- Sweden

- /

- Retail Distributors

- /

- OM:ZZ B

3 Dividend Stocks On Swedish Exchange Yielding Up To 4.6%

Reviewed by Simply Wall St

As global markets respond to China's stimulus measures and European indices experience a rebound, Sweden's economy is navigating its own path with recent interest rate cuts by the Riksbank. Against this backdrop, dividend stocks on the Swedish exchange present an intriguing opportunity for investors seeking income in a fluctuating market environment. A good dividend stock often combines stable earnings with a commitment to returning capital to shareholders, making them appealing during times of economic uncertainty.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.55% | ★★★★★★ |

| Nordea Bank Abp (OM:NDA SE) | 8.91% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.89% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.33% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.77% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.70% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.79% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.87% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.07% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.85% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Swedish Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

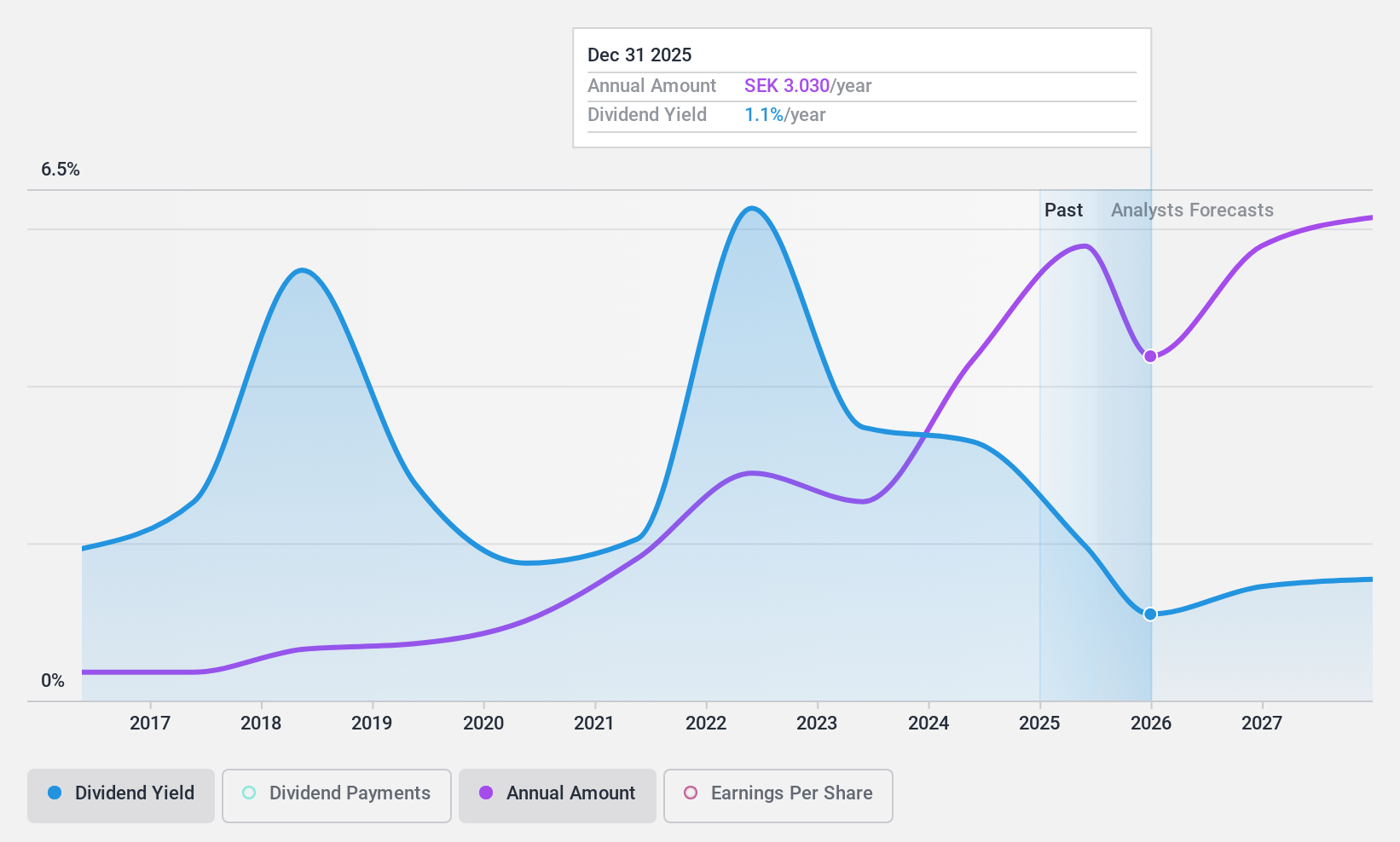

Afry (OM:AFRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Afry AB offers engineering, design, and advisory services across infrastructure, industry, energy, and digitalization sectors in North and South America, Finland, and Central Europe with a market cap of approximately SEK20.29 billion.

Operations: Afry AB's revenue segments include Infrastructure (SEK10.43 billion), Industrial & Digital Solutions (SEK6.83 billion), Process Industries (SEK5.47 billion), Energy (SEK3.69 billion), and Management Consulting (SEK1.69 billion).

Dividend Yield: 3.1%

Afry's dividend payments have been volatile over the past decade, with significant annual drops exceeding 20%. Despite this instability, dividends are well-covered by both earnings and cash flows, with payout ratios at 52.1% and 38.8%, respectively. The company's recent financial performance shows growth in sales and net income, indicating potential for improved stability. However, its dividend yield of 3.07% remains lower than the top quartile of Swedish dividend payers at 4.33%.

- Take a closer look at Afry's potential here in our dividend report.

- Upon reviewing our latest valuation report, Afry's share price might be too pessimistic.

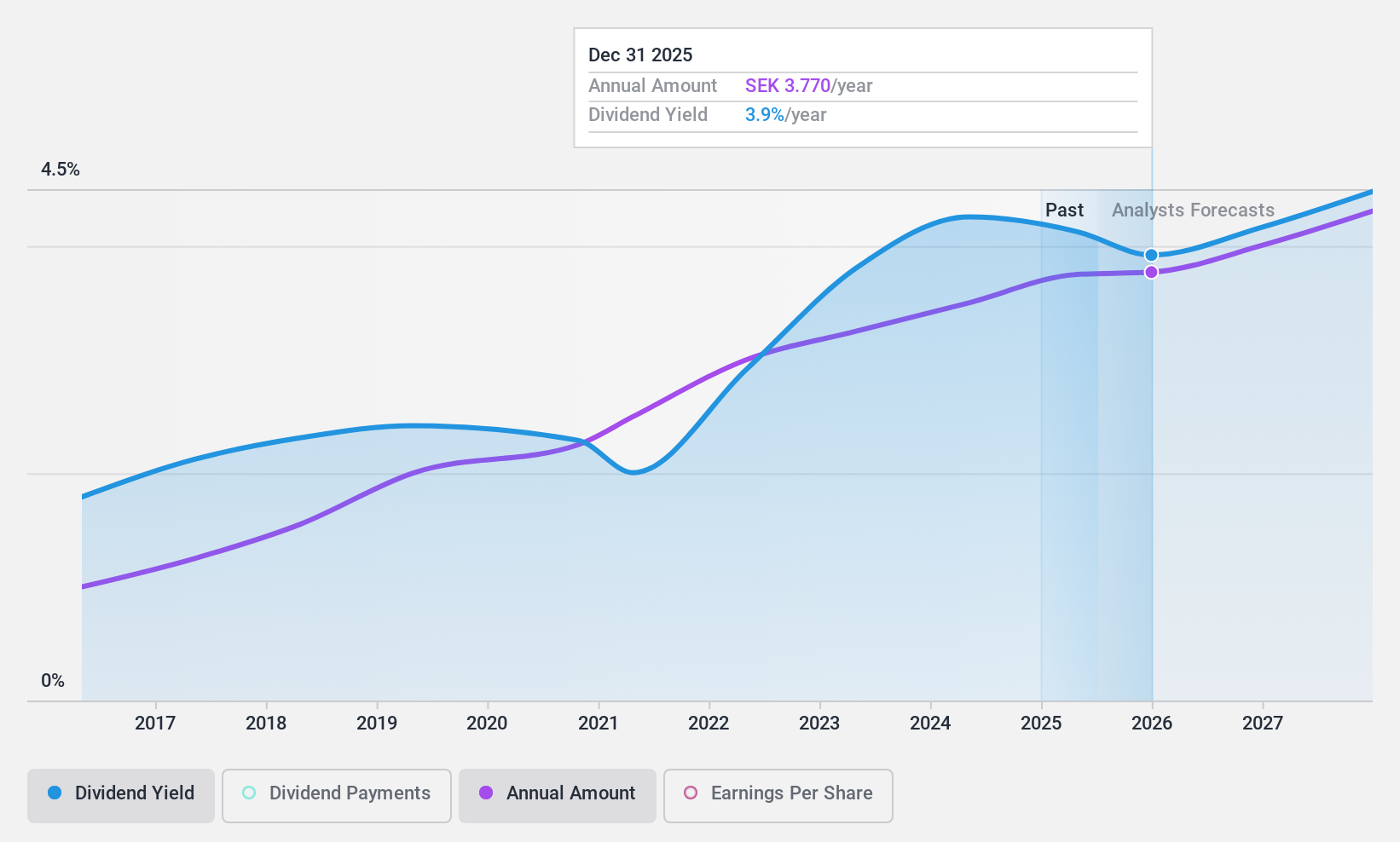

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB (publ) offers technical services and installations for buildings and industrial facilities across Sweden, Norway, Denmark, and Finland, with a market cap of approximately SEK15.52 billion.

Operations: Bravida Holding AB (publ) generates revenue through its provision of technical services and installations for both buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Dividend Yield: 4.6%

Bravida Holding's dividend yield of 4.61% places it in the top quartile among Swedish dividend payers, and its dividends are well-covered by both earnings (65% payout ratio) and cash flows (34.8% cash payout ratio). Despite a relatively short eight-year history of stable and growing dividends, recent earnings reports show a decline in net income to SEK 236 million for Q2 2024. The company has secured significant contracts, including with the Swedish Transport Administration, potentially supporting future revenue streams.

- Get an in-depth perspective on Bravida Holding's performance by reading our dividend report here.

- The analysis detailed in our Bravida Holding valuation report hints at an deflated share price compared to its estimated value.

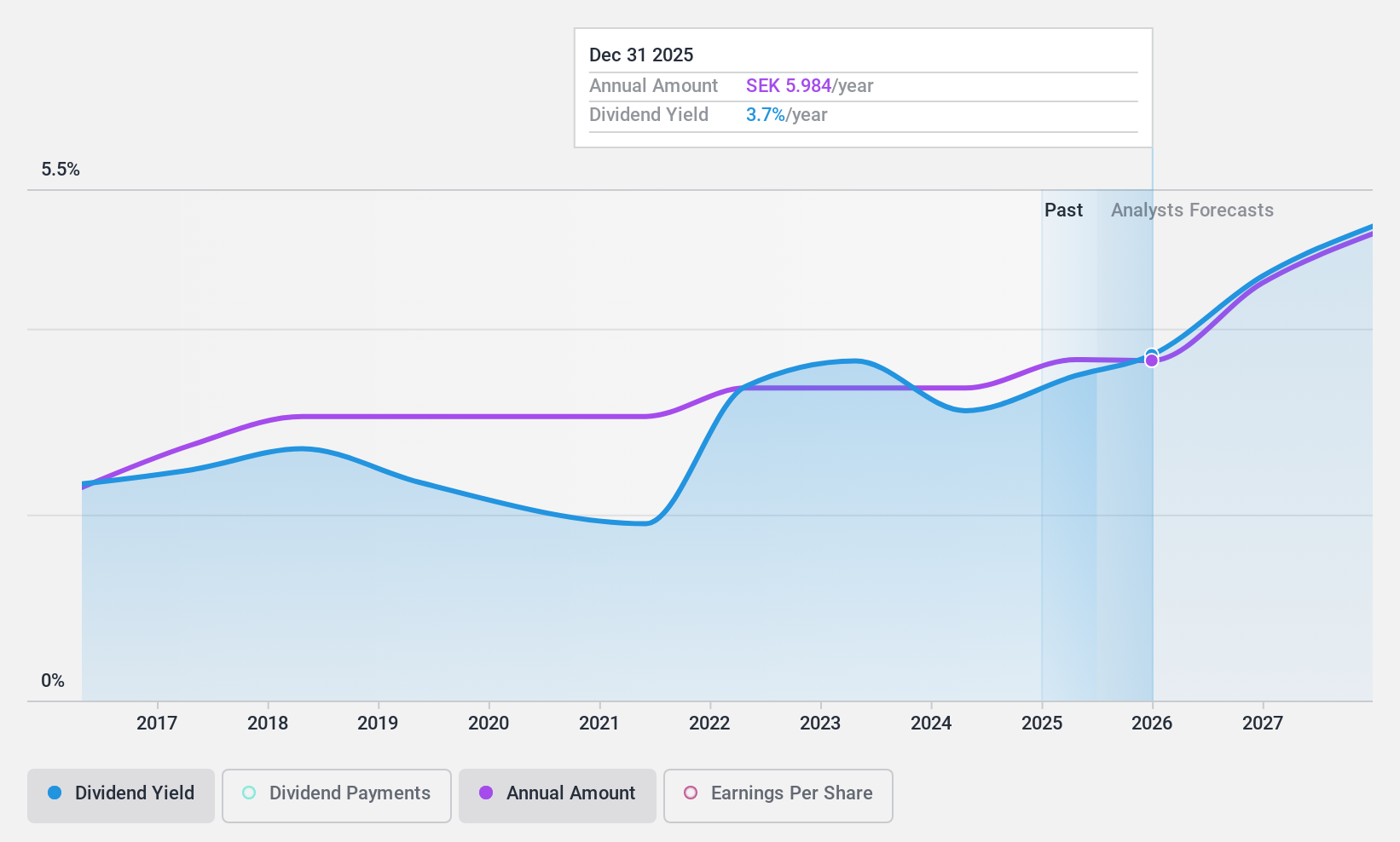

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products both in Sweden and internationally, with a market cap of SEK3.09 billion.

Operations: Zinzino AB (publ) generates revenue primarily from its Zinzino (Incl. VMA Life) segment, which accounts for SEK1.83 billion, alongside a smaller contribution from the Faun segment at SEK170.31 million.

Dividend Yield: 3.3%

Zinzino's dividend yield of 3.33% is below the top quartile in Sweden but remains stable and reliable over the past decade. Dividends are well-covered, with a payout ratio of 56.3% and a cash payout ratio of 47.4%. Recent financial performance shows strong revenue growth, with a 21% increase year-to-date to SEK 1.31 billion, supporting its dividend sustainability. The company's addition to the S&P Global BMI Index may enhance investor visibility and interest.

- Click here to discover the nuances of Zinzino with our detailed analytical dividend report.

- Our valuation report unveils the possibility Zinzino's shares may be trading at a discount.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 18 Top Swedish Dividend Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zinzino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ZZ B

Zinzino

A direct sales company, provides dietary supplements and skincare products in Sweden and internationally.

Flawless balance sheet established dividend payer.