- Sweden

- /

- Specialty Stores

- /

- OM:RIZZO B

Rizzo Group AB (publ)'s (STO:RIZZO B) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/SRatio

Rizzo Group AB (publ) (STO:RIZZO B) shares have had a horrible month, losing 26% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 80% share price decline.

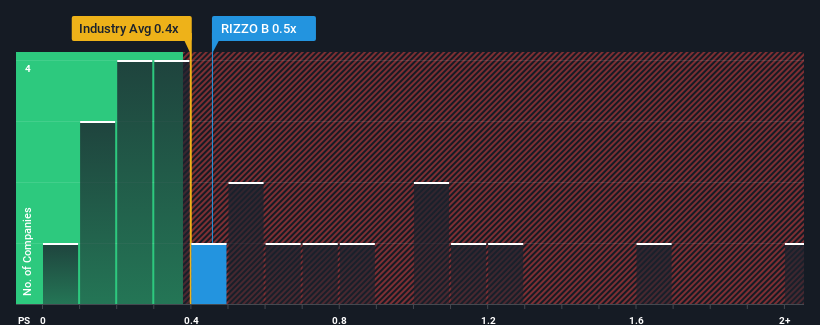

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Rizzo Group's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Specialty Retail industry in Sweden is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Rizzo Group

What Does Rizzo Group's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Rizzo Group over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Rizzo Group's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Rizzo Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Rizzo Group's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. As a result, revenue from three years ago have also fallen 68% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.6% shows it's an unpleasant look.

With this information, we find it concerning that Rizzo Group is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Bottom Line On Rizzo Group's P/S

Following Rizzo Group's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We find it unexpected that Rizzo Group trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 6 warning signs for Rizzo Group (4 don't sit too well with us!) that you should be aware of before investing here.

If you're unsure about the strength of Rizzo Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RIZZO B

Rizzo Group

Rizzo Group AB (publ) offers bags, accessories, and travel accessories.

Slightly overvalued with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026