With EPS Growth And More, Addnode Group (STO:ANOD B) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Addnode Group (STO:ANOD B). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Addnode Group with the means to add long-term value to shareholders.

Check out our latest analysis for Addnode Group

How Quickly Is Addnode Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Addnode Group has managed to grow EPS by 35% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

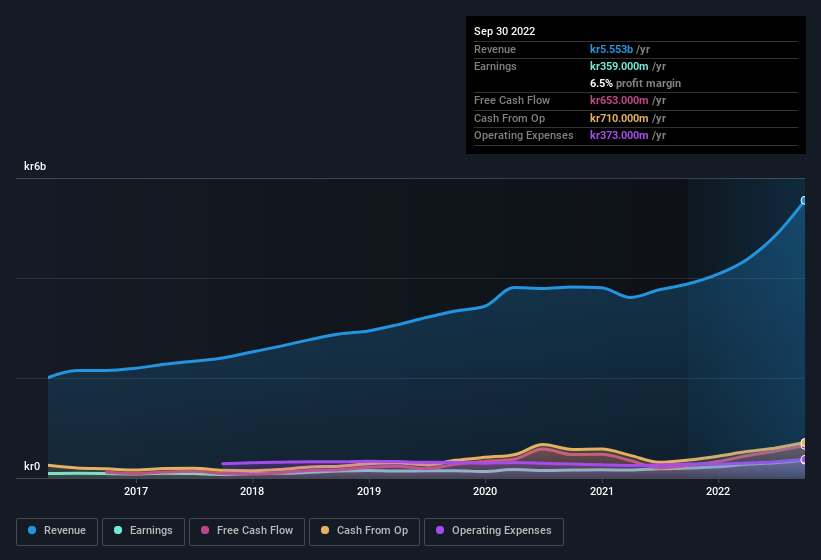

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Addnode Group achieved similar EBIT margins to last year, revenue grew by a solid 43% to kr5.6b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Addnode Group.

Are Addnode Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

While some insiders did sell some of their holdings in Addnode Group, one lone insider trumped that with significant stock purchases. Specifically the President of Process Management Division, Andreas Wikholm, spent kr3.7m, paying about kr95.00 per share. That certainly piques our interest.

Along with the insider buying, another encouraging sign for Addnode Group is that insiders, as a group, have a considerable shareholding. To be specific, they have kr257m worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 1.9%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Johan Andersson is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between kr10b and kr33b, like Addnode Group, the median CEO pay is around kr9.0m.

Addnode Group offered total compensation worth kr7.7m to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Addnode Group Deserve A Spot On Your Watchlist?

For growth investors, Addnode Group's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. These things considered, this is one stock worth watching. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Addnode Group. You might benefit from giving it a glance today.

The good news is that Addnode Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ANOD B

Addnode Group

Offers software and services for the design, construction, product data information, project collaboration, and facility management in Sweden, Nordic countries, the United States, the United Kingdom, Germany, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives