- Sweden

- /

- Specialty Stores

- /

- OM:BILI A

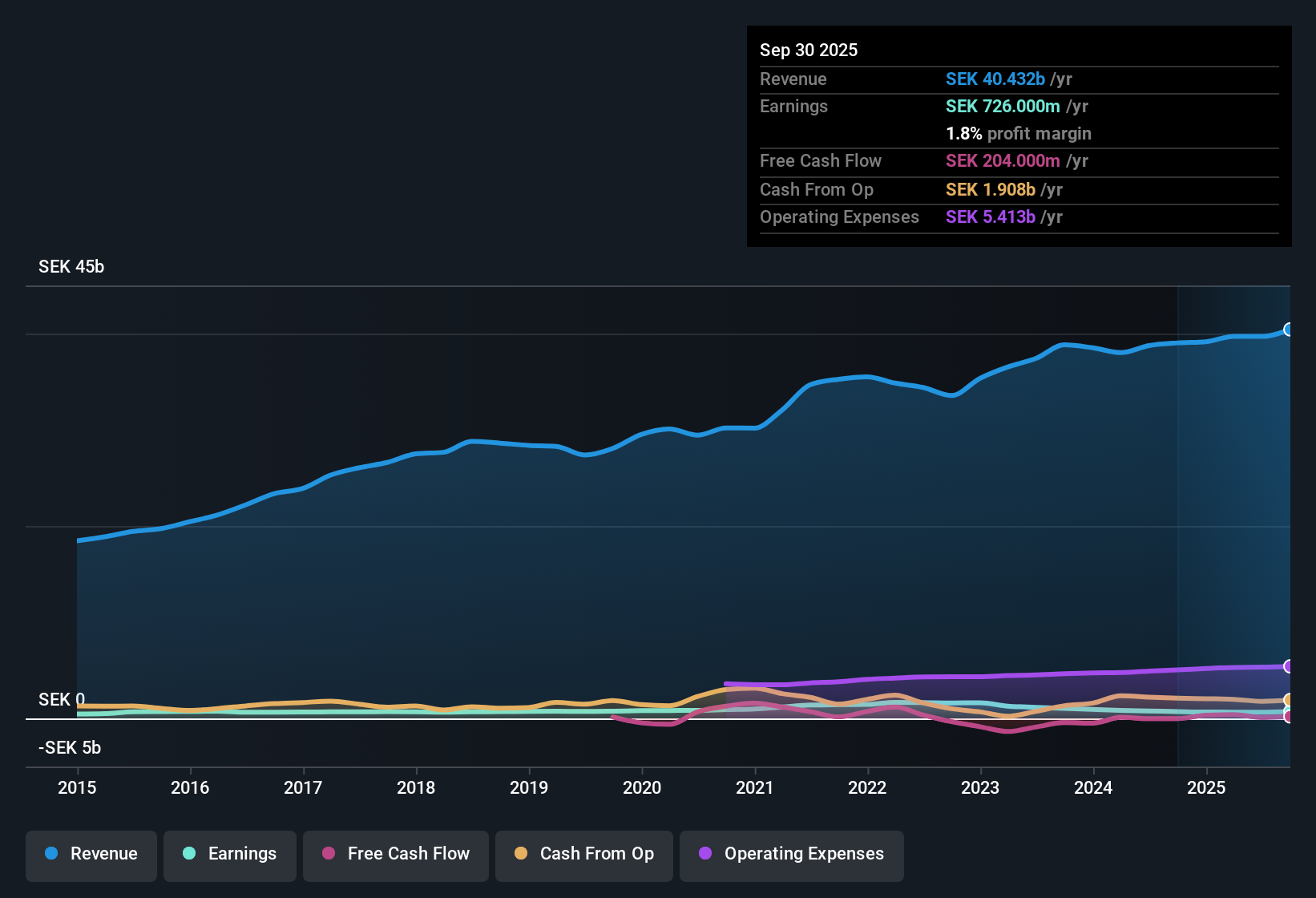

Bilia (OM:BILI A): Net Profit Margin Decline Challenges Bullish Narrative Despite Strong Earnings Forecast

Reviewed by Simply Wall St

Bilia (OM:BILI A) is forecasting earnings growth of 17.9% per year, outpacing the Swedish market’s 12.3% average. Revenue is similarly expected to grow at 3.7% annually compared to the market’s 3.6%. However, recent profitability tells a more cautious story, as net profit margins are currently 1.6%, down from 2% last year, and earnings have declined by 13.4% per year over the past five years.

See our full analysis for Bilia.Next, we will see how these numbers hold up when stacked against the community’s most widely followed narratives, highlighting where market perceptions are confirmed and where new questions might emerge.

See what the community is saying about Bilia

Profit Margins Projected to Recover by 2028

- Analysts project Bilia’s profit margin to improve from the current 1.6% to 2.8% over the next three years, in contrast to a period where margins have been shrinking and profitability underperformed peers.

- According to the analysts' consensus view, stable recurring service revenues, particularly from expanding into older car servicing and integrating new EV brands, are seen as the main drivers for this margin rebound.

- This recurring revenue, alongside investments in digital and physical channels, is expected to shield margins as the industry shifts toward wholesale models.

- However, profitability is threatened by structural pressures such as price declines in used EVs and subdued demand in new car sales, both highlighted as downside risks by the consensus.

- Results reinforce the consensus narrative that Bilia’s margin rebound is both an opportunity and a risk, as industry shifts could easily swing the outlook in either direction. 📊 Read the full Bilia Consensus Narrative.

PE Ratio Flags Undervalued Status Versus Peers

- With a Price-To-Earnings (PE) ratio of 18.6x, Bilia trades at a discount to both sector peers (45.4x) and the European Specialty Retail industry average (21x). This suggests the stock may be undervalued if profit growth materializes as forecasted.

- Analysts' consensus view highlights that while Bilia’s PE is below the sector, any reversal of margin or sales gains could quickly erode this value positioning.

- This tension is intensified by the company’s dependence on a small cluster of premium brands, where lost contracts or shifts in digital sales models could weigh on future multiples.

- Positive profit growth forecasts depend on Bilia’s ability to sustain earnings momentum despite sector disruptions.

DCF Fair Value Implies Major Upside, But Analyst Target Is More Tame

- The current share price of SEK128.5 stands far below DCF fair value (SEK378.46) and is also well under the analyst consensus target of SEK143, indicating a prospective 11.3% upside relative to the latter and suggesting a notable disconnect between price and forward-looking models.

- Analysts' consensus view regards the DCF gap as an artifact of optimistic growth and margin assumptions, cautioning that real-world risks such as persistently low new car volumes or inventory headwinds in EVs could cap the stock closer to the analyst target rather than the higher DCF estimate.

- Bearish risks in the consensus narrative highlight that Bilia’s physical dealership model and operational concentration could make the fair value gap slow to close.

- Bulls among analysts still cite service business growth and periodic demand recovery as reasons for optimism if execution meets or exceeds forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bilia on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? It only takes a few minutes to share your own interpretation and spotlight what you see. Do it your way

A great starting point for your Bilia research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Bilia’s shrinking margins, inconsistent profit history, and reliance on cyclical auto sales suggest that its earnings performance has not been reliably steady.

If stable results matter more to you, check out stable growth stocks screener (2090 results) to find companies consistently growing earnings and revenue. This can offer greater predictability even when markets change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bilia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BILI A

Bilia

Operates as a full-service supplier for car ownership in Sweden, Norway, Luxemburg, and Belgium.

Undervalued average dividend payer.

Market Insights

Community Narratives