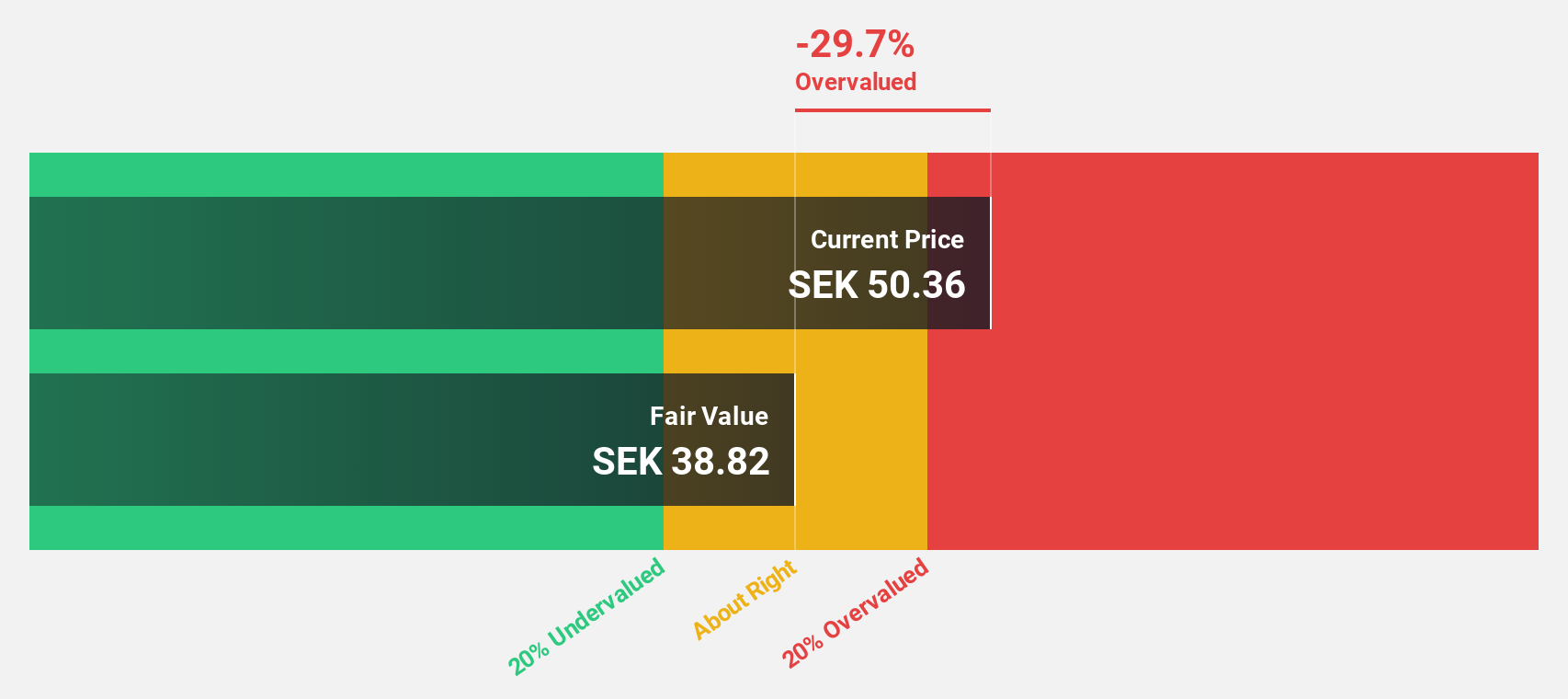

Estimated Discount To Fair Value: 44.9%

Husqvarna, trading at SEK68.88, is significantly undervalued compared to its estimated fair value of SEK124.97. Despite a high debt level and recent challenges impacting sales and operating results, the company's earnings are forecast to grow substantially at 26.3% annually over the next three years, outpacing the Swedish market's growth rate. Recent product innovations in robotic lawnmowers could enhance future cash flows and strengthen its position in autonomous turf care technology.

- The analysis detailed in our Husqvarna growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Husqvarna.

Where To Now?

- Discover the full array of 47 Undervalued Swedish Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Husqvarna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUSQ B

Husqvarna

Produces and sells outdoor power products, watering products, and lawn care power equipment.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives