- Sweden

- /

- Specialty Stores

- /

- OM:CLAS B

A Look at Clas Ohlson's (OM:CLAS B) Valuation Following Strong Sales Growth Announcement

Reviewed by Simply Wall St

Clas Ohlson (OM:CLAS B) just released its latest sales figures. The company reported an 8% rise in October net sales compared to last year, fueled mostly by organic growth and a recently expanded store network.

See our latest analysis for Clas Ohlson.

Momentum around Clas Ohlson has been building this year, with its strong sales growth helping fuel a remarkable 74% year-to-date share price return. Even more notably, total shareholder return over the past 12 months sits at nearly 93%, a sign that recent results are resonating with both investors and the broader market.

If solid growth stories catch your attention, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

But with such impressive momentum already reflected in both sales growth and share price returns, investors are left to wonder if Clas Ohlson is still undervalued or if the market has already priced in all of its future potential.

Most Popular Narrative: 1.7% Undervalued

The most widely followed narrative suggests Clas Ohlson’s fair value is only slightly above the latest close, indicating that shares have largely priced in the expected growth story. With such a small margin, every assumption in the narrative matters.

Clas Ohlson's shift from a generalist retailer to a multi-niche player allows them to differentiate within multiple market segments. This approach could drive continued sales growth and improve operating margins. The focus on a profitable online business, with online sales growth at 22%, aims to continually increase the share of online sales, positively impacting revenue and potentially improving net margins.

Curious about which financial ambitions are driving this tight valuation? Behind the scenes, bold multi-year targets for operating margins and growth form the backbone of this outlook. Eager to see how high the bar is set? Uncover the fundamental projections that shape this consensus view.

Result: Fair Value of $370 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including currency fluctuations and rising operating expenses. Either of these factors could dampen the growth outlook and challenge current valuations.

Find out about the key risks to this Clas Ohlson narrative.

Another View: What Does the SWS DCF Model Say?

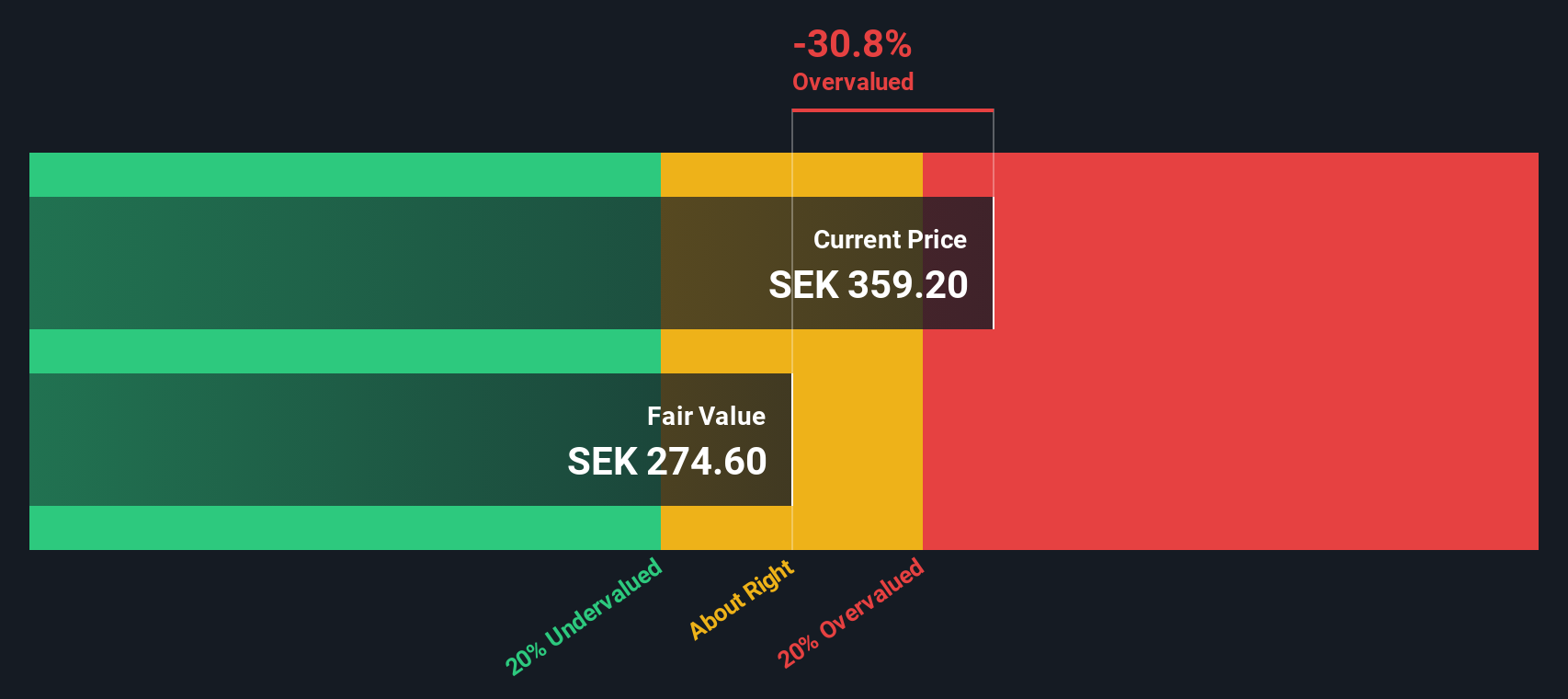

While most are focusing on the company’s price target using valuation multiples, our SWS DCF model offers a different angle. It suggests Clas Ohlson might actually be overvalued at current market prices, with the current share price sitting well above the estimated fair value.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clas Ohlson Narrative

If you see the numbers differently or want to shape your own story, take a few minutes to dive into the details yourself and Do it your way.

A great starting point for your Clas Ohlson research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and seize new opportunities with Simply Wall Street’s powerful Screener, designed to help you spot promising investments you might otherwise miss out on.

- Tap into smart income opportunities by checking out these 14 dividend stocks with yields > 3%, which features high yields and robust financials to strengthen your portfolio’s cash flow.

- Get ahead of the curve by exploring these 27 AI penny stocks, where breakthrough AI companies could define tomorrow’s market leaders.

- Unlock deep value by zeroing in on these 880 undervalued stocks based on cash flows, which analysts believe have room to grow and potential to outperform the broader market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CLAS B

Clas Ohlson

A retail company, sells building, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives