While shareholders of Urb-it (STO:URBIT) are in the black over 3 years, those who bought a week ago aren't so fortunate

It hasn't been the best quarter for Urb-it AB (publ) (STO:URBIT) shareholders, since the share price has fallen 22% in that time. But in three years the returns have been great. In three years the stock price has launched 280% higher: a great result. To some, the recent share price pullback wouldn't be surprising after such a good run. Only time will tell if there is still too much optimism currently reflected in the share price.

Since the long term performance has been good but there's been a recent pullback of 11%, let's check if the fundamentals match the share price.

Check out our latest analysis for Urb-it

Urb-it isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Urb-it's revenue trended up 45% each year over three years. That's well above most pre-profit companies. Meanwhile, the share price performance has been pretty solid at 56% compound over three years. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Urb-it is still worth investigating - successful businesses can often keep growing for long periods.

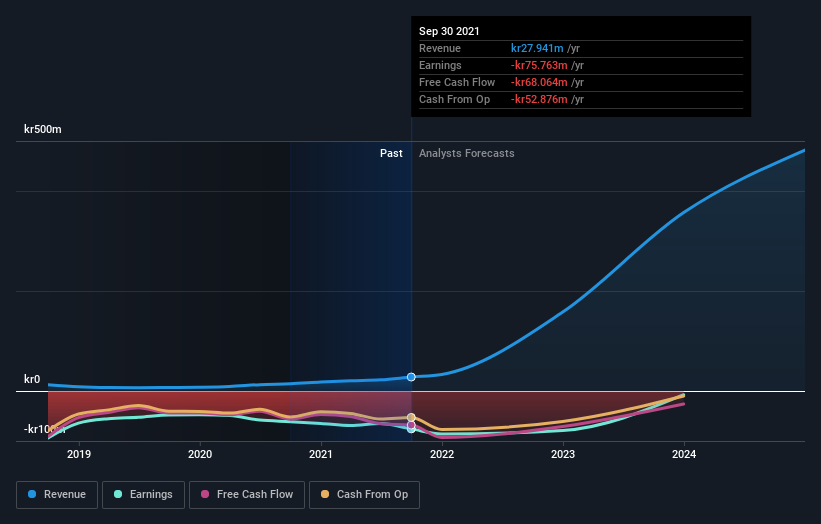

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Urb-it stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Urb-it shareholders have gained 31% (in total) over the last year. The TSR has been even better over three years, coming in at 56% per year. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 5 warning signs for Urb-it you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:URBIT

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives