- Switzerland

- /

- Commercial Services

- /

- SWX:OFN

Exploring Momentum Group And 2 Hidden European Small Caps With Potential

Reviewed by Simply Wall St

Amidst tentative optimism surrounding a potential EU-U.S. trade deal, European markets have shown resilience, with the STOXX Europe 600 Index rising by 0.54%. In this environment of cautious growth and strategic positioning, investors often seek out small-cap stocks that demonstrate strong fundamentals and the ability to capitalize on evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★★★

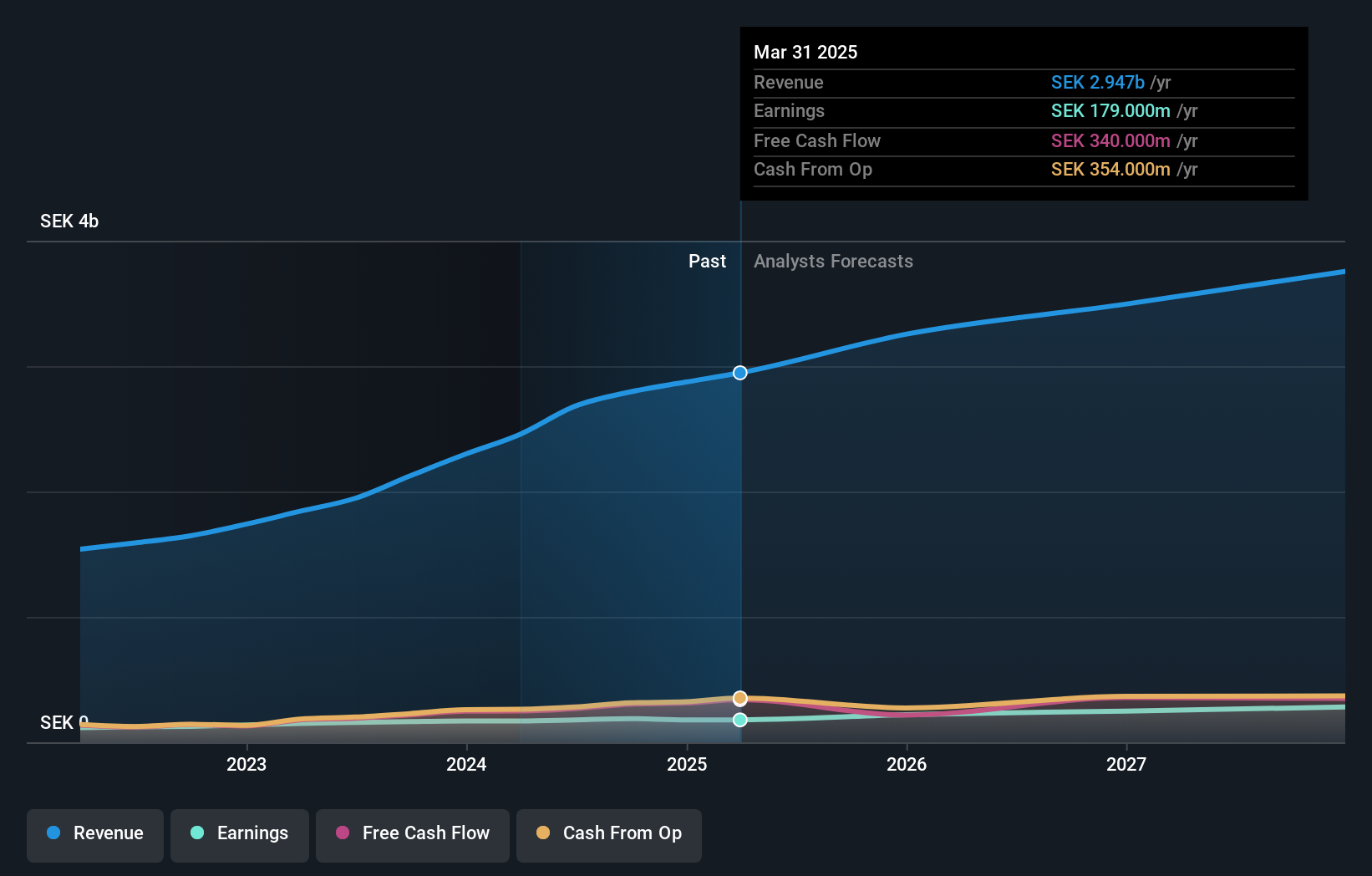

Overview: Momentum Group AB (publ) provides industrial components and services to the industrial sector across Sweden, Norway, Denmark, Finland, and internationally with a market cap of approximately SEK7.84 billion.

Operations: Momentum Group AB generates revenue primarily from its Industry and Infrastructure segments, with SEK1.74 billion and SEK1.29 billion respectively. The company's net profit margin reflects its financial efficiency in converting revenue into profit.

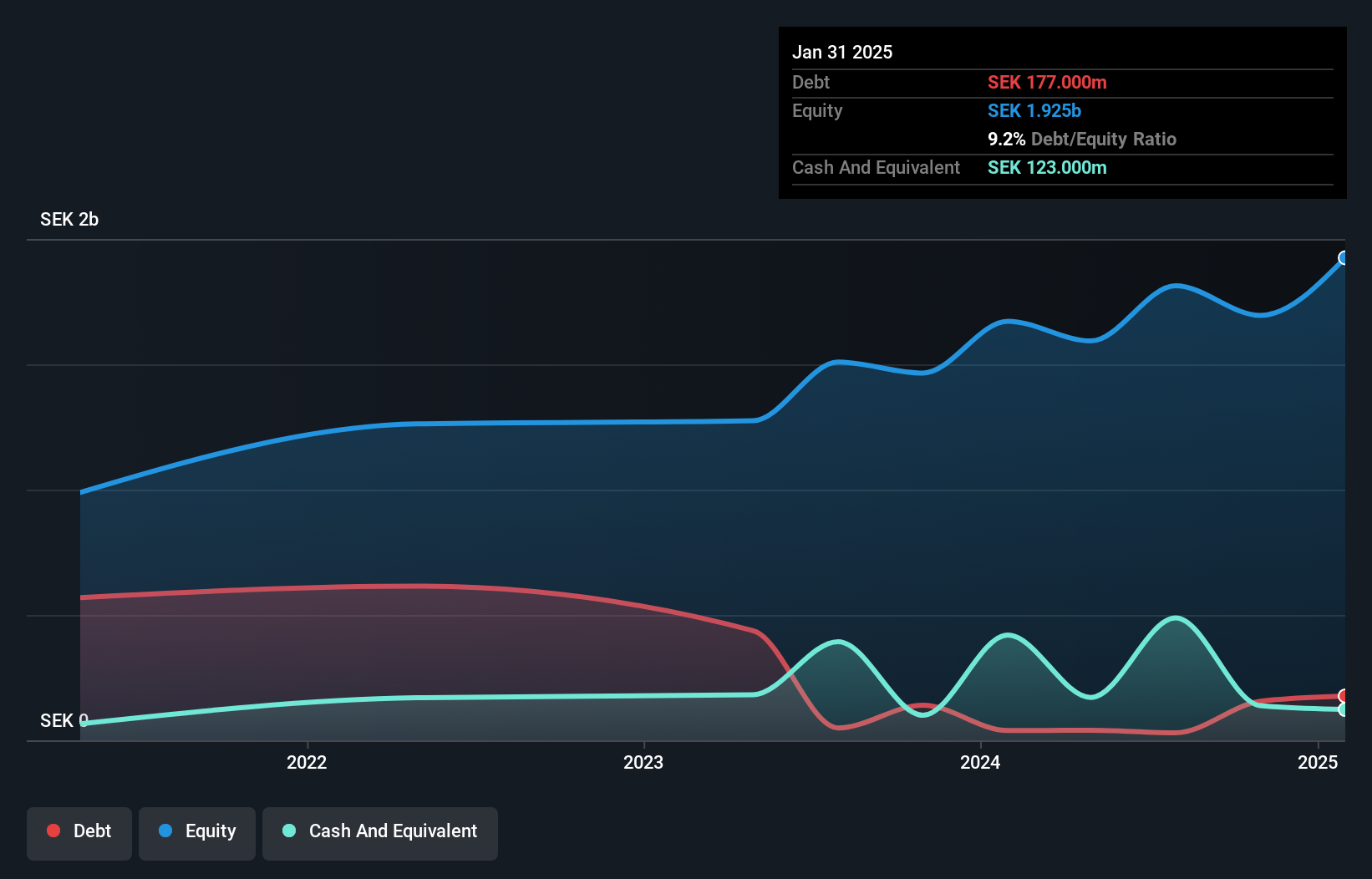

Momentum Group, a notable player in the trade distribution sector, has seen its debt to equity ratio improve significantly from 43.2% to 28.7% over five years, reflecting prudent financial management. Despite a challenging year with earnings growth at -1.1%, the company maintains high-quality earnings and strong EBIT coverage of interest payments at 10.7 times, indicating robust operational efficiency. The recent completion of a share buyback program for RUB 1,453 million highlights strategic capital allocation efforts. With sales reaching SEK 824 million in Q2 2025 and net income stable at SEK 51 million, Momentum Group shows resilience amidst industry pressures.

- Navigate through the intricacies of Momentum Group with our comprehensive health report here.

Gain insights into Momentum Group's past trends and performance with our Past report.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market capitalization of approximately SEK11.96 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden (SEK6.86 billion), Norway (SEK2.53 billion), and other markets (SEK2.44 billion).

Rusta's financial health shows promise, with a net debt to equity ratio of 4.2%, indicating satisfactory leverage. While earnings grew at 0.3% annually over five years, recent growth was 16.7%, slightly below the industry average of 20.2%. The company's EBIT covers interest payments by 3.6 times, highlighting robust interest coverage. Recent full-year results revealed sales climbed to SEK11.83 billion from SEK11.12 billion, and net income rose to SEK476 million from SEK408 million last year, reflecting solid performance despite a competitive landscape and currency risks in new markets like Germany where expansion is underway with plans for up to 80 new stores in three years.

Orell Füssli (SWX:OFN)

Simply Wall St Value Rating: ★★★★★★

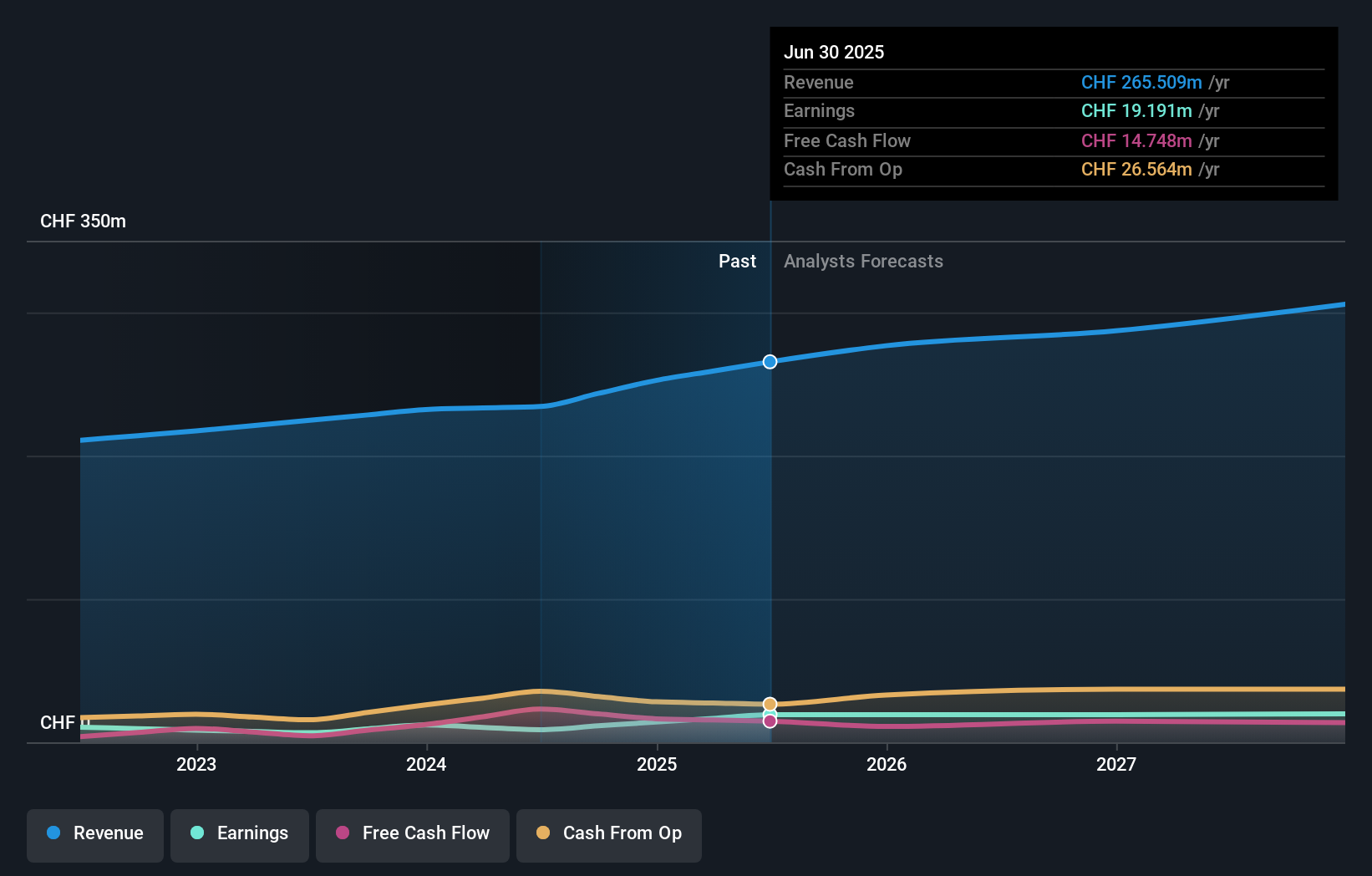

Overview: Orell Füssli AG operates in security printing and technology, book retailing, and publishing across various regions including Switzerland, Germany, the rest of Europe and Africa, North and South America, Asia, and Oceania with a market cap of CHF205.80 million.

Operations: The company generates revenue primarily from security printing and technology, book retailing, and publishing. It operates in various regions including Switzerland and Germany. The business has a market cap of CHF205.80 million.

Orell Füssli, a niche player in the European market, has showcased impressive financial resilience. With no debt over the past five years and trading at 38.7% below its estimated fair value, it appears undervalued. Earnings surged by 117.9% last year, outpacing industry growth of 1.3%. Recent results for the half-year ending June 2025 saw revenue climb to CHF 124.98 million from CHF 111.38 million previously, while net income jumped to CHF 6.69 million from CHF 1.59 million a year ago. The company also increased its dividend to CHF 4.40 per share, reflecting strong cash flow positivity and profitability prospects despite forecasted earnings decline of an average of 3.9% annually over three years.

- Get an in-depth perspective on Orell Füssli's performance by reading our health report here.

Examine Orell Füssli's past performance report to understand how it has performed in the past.

Make It Happen

- Gain an insight into the universe of 320 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:OFN

Orell Füssli

Engages in security printing and technology, book retailing, and publishing business in Switzerland Germany, rest of Europe and Africa, North and South America, Asia, and Oceania.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives