Loss-Making Artificial Solutions International AB (publ) (STO:ASAI) Expected To Breakeven In The Medium-Term

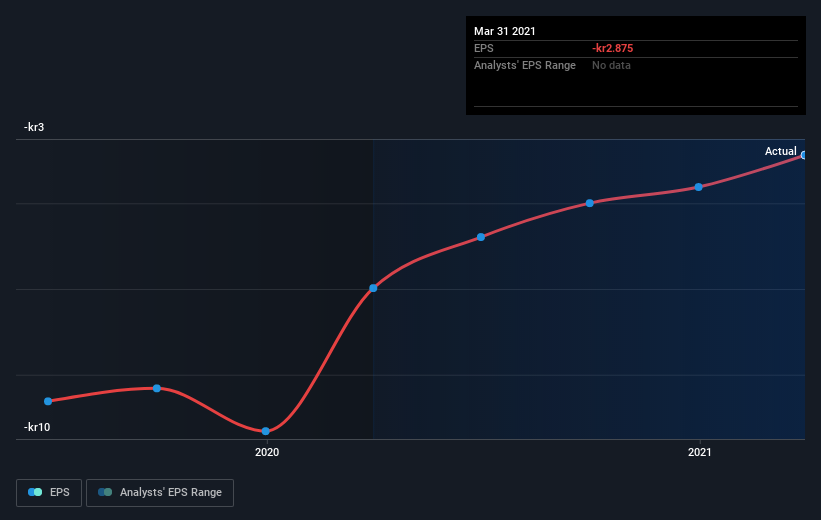

We feel now is a pretty good time to analyse Artificial Solutions International AB (publ)'s (STO:ASAI) business as it appears the company may be on the cusp of a considerable accomplishment. Artificial Solutions International AB (publ) provides conversational AI platform that allows people to communicate with applications, Websites, and devices in everyday humanlike natural language through voice, text, touch or gesture input. With the latest financial year loss of kr154m and a trailing-twelve-month loss of kr135m, the kr447m market-cap company alleviated its loss by moving closer towards its target of breakeven. Many investors are wondering about the rate at which Artificial Solutions International will turn a profit, with the big question being “when will the company breakeven?” In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

Check out our latest analysis for Artificial Solutions International

Consensus from 2 of the Swedish Software analysts is that Artificial Solutions International is on the verge of breakeven. They expect the company to post a final loss in 2022, before turning a profit of kr120m in 2023. So, the company is predicted to breakeven approximately 2 years from now. What rate will the company have to grow year-on-year in order to breakeven on this date? Using a line of best fit, we calculated an average annual growth rate of 96%, which is rather optimistic! If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

We're not going to go through company-specific developments for Artificial Solutions International given that this is a high-level summary, though, keep in mind that generally a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Before we wrap up, there’s one issue worth mentioning. Artificial Solutions International currently has negative equity on its balance sheet. This can sometimes arise from accounting methods used to deal with accumulated losses from prior years, which are viewed as liabilities carried forward until it cancels out in the future. These losses tend to occur only on paper, however, in other cases it can be forewarning.

Next Steps:

There are too many aspects of Artificial Solutions International to cover in one brief article, but the key fundamentals for the company can all be found in one place – Artificial Solutions International's company page on Simply Wall St. We've also compiled a list of pertinent factors you should further research:

- Historical Track Record: What has Artificial Solutions International's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Artificial Solutions International's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you decide to trade Artificial Solutions International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Teneo AI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:TENEO

Teneo AI

An AI platform, provides Al-powered and automated conversations solutions in Europe, the United States, and internationally.

High growth potential and good value.