Why We're Not Concerned Yet About Clavister Holding AB (publ.)'s (STO:CLAV) 27% Share Price Plunge

The Clavister Holding AB (publ.) (STO:CLAV) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 218%.

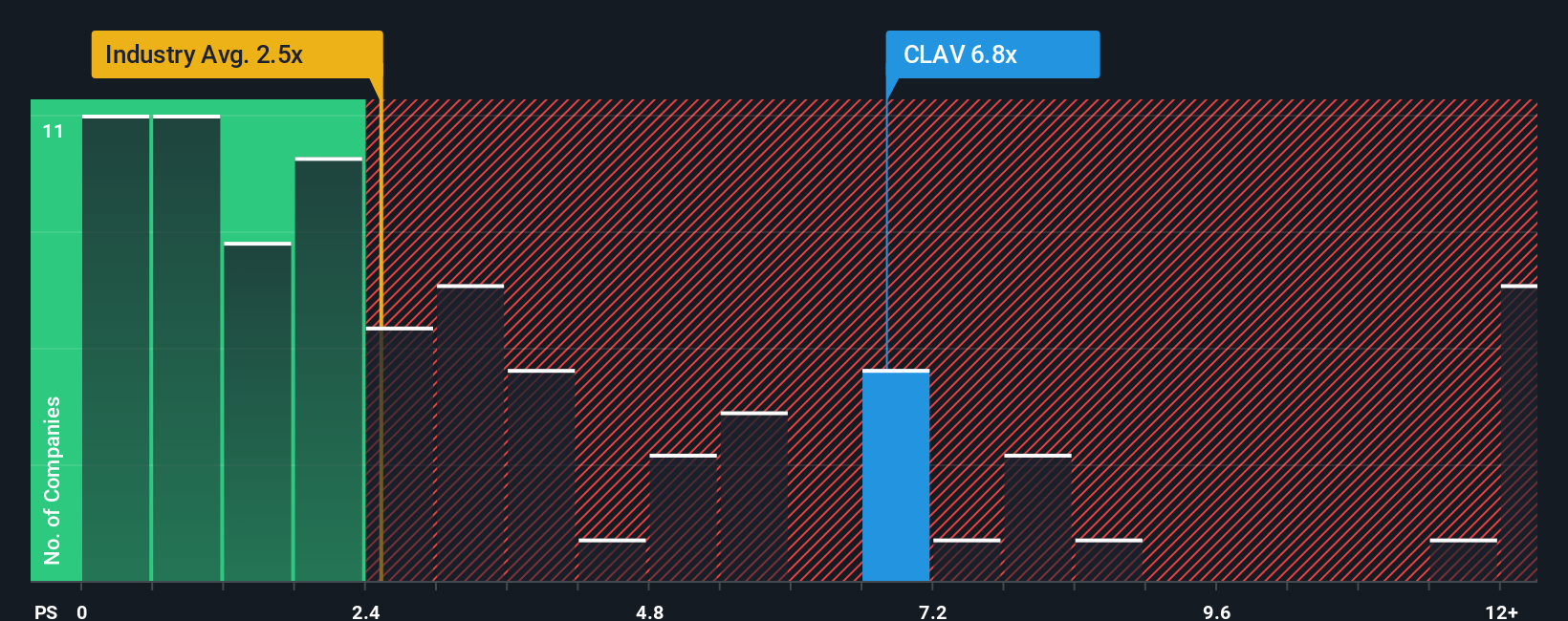

Although its price has dipped substantially, given around half the companies in Sweden's Software industry have price-to-sales ratios (or "P/S") below 2.5x, you may still consider Clavister Holding AB (publ.) as a stock to avoid entirely with its 6.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Clavister Holding AB (publ.)

What Does Clavister Holding AB (publ.)'s P/S Mean For Shareholders?

Recent times have been advantageous for Clavister Holding AB (publ.) as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clavister Holding AB (publ.).Is There Enough Revenue Growth Forecasted For Clavister Holding AB (publ.)?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Clavister Holding AB (publ.)'s to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The latest three year period has also seen an excellent 53% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 20% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 14%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Clavister Holding AB (publ.)'s P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Clavister Holding AB (publ.)'s P/S Mean For Investors?

Even after such a strong price drop, Clavister Holding AB (publ.)'s P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Clavister Holding AB (publ.) maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Clavister Holding AB (publ.) (including 2 which are concerning).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CLAV

Clavister Holding AB (publ.)

Develops, produces, and sells cybersecurity solutions in Sweden, rest of Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives