- Sweden

- /

- Specialty Stores

- /

- OM:CLAS B

A Look at Clas Ohlson (OM:CLAS B) Valuation Following Major SEK 400m Logistics Investment

Reviewed by Simply Wall St

Clas Ohlson (OM:CLAS B) just announced a SEK 400 to 450 million investment to overhaul its Insjon distribution centre, boosting automation and capacity. This significant step signals their focus on supporting long-term growth and efficiency.

See our latest analysis for Clas Ohlson.

Clas Ohlson’s recent logistics overhaul arrives as momentum has been building, with the share price up nearly 75% year to date and an impressive 89% total shareholder return over the past twelve months. This latest move appears to reinforce market confidence in its growth trajectory.

If you’re curious about what’s fueling growth stories on the market lately, now’s a great time to discover fast growing stocks with high insider ownership.

With the stock riding high after a stellar year, investors now face an important question: does Clas Ohlson still have room to surprise on the upside, or is the market already pricing in all this growth?

Most Popular Narrative: 1.4% Undervalued

Compared to the last close price of SEK 364.8, Clas Ohlson’s most widely followed narrative sets a fair value slightly higher. This points to a modest undervaluation by the market. Market watchers are weighing the credibility of this premium as anticipation builds around the company's next moves.

The focus on a profitable online business, with online sales growth at 22%, aims to continually increase the share of online sales. This could positively impact revenue and potentially improve net margins. The store expansion strategy, with a goal of adding approximately 10 new stores annually, combined with improvements in existing stores, is expected to sustain organic growth and enhance revenue.

Want to peek behind the curtain? The secret to this valuation lies in surprisingly ambitious forecasts for both profit margins and future earnings multiples. Which of these numbers make analysts so confident, and how aggressive are their underlying growth bets? Uncover the detailed assumptions for yourself in the full narrative.

Result: Fair Value of SEK 370 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as currency fluctuations and rising freight costs could quickly challenge these growth assumptions. This makes the outlook less predictable than it might initially appear.

Find out about the key risks to this Clas Ohlson narrative.

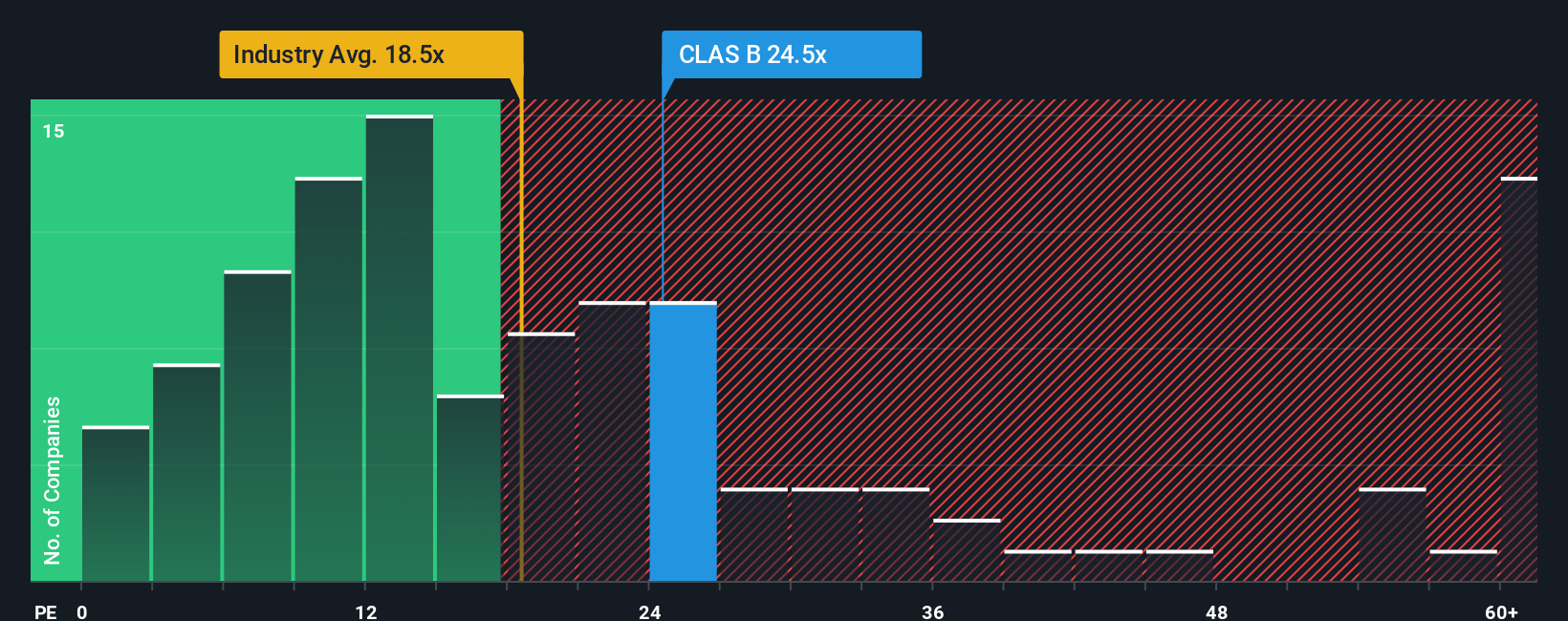

Another View: Market Multiple Sends a Different Signal

Despite the upbeat fair value estimates, Clas Ohlson looks pricey when viewed through its current price-to-earnings ratio. At 24.5x, it trades above both its peer average (19.5x) and the European Specialty Retail average (18.6x). Even compared to its own fair ratio of 22.6x, there is a premium. This may raise the stakes for downside risk if expectations cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clas Ohlson Narrative

If you see things differently or want to take a hands-on approach, it’s easy to dive into the numbers and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Clas Ohlson research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Actionable Ideas?

Turn insights into impact. With so many opportunities just a click away, you could be missing out on some of the market’s most exciting themes and trends right now.

- Find stocks tapping into rapid digital transformation by checking out these 25 AI penny stocks. Follow those setting the pace for artificial intelligence innovation.

- Secure resilient long-term returns when you review these 15 dividend stocks with yields > 3% with strong yields above 3% for reliable income potential.

- Spot undervalued gems making strategic moves with these 913 undervalued stocks based on cash flows and see which companies are poised for a re-rating based on their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:CLAS B

Clas Ohlson

A retail company, sells building, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026