Amidst increasing losses, Investors bid up Checkin.Com Group (STO:CHECK) 17% this past week

It's nice to see the Checkin.Com Group AB (publ) (STO:CHECK) share price up 17% in a week. But that isn't much consolation to those who have suffered through the declines of the last year. Like a receding glacier in a warming world, the share price has melted 57% in that period. The share price recovery is not so impressive when you consider the fall. You could argue that the sell-off was too severe.

On a more encouraging note the company has added kr121m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

See our latest analysis for Checkin.Com Group

Checkin.Com Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Checkin.Com Group grew its revenue by 103% over the last year. That's well above most other pre-profit companies. In contrast the share price is down 57% over twelve months. Yes, the market can be a fickle mistress. This could mean hype has come out of the stock because the bottom line is concerning investors. We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

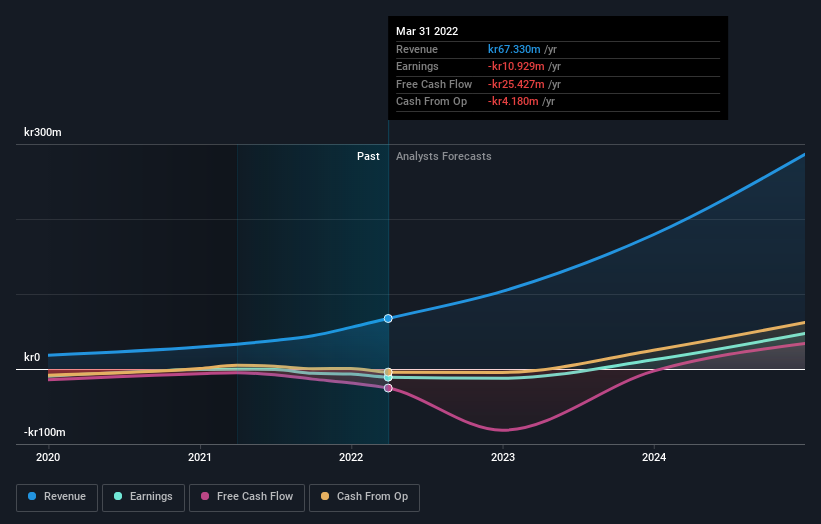

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Checkin.Com Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Checkin.Com Group shareholders are down 57% for the year, even worse than the market loss of 22%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 18% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Checkin.Com Group better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Checkin.Com Group .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CHECK

Checkin.Com Group

Develops software as a service that allow its consumers to connect with brands and services online in Sweden and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives