Addnode Group AB (publ)'s (STO:ANOD B) CEO Looks Like They Deserve Their Pay Packet

Key Insights

- Addnode Group to hold its Annual General Meeting on 7th of May

- Total pay for CEO Johan Andersson includes kr4.33m salary

- The total compensation is similar to the average for the industry

- Addnode Group's EPS grew by 23% over the past three years while total shareholder return over the past three years was 59%

We have been pretty impressed with the performance at Addnode Group AB (publ) (STO:ANOD B) recently and CEO Johan Andersson deserves a mention for their role in it. Coming up to the next AGM on 7th of May, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Addnode Group

How Does Total Compensation For Johan Andersson Compare With Other Companies In The Industry?

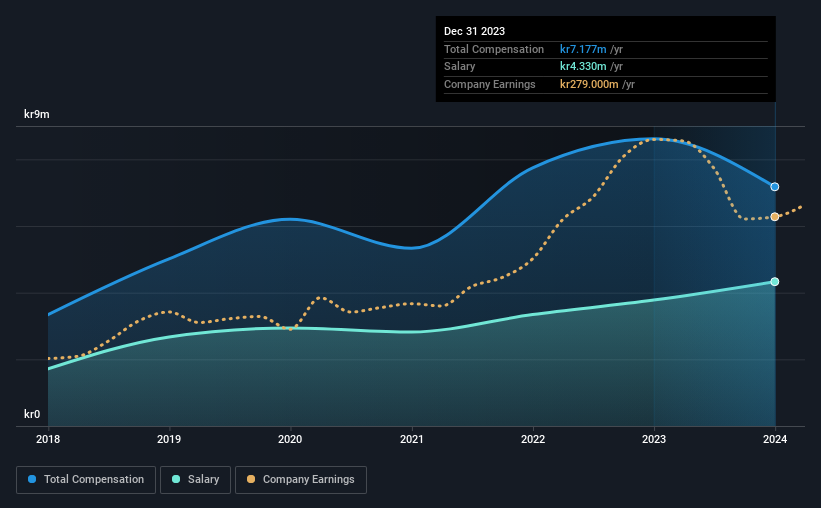

Our data indicates that Addnode Group AB (publ) has a market capitalization of kr15b, and total annual CEO compensation was reported as kr7.2m for the year to December 2023. We note that's a decrease of 17% compared to last year. In particular, the salary of kr4.33m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the Swedish IT industry with market capitalizations ranging from kr11b to kr35b, the reported median CEO total compensation was kr7.2m. This suggests that Addnode Group remunerates its CEO largely in line with the industry average. What's more, Johan Andersson holds kr53m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr4.3m | kr3.8m | 60% |

| Other | kr2.8m | kr4.8m | 40% |

| Total Compensation | kr7.2m | kr8.6m | 100% |

Speaking on an industry level, nearly 64% of total compensation represents salary, while the remainder of 36% is other remuneration. There isn't a significant difference between Addnode Group and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Addnode Group AB (publ)'s Growth Numbers

Over the past three years, Addnode Group AB (publ) has seen its earnings per share (EPS) grow by 23% per year. It achieved revenue growth of 14% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Addnode Group AB (publ) Been A Good Investment?

We think that the total shareholder return of 59%, over three years, would leave most Addnode Group AB (publ) shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Addnode Group that investors should be aware of in a dynamic business environment.

Switching gears from Addnode Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ANOD B

Addnode Group

Offers software and services for the design, construction, product data information, project collaboration, and facility management in Sweden, Nordic countries, the United States, the United Kingdom, Germany, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion