- Sweden

- /

- Specialty Stores

- /

- OM:HM B

H & M Hennes & Mauritz (STO:HM B) Has Affirmed Its Dividend Of SEK3.25

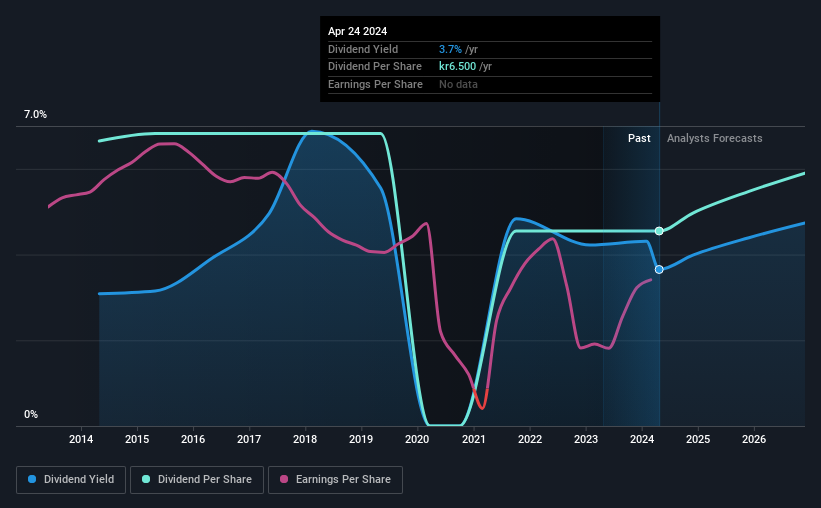

H & M Hennes & Mauritz AB (publ) (STO:HM B) has announced that it will pay a dividend of SEK3.25 per share on the 13th of May. This payment means that the dividend yield will be 3.7%, which is around the industry average.

Check out our latest analysis for H & M Hennes & Mauritz

H & M Hennes & Mauritz's Earnings Easily Cover The Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, the company was paying out 112% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 44%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Over the next year, EPS is forecast to expand by 95.5%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 54% which would be quite comfortable going to take the dividend forward.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of SEK9.50 in 2014 to the most recent total annual payment of SEK6.50. The dividend has shrunk at around 3.7% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

H & M Hennes & Mauritz May Find It Hard To Grow The Dividend

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. H & M Hennes & Mauritz has seen earnings per share falling at 4.3% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think H & M Hennes & Mauritz is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for H & M Hennes & Mauritz that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives