Stock Analysis

- Sweden

- /

- Capital Markets

- /

- OM:EQT

Swedish Exchange Growth Leaders With High Insider Ownership In July 2024

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by trade tensions and shifting investment trends, the Swedish stock market presents unique opportunities, particularly in growth companies with high insider ownership. In July 2024, understanding the intricacies of these companies becomes crucial as investors look for stability and potential growth amid broader economic uncertainties.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Biovica International (OM:BIOVIC B) | 18.7% | 73.8% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Sileon (OM:SILEON) | 20.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Underneath we present a selection of stocks filtered out by our screen.

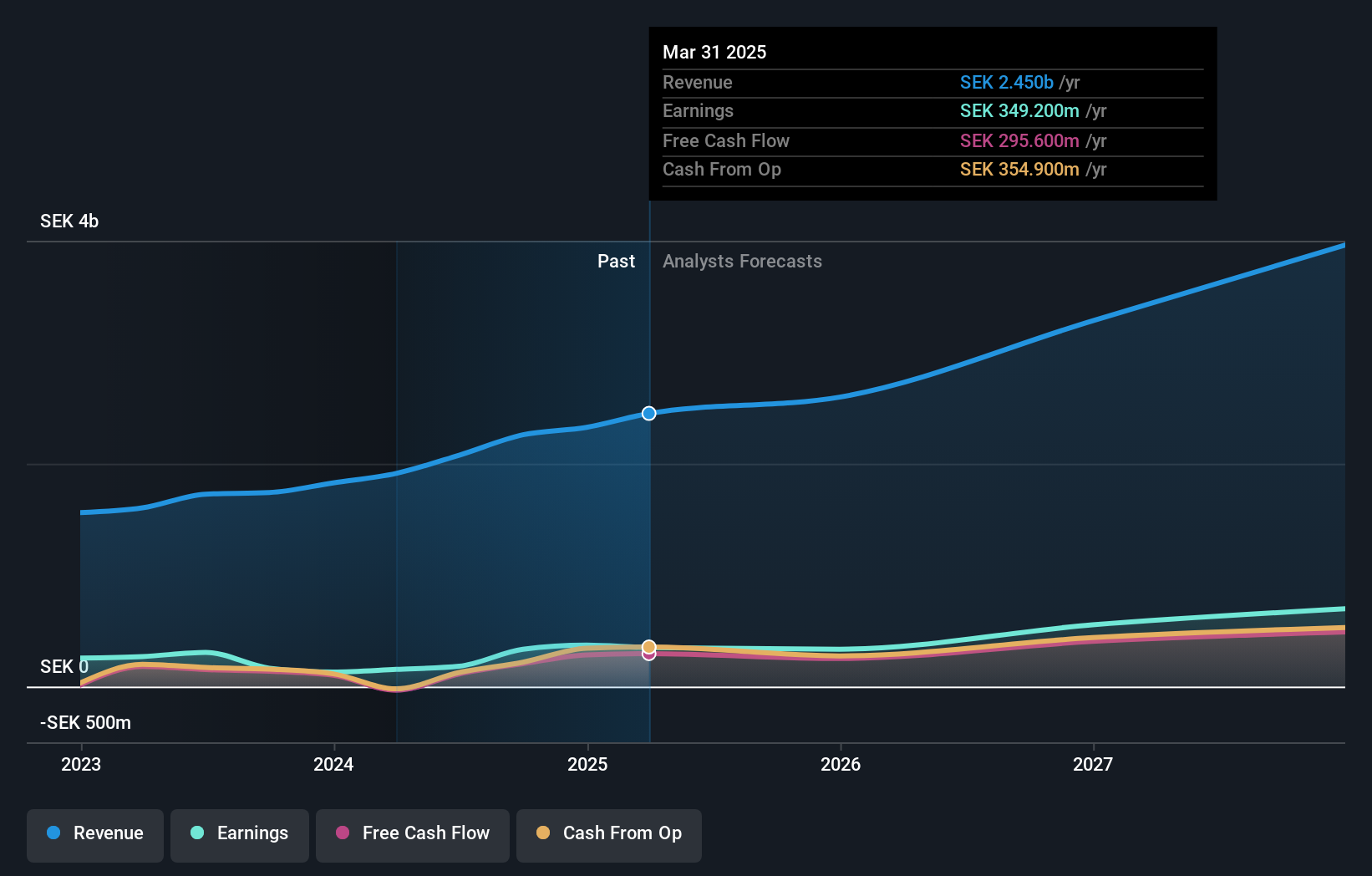

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market capitalization of approximately SEK 398.31 billion.

Operations: EQT's revenue is primarily derived from its Private Capital and Real Assets segments, generating €1.28 billion and €0.88 billion respectively.

Insider Ownership: 31%

Return On Equity Forecast: 23% (2027 estimate)

EQT, a Swedish private equity firm, reported a substantial year-over-year earnings increase with net income rising to €282 million in the first half of 2024 from €120 million. Despite this growth, its revenue increase of 17.9% per year is forecasted to grow slower than the market average. However, EQT's earnings are expected to outpace the market with significant annual growth projected over the next three years. Insider activity has been balanced, with more shares bought than sold recently, though not in large volumes. Additionally, EQT is actively exploring strategic options for its holdings like Karo Healthcare and Reworld, indicating potential future liquidity events or restructuring that could impact company valuation and focus.

- Click to explore a detailed breakdown of our findings in EQT's earnings growth report.

- Our valuation report here indicates EQT may be overvalued.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) operates in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK 47.13 billion.

Operations: The company's revenue is primarily derived from its Imaging IT Solutions and Secure Communications segments, generating SEK 2.55 billion and SEK 367.35 million respectively, along with a smaller contribution of SEK 89.87 million from Business Innovation.

Insider Ownership: 30.3%

Return On Equity Forecast: 30% (2027 estimate)

Sectra, a Swedish company specializing in medical imaging IT and cybersecurity, has shown consistent financial performance with a recent year-on-year revenue increase to SEK 915.7 million and net income of SEK 158.45 million. Its earnings are forecasted to grow by 19.33% annually, outpacing the Swedish market average. Despite moderate growth rates, Sectra's high Return on Equity at 30.5% signals strong profitability potential. Additionally, recent expansions into cloud-based services and genomic diagnostics indicate strategic moves to enhance operational efficiencies and market reach, maintaining its competitive edge in healthcare technology without substantial insider trading reported in the past three months.

- Click here to discover the nuances of Sectra with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Sectra's current price could be inflated.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 23.08 billion.

Operations: The company generates SEK 1.93 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Return On Equity Forecast: 28% (2027 estimate)

Yubico, a Swedish growth company with significant insider ownership, recently reported a substantial year-on-year revenue increase to SEK 504.4 million and net income of SEK 77.5 million for Q1 2024. Despite some shareholder dilution over the past year, Yubico's earnings are expected to grow by 43.8% annually, outperforming the Swedish market forecast of 15.3% growth. The firm's recent launch of MilSecure Mobile and firmware updates underline its commitment to enhancing secure web browsing technologies and passwordless authentication solutions globally.

- Delve into the full analysis future growth report here for a deeper understanding of Yubico.

- In light of our recent valuation report, it seems possible that Yubico is trading beyond its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 93 Fast Growing Swedish Companies With High Insider Ownership by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity firm specializing in private capital and real asset segments.

High growth potential with excellent balance sheet.