- Sweden

- /

- Specialty Stores

- /

- OM:BILI A

Most Shareholders Will Probably Find That The CEO Compensation For Bilia AB (publ) (STO:BILI A) Is Reasonable

Key Insights

- Bilia to hold its Annual General Meeting on 25th of April

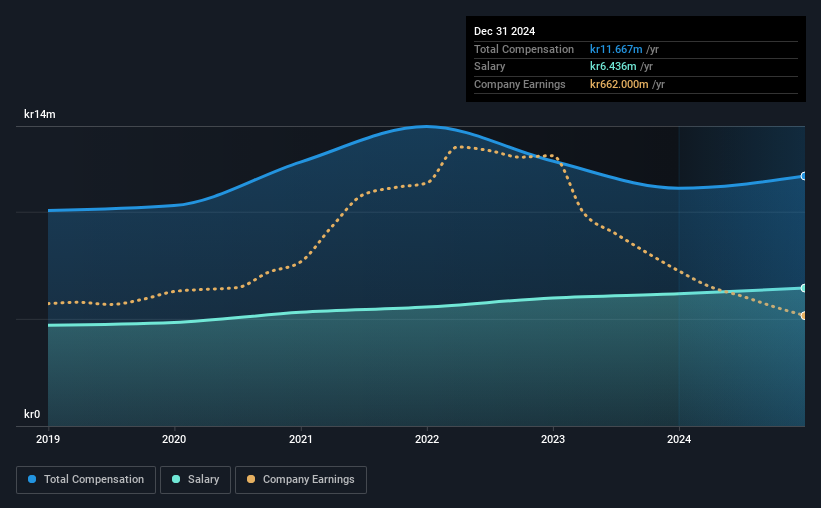

- Total pay for CEO Per Avander includes kr6.44m salary

- The overall pay is comparable to the industry average

- Bilia's EPS declined by 22% over the past three years while total shareholder return over the past three years was 9.8%

Despite positive share price growth of 9.8% for Bilia AB (publ) (STO:BILI A) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 25th of April. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for Bilia

Comparing Bilia AB (publ)'s CEO Compensation With The Industry

At the time of writing, our data shows that Bilia AB (publ) has a market capitalization of kr11b, and reported total annual CEO compensation of kr12m for the year to December 2024. That's a fairly small increase of 5.1% over the previous year. Notably, the salary which is kr6.44m, represents a considerable chunk of the total compensation being paid.

On comparing similar companies from the Swedish Specialty Retail industry with market caps ranging from kr3.9b to kr15b, we found that the median CEO total compensation was kr10m. So it looks like Bilia compensates Per Avander in line with the median for the industry. Furthermore, Per Avander directly owns kr8.9m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr6.4m | kr6.2m | 55% |

| Other | kr5.2m | kr4.9m | 45% |

| Total Compensation | kr12m | kr11m | 100% |

Talking in terms of the industry, salary represented approximately 55% of total compensation out of all the companies we analyzed, while other remuneration made up 45% of the pie. Our data reveals that Bilia allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Bilia AB (publ)'s Growth Numbers

Over the last three years, Bilia AB (publ) has shrunk its earnings per share by 22% per year. Its revenue is up 1.7% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Bilia AB (publ) Been A Good Investment?

Bilia AB (publ) has generated a total shareholder return of 9.8% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

While it's true that shareholders have owned decent returns, it's hard to overlook the lack of earnings growth and this makes us question whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for Bilia that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Bilia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BILI A

Bilia

Operates as a full-service supplier for car ownership in Sweden, Norway, Luxemburg, and Belgium.

Undervalued average dividend payer.

Market Insights

Community Narratives