A Look At Clavister Holding AB (publ.)'s (STO:CLAV) Share Price Returns

Clavister Holding AB (publ.) (STO:CLAV) shareholders should be happy to see the share price up 26% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. In fact, the share price has tumbled down a mountain to land 82% lower after that period. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Clavister Holding AB (publ.)

Clavister Holding AB (publ.) wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Clavister Holding AB (publ.) grew its revenue at 17% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 13% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

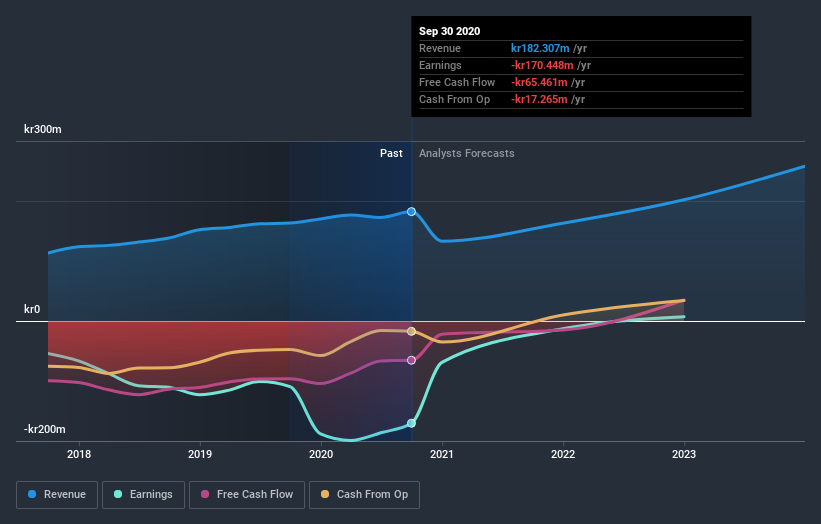

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market gained around 18% in the last year, Clavister Holding AB (publ.) shareholders lost 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Clavister Holding AB (publ.) (of which 2 are concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade Clavister Holding AB (publ.), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:CLAV

Clavister Holding AB (publ.)

Develops, produces, and sells cybersecurity solutions in Sweden, rest of Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives