Stock Analysis

- Sweden

- /

- Specialty Stores

- /

- OM:CLAS B

Are Clas Ohlson AB (publ)'s (STO:CLAS B) Mixed Financials The Reason For Its Gloomy Performance on The Stock Market?

It is hard to get excited after looking at Clas Ohlson's (STO:CLAS B) recent performance, when its stock has declined 9.4% over the past three months. It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Specifically, we decided to study Clas Ohlson's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Clas Ohlson

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Clas Ohlson is:

24% = kr458m ÷ kr1.9b (Based on the trailing twelve months to October 2020).

The 'return' is the profit over the last twelve months. So, this means that for every SEK1 of its shareholder's investments, the company generates a profit of SEK0.24.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Clas Ohlson's Earnings Growth And 24% ROE

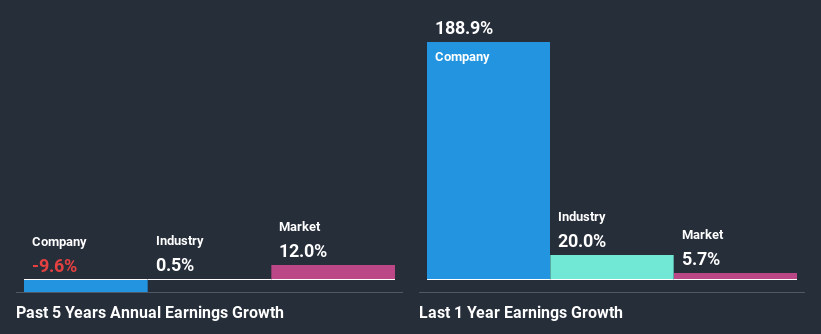

Firstly, we acknowledge that Clas Ohlson has a significantly high ROE. Second, a comparison with the average ROE reported by the industry of 10% also doesn't go unnoticed by us. As you might expect, the 9.6% net income decline reported by Clas Ohlson doesn't bode well with us. So, there might be some other aspects that could explain this. These include low earnings retention or poor allocation of capital.

That being said, we compared Clas Ohlson's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 0.5% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Clas Ohlson's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Clas Ohlson Using Its Retained Earnings Effectively?

While the company did payout a portion of its dividend in the past, it currently doesn't pay a dividend. This implies that potentially all of its profits are being reinvested in the business.

Our latest analyst data shows that the future payout ratio of the company is expected to drop to 87% over the next three years. Regardless, the ROE is not expected to change much for the company despite the lower expected payout ratio.

Conclusion

In total, we're a bit ambivalent about Clas Ohlson's performance. In spite of the high ROE, the company has failed to see growth in its earnings due to it paying out most of its profits as dividend, with almost nothing left to invest into its own business. That being so, the latest industry analyst forecasts show that analysts are forecasting a slight improvement in the company's future earnings growth. This could offer some relief to the company's existing shareholders. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade Clas Ohlson, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:CLAS B

Clas Ohlson

A retail company, sells hardware, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally.

Flawless balance sheet with solid track record.