- South Korea

- /

- Healthtech

- /

- KOSDAQ:A328130

3 Insider-Owned Growth Companies With Up To 78% Earnings Growth

Reviewed by Simply Wall St

As global markets react to political developments and economic indicators, U.S. stocks have been buoyed by hopes for softer tariffs and enthusiasm surrounding artificial intelligence initiatives, with major indexes reaching new highs. In this environment of optimism, growth stocks have notably outperformed their value counterparts, highlighting the potential appeal of companies that combine robust insider ownership with significant earnings growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Here's a peek at a few of the choices from the screener.

Lunit (KOSDAQ:A328130)

Simply Wall St Growth Rating: ★★★★★☆

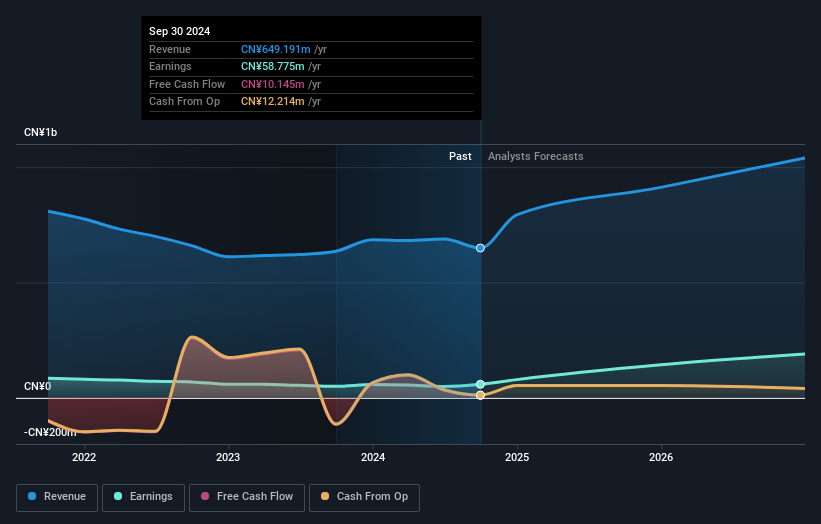

Overview: Lunit Inc. is a South Korean company specializing in AI-powered software and solutions for cancer diagnostics and therapeutics, with a market cap of ₩2.07 trillion.

Operations: The company's revenue primarily comes from its healthcare software segment, generating ₩39.54 billion.

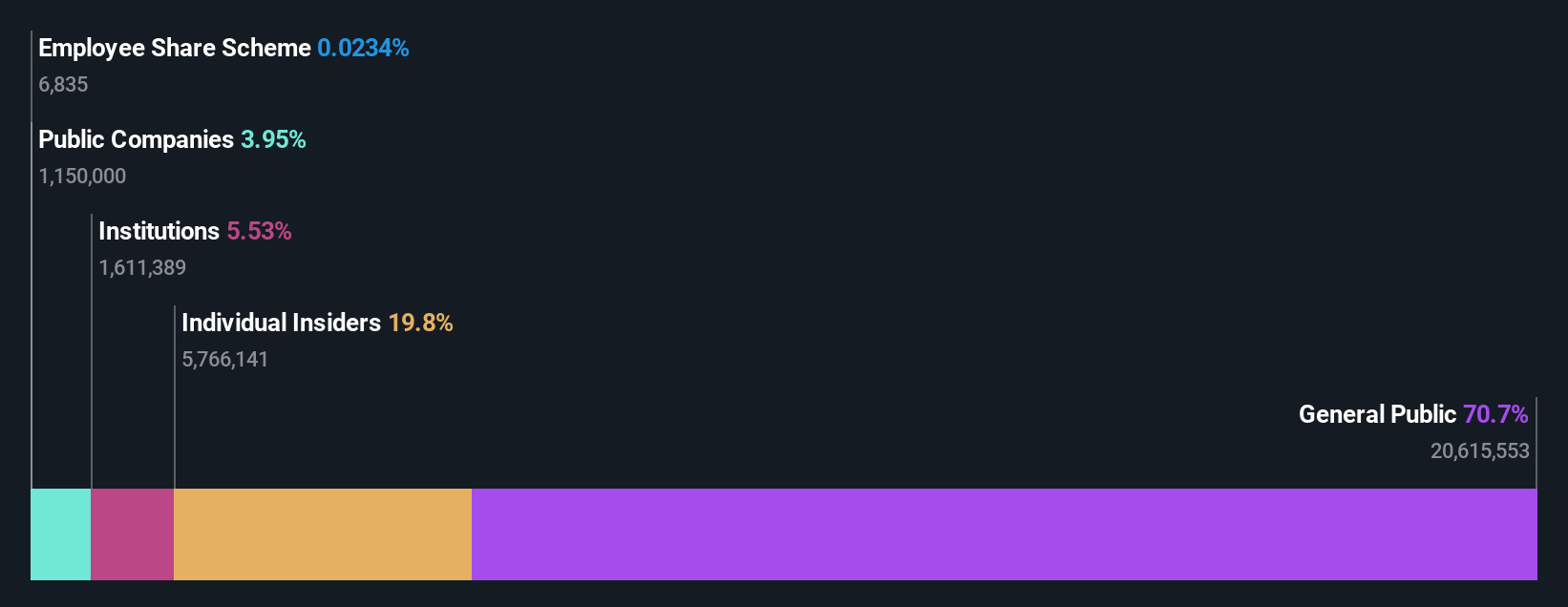

Insider Ownership: 20.8%

Earnings Growth Forecast: 78.2% p.a.

Lunit, a company with significant insider ownership, is making strides in AI-powered pathology and imaging solutions. Recent collaborations with AstraZeneca and Salud Digna highlight its strategic expansion in precision oncology and diagnostic capabilities. Despite high share price volatility, Lunit's revenue is forecast to grow 49.9% annually, outpacing market averages. The company trades below estimated fair value and aims for profitability within three years. Key innovations include enhanced cancer detection tools showcased at RSNA 2024.

- Delve into the full analysis future growth report here for a deeper understanding of Lunit.

- Our valuation report unveils the possibility Lunit's shares may be trading at a premium.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB (publ) offers financial and administrative software solutions tailored for small to medium-sized businesses, accounting firms, and organizations, with a market cap of SEK44.04 billion.

Operations: The company's revenue segments include Core Products at SEK768 million, Businesses at SEK397 million, Accounting Firms at SEK376 million, Financial Services at SEK267 million, and Marketplaces at SEK173 million.

Insider Ownership: 19.1%

Earnings Growth Forecast: 23.9% p.a.

Fortnox, with substantial insider ownership, shows promising growth potential. Its revenue is forecast to grow at 17.6% annually, surpassing the Swedish market's 1% growth rate. Earnings grew by 45% last year and are expected to increase by 23.89% annually over the next three years, outpacing market averages. Trading at approximately 10.8% below fair value estimates and with a high forecasted Return on Equity of 33%, Fortnox presents an attractive investment profile amidst its sector peers.

- Click here to discover the nuances of Fortnox with our detailed analytical future growth report.

- Our valuation report here indicates Fortnox may be overvalued.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector and has a market cap of CN¥7.44 billion.

Operations: I'm sorry, but it seems that the revenue segment information you provided is incomplete or missing. If you could provide the specific revenue figures for each segment, I would be happy to help summarize them for you.

Insider Ownership: 35%

Earnings Growth Forecast: 49.5% p.a.

Hui Lyu Ecological Technology Groups Ltd. exhibits strong growth potential with its earnings forecasted to grow significantly at 49.5% annually, outpacing the Chinese market's 25.1% rate. Despite a revenue decline to CNY 353.19 million in recent earnings, net income increased slightly, indicating operational resilience. The company's share price has been highly volatile recently, and while insider trading activity is minimal, substantial insider ownership aligns management interests with shareholders'.

- Unlock comprehensive insights into our analysis of Hui Lyu Ecological Technology GroupsLtd stock in this growth report.

- The analysis detailed in our Hui Lyu Ecological Technology GroupsLtd valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Embark on your investment journey to our 1470 Fast Growing Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A328130

Lunit

Provides AI-powered software and solutions for cancer diagnostics and therapeutics in South Korea.

Limited growth with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives