Global Stocks Conceivably Trading Below Fair Value Estimates In June 2025

Reviewed by Simply Wall St

As global markets grapple with escalating geopolitical tensions in the Middle East and fluctuating trade policies, investors are navigating a landscape marked by volatility and cautious optimism. Despite these challenges, opportunities may exist for discerning investors to identify stocks trading below their fair value estimates, particularly as economic indicators show mixed signals of inflationary pressures and consumer sentiment recovery. In such an environment, a good stock might be characterized by strong fundamentals that can withstand market turbulence and potential growth prospects that align with improving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥2358.00 | ¥4703.49 | 49.9% |

| StemCell Institute (TSE:7096) | ¥1061.00 | ¥2118.09 | 49.9% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK363.99 | 49.6% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥21.79 | CN¥43.47 | 49.9% |

| Pansoft (SZSE:300996) | CN¥14.14 | CN¥28.02 | 49.5% |

| Lectra (ENXTPA:LSS) | €23.40 | €46.49 | 49.7% |

| Just Eat Takeaway.com (ENXTAM:TKWY) | €19.50 | €38.90 | 49.9% |

| Global Tax Free (KOSDAQ:A204620) | ₩6980.00 | ₩13833.74 | 49.5% |

| GCH Technology (SHSE:688625) | CN¥30.65 | CN¥60.63 | 49.4% |

| Absolent Air Care Group (OM:ABSO) | SEK209.00 | SEK416.07 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

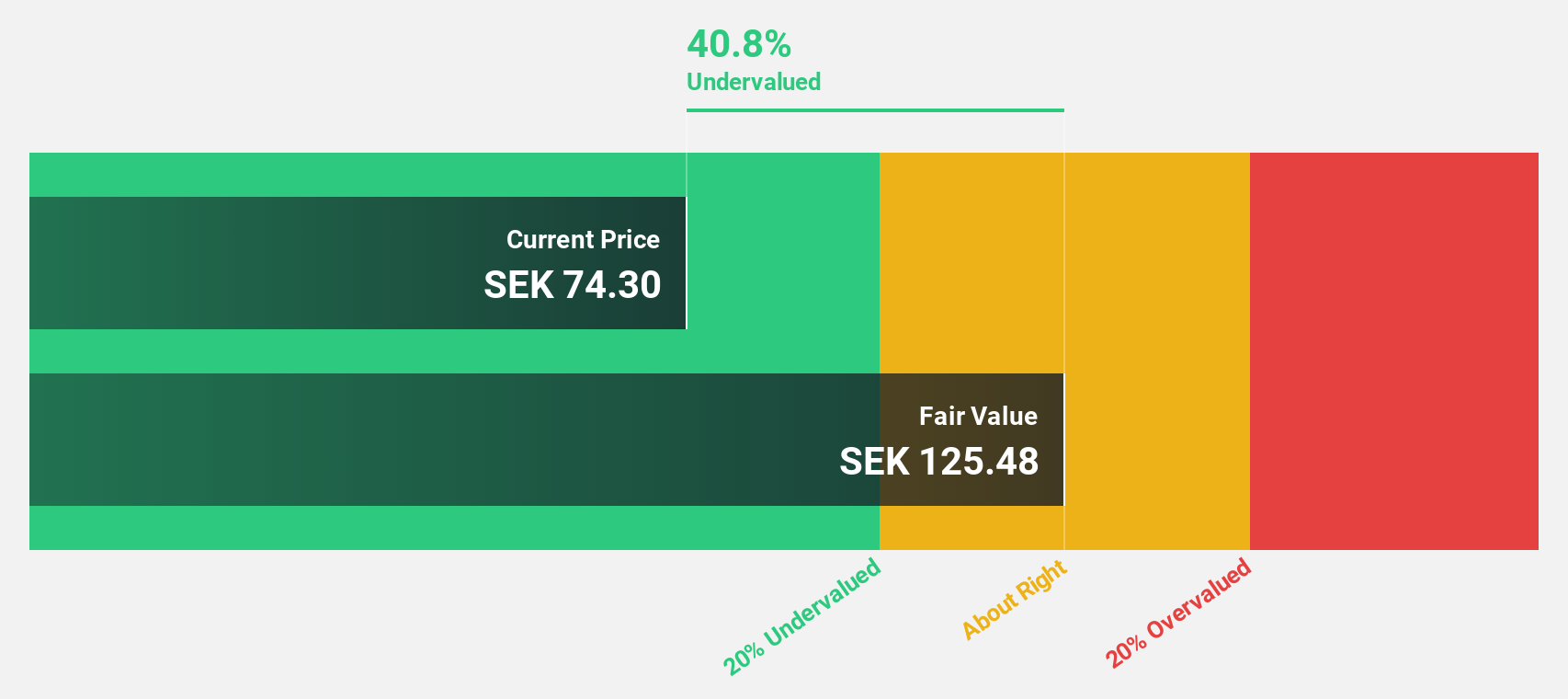

Rusta (OM:RUSTA)

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK11.88 billion.

Operations: Rusta generates revenue from retailing home and leisure products across its markets in Sweden, Norway, Finland, and Germany.

Estimated Discount To Fair Value: 38.7%

Rusta is trading at SEK 77.65, significantly below its estimated fair value of SEK 126.61, making it undervalued based on cash flows. Earnings are expected to grow by 17.4% annually, outpacing the broader Swedish market's growth rate of 15.9%. Recent earnings showed improved net income and sales growth year-over-year. The company is enhancing efficiency with a new bonded warehouse and expanding its store footprint across Sweden and neighboring countries, supporting long-term profitability goals.

- Our growth report here indicates Rusta may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Rusta.

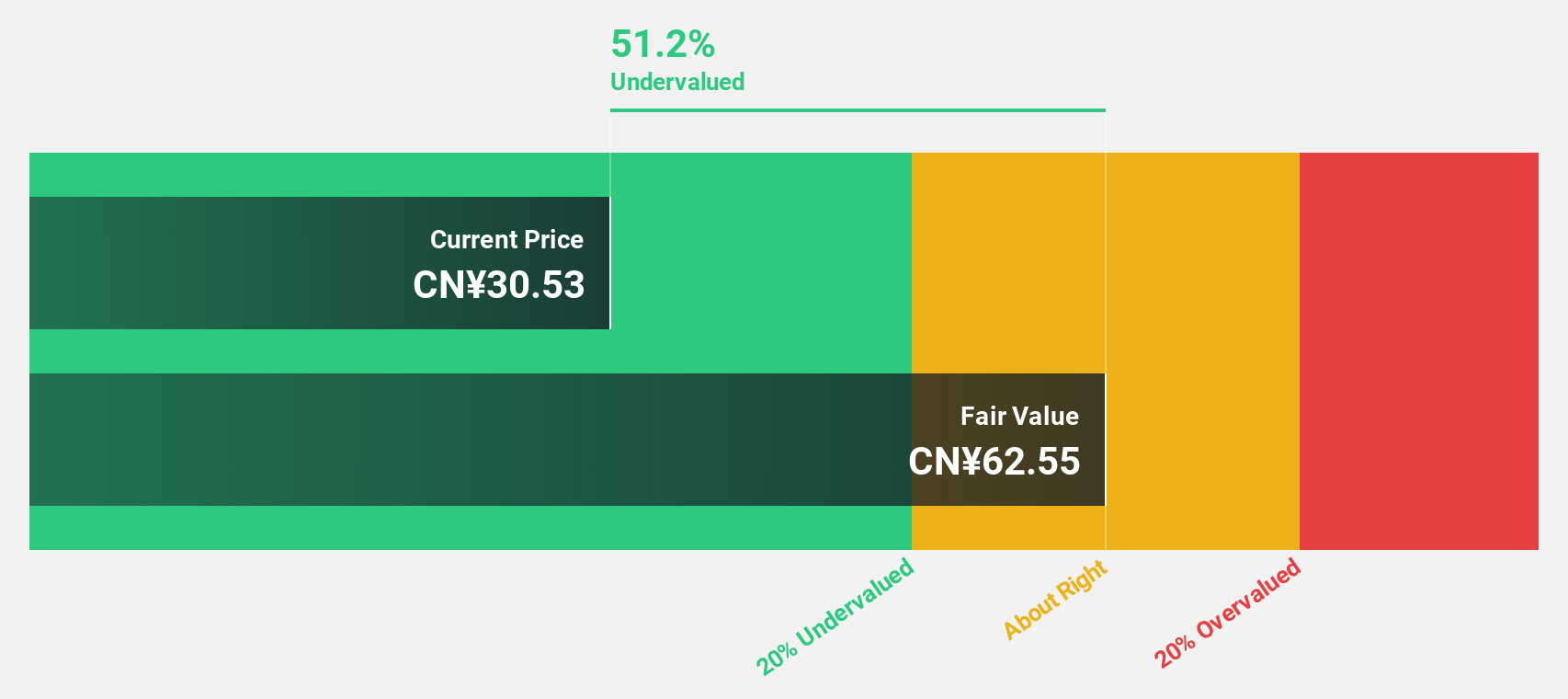

Dajin Heavy IndustryLtd (SZSE:002487)

Overview: Dajin Heavy Industry Co., Ltd. develops, produces, and sells wind power equipment in China with a market cap of CN¥19.60 billion.

Operations: Dajin Heavy Industry Co., Ltd. generates its revenue through the development, production, and sale of wind power equipment within China.

Estimated Discount To Fair Value: 49.3%

Dajin Heavy Industry Ltd. trades at CN¥31.69, significantly below its estimated fair value of CN¥62.57, highlighting its undervaluation based on cash flows. Earnings grew 61.6% last year and are forecast to grow 31.59% annually, outpacing the Chinese market's growth rate of 23.2%. Despite a recent dividend decrease, Q1 2025 results showed robust revenue and net income growth compared to the previous year, reinforcing its strong cash flow position.

- Our expertly prepared growth report on Dajin Heavy IndustryLtd implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Dajin Heavy IndustryLtd stock in this financial health report.

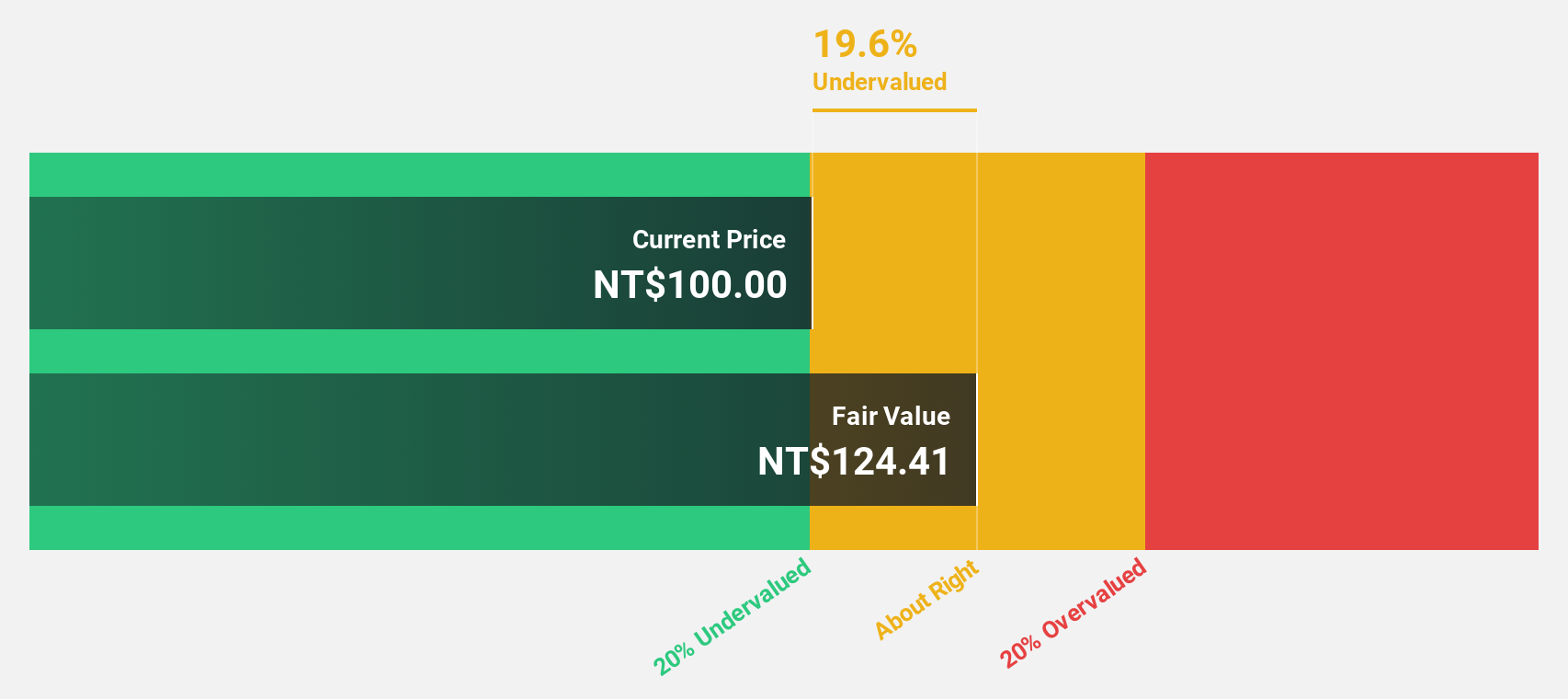

King Yuan Electronics (TWSE:2449)

Overview: King Yuan Electronics Co., Ltd. provides design, manufacturing, selling, testing, and assembly services for integrated circuits globally and has a market cap of NT$125.94 billion.

Operations: The company generates revenue from its Contract Electronics Manufacturing Services segment, amounting to NT$28.19 billion.

Estimated Discount To Fair Value: 17.8%

King Yuan Electronics Co., Ltd. trades at NT$102.5, slightly undervalued compared to its fair value of NT$124.71, based on cash flows. The company reported significant Q1 2025 earnings growth with net income reaching TWD 4.29 billion, up from TWD 1.37 billion a year ago, supporting strong cash flow generation despite a dividend not well covered by earnings or free cash flows. Earnings are forecast to grow significantly at 25% annually over the next three years.

- In light of our recent growth report, it seems possible that King Yuan Electronics' financial performance will exceed current levels.

- Get an in-depth perspective on King Yuan Electronics' balance sheet by reading our health report here.

Taking Advantage

- Gain an insight into the universe of 497 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany.

Outstanding track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives