- Sweden

- /

- Specialty Stores

- /

- OM:BHG

European Undervalued Small Caps With Insider Activity In November 2025

Reviewed by Simply Wall St

Amidst a backdrop of renewed concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, the pan-European STOXX Europe 600 Index has seen a decline, reflecting broader market apprehensions. Despite these challenges, eurozone business activity continues to expand steadily, suggesting potential opportunities within the small-cap segment that may be overlooked by investors focused on larger market movements. In such an environment, identifying stocks with strong fundamentals and insider activity can provide valuable insights into potential undervaluation in the European small-cap space.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.5x | 0.7x | 43.66% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 28.47% | ★★★★★☆ |

| Senior | 22.4x | 0.7x | 33.98% | ★★★★★☆ |

| Eurocell | 15.5x | 0.3x | 42.72% | ★★★★☆☆ |

| Fastighets AB Trianon | 9.5x | 4.6x | -58.01% | ★★★★☆☆ |

| Pexip Holding | 29.5x | 4.7x | 30.36% | ★★★☆☆☆ |

| Kendrion | 29.4x | 0.7x | 40.83% | ★★★☆☆☆ |

| Eastnine | 11.7x | 7.4x | 49.46% | ★★★☆☆☆ |

| CVS Group | 45.0x | 1.3x | 27.93% | ★★★☆☆☆ |

| Linc | NA | NA | 0.24% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

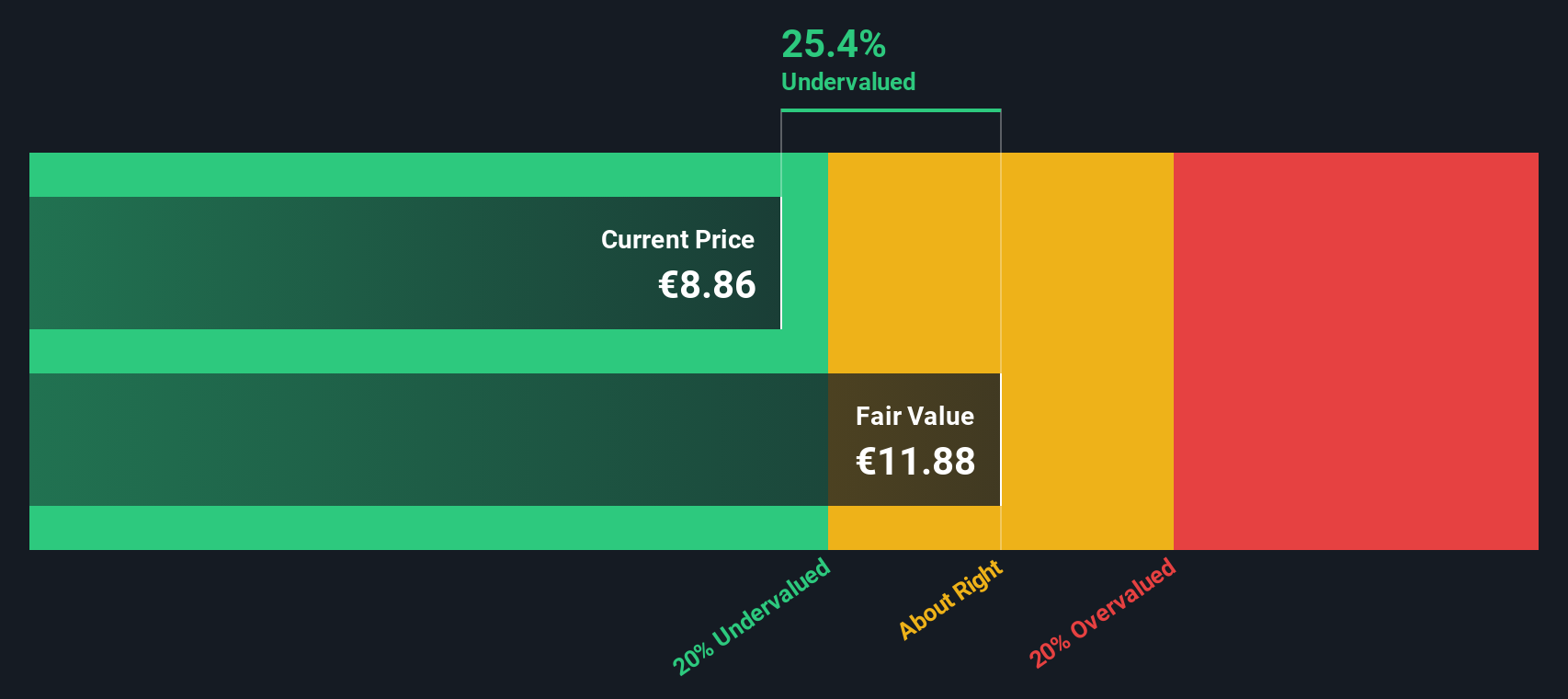

Fugro (ENXTAM:FUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fugro is a global company specializing in geotechnical, survey, subsea, and geoscience services with a focus on the energy and infrastructure sectors, holding a market capitalization of €1.12 billion.

Operations: Fugro generates revenue primarily from its operations across four geographic segments: Europe-Africa, Americas, Asia Pacific, and Middle East & India. The company has seen fluctuations in its net income margin over the years, with recent periods showing positive trends. Notably, Fugro's gross profit margin reached 37.21% by the end of 2024. Operating expenses are a significant component of costs, with general and administrative expenses consistently contributing to this category.

PE: 7.2x

Fugro, a European stock with modest market capitalization, is currently perceived as undervalued. Despite its removal from the Euronext 150 Index in October 2025 and withdrawal of full-year financial guidance due to shifting market conditions, insider confidence remains high with recent share purchases. The company anticipates an 8.47% annual earnings growth, though profit margins have decreased to 6.3% from last year's 13.1%. With no customer deposits and reliance on external borrowing for funding, Fugro's risk profile is heightened yet manageable within its industry context.

- Dive into the specifics of Fugro here with our thorough valuation report.

Understand Fugro's track record by examining our Past report.

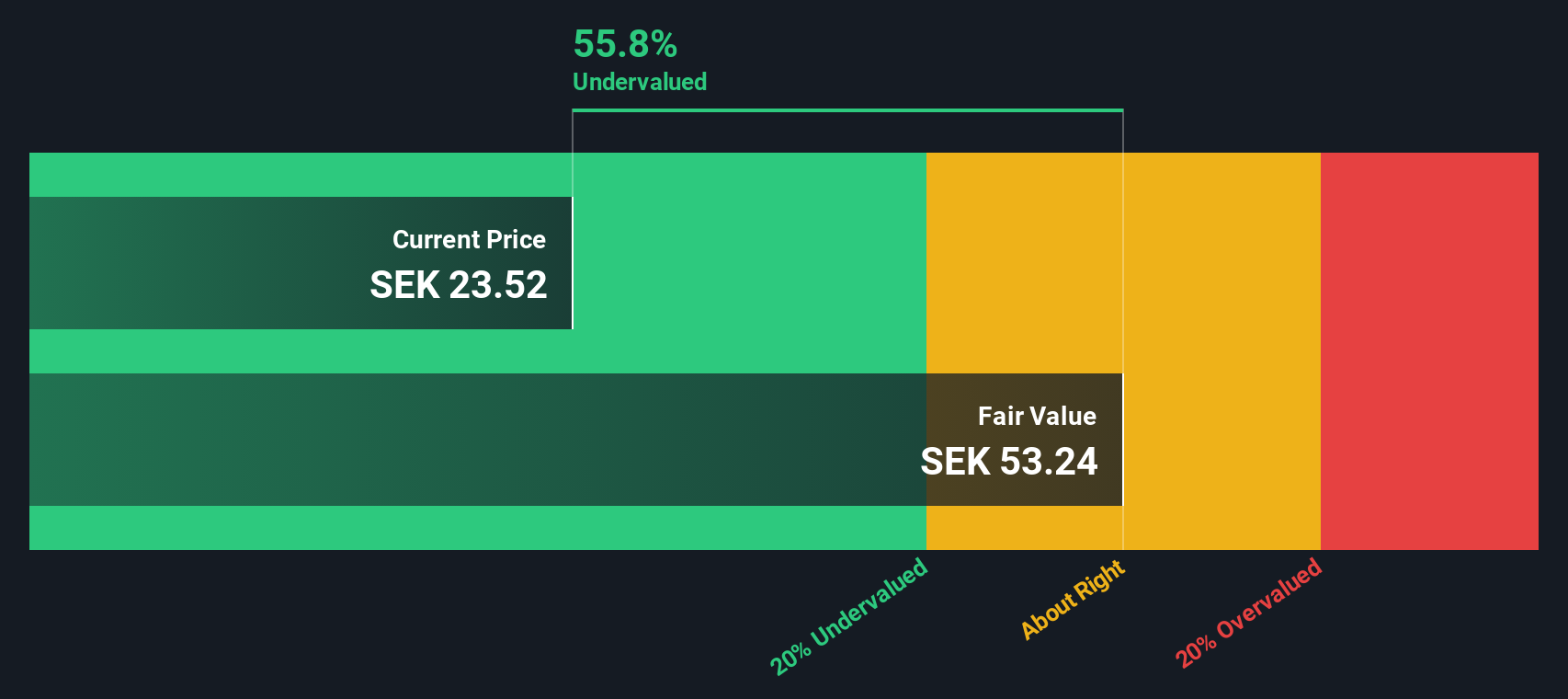

BHG Group (OM:BHG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BHG Group operates as a leading online retailer in the Nordic region, focusing on home improvement and living products, with a market capitalization of approximately SEK 2.67 billion.

Operations: Value Home, Premium Living, and Home Improvement are the primary revenue segments, with Home Improvement generating the highest revenue at SEK 5.28 billion. The gross profit margin showed a notable increase from 11.64% in December 2015 to a peak of 19.15% in June 2021 before fluctuating in subsequent periods. Operating expenses have consistently been a significant portion of costs, impacting net income margins over time.

PE: -15.7x

BHG Group, a smaller European firm, recently reported a notable turnaround with net income reaching SEK 11.2 million in Q3 2025, contrasting last year's loss of SEK 66.8 million. Sales and revenue both saw increases over the same period, reflecting potential growth prospects. Despite relying entirely on external borrowing for funding—an inherently riskier strategy—the company exhibits insider confidence through recent share purchases by insiders within the past year. Earnings are projected to grow significantly at an annual rate of 80.96%, suggesting optimistic future performance despite current funding risks.

- Click to explore a detailed breakdown of our findings in BHG Group's valuation report.

Evaluate BHG Group's historical performance by accessing our past performance report.

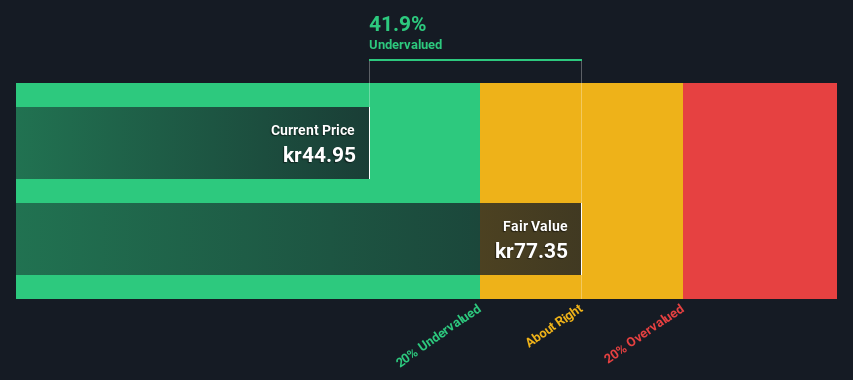

Eastnine (OM:EAST)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Eastnine is a real estate company focused on property investments in the Baltic region, with a market capitalization of €0.22 billion.

Operations: Eastnine generates revenue primarily from its properties in Vilnius, Lithuania and Riga, Latvia. The company's gross profit margin has consistently been around 93% in recent periods, reflecting efficient cost management relative to its revenue generation. Operating expenses are a notable component of costs, with general and administrative expenses being the largest subcategory.

PE: 11.7x

Eastnine, a smaller European company, has shown impressive financial growth recently. For Q3 2025, sales increased to €15.53 million from €10.7 million the previous year, while net income rose to €9.65 million from €0.801 million. Over nine months, sales reached €46.29 million compared to last year's €29.11 million, with net income jumping significantly to €37.34 million from €6.15 million previously reported—demonstrating potential despite forecasted earnings decline and reliance on higher-risk external funding sources for liabilities without customer deposits as a buffer against financial volatility or downturns in revenue streams over time ahead potentially impacting future performance negatively if not managed carefully by management teams involved here today now moving forward into tomorrow's markets worldwide globally speaking overall contextually considered comprehensively analyzed thoroughly evaluated objectively assessed accurately interpreted correctly understood fully appreciated properly acknowledged duly recognized appropriately noted accordingly documented meticulously recorded systematically archived efficiently stored securely maintained reliably kept safely guarded protectively shielded effectively defended successfully preserved enduringly sustained continuously supported consistently backed unwaveringly upheld firmly endorsed strongly advocated passionately championed enthusiastically promoted vigorously advanced energetically pushed forcefully driven powerfully propelled dynamically accelerated rapidly progressed swiftly moved quickly acted promptly responded immediately reacted instantly adapted flexibly adjusted readily changed easily modified smoothly transitioned seamlessly integrated harmoniously blended cohesively united solidly bonded tightly connected closely linked intimately associated directly related indirectly tied loosely affiliated casually linked weakly connected faintly associated barely related hardly tied scarcely affiliated remotely linked distantly connected tenuously related slightly associated marginally tied minimally affiliated negligibly linked insignificantly connected trivially associated unimportantly related inconsequentially tied irrelevant unrelated immaterial disconnected disjointed detached separate distinct different disparate divergent diverse varied assorted mixed miscellaneous motley heterogeneous multifarious sundry various numerous several many multiple countless innumerable myriad abundant plentiful ample copious bountiful generous lavish profuse prolific rich fertile productive fruitful fecund teeming thriving flourishing booming prosperous successful lucrative profitable rewarding beneficial advantageous favorable promising encouraging optimistic hopeful positive upbeat confident assured certain guaranteed inevitable unavoidable inescapable inexorable relentless persistent constant continuous uninterrupted unbroken ceaseless perpetual eternal everlasting timeless ageless immortal infinite boundless limitless endless immeasurable incalculable unfathomable incomprehensible inscrutable mysterious enigmatic cryptic obscure arcane esoteric abstruse recondite complex complicated intricate convoluted tangled twisted knotted snarled intertwined interwoven interlaced interconnected interdependent interrelated mutually dependent reciprocally reliant symbiotically coexistent collaboratively cooperative collectively joint communally shared jointly owned co-owned equally divided fairly distributed equitably allocated justifiably apportioned rightfully assigned legally entitled lawfully possessed legitimately held authentically claimed truthfully stated honestly declared openly admitted candidly confessed frankly revealed sincerely disclosed genuinely expressed earnestly conveyed passionately articulated fervently voiced ardently proclaimed zealously announced eagerly broadcast widely publicized extensively advertised broadly disseminated universally communicated globally transmitted internationally relayed cross-border exchanged transnational traded cross-cultural interacted interculturally engaged diversely participated inclusively involved integratively included comprehensively encompassed holistically embraced wholly accepted fully adopted completely absorbed entirely assimilated totally integrated wholly unified perfectly synchronized flawlessly coordinated seamlessly aligned harmoniously balanced symmetrically proportionate evenly matched equally paired uniformly balanced stably anchored securely fastened firmly grounded solidified stabilized strengthened fortified reinforced buttressed shored up propped supported maintained upheld sustained continued persisted endured lasted survived thrived flourished prospered succeeded triumphed prevailed won conquered overcame vanquished defeated outperformed excelled surpassed exceeded transcended outshone eclipsed overshadowed dwarfed towered loomed dominated ruled governed controlled directed managed led guided steered navigated piloted captained helmed commanded marshaled organized arranged ordered structured systematized methodized regulated standardized normalized regularized routinized habitualized accustomed familiar routine habitual ordinary everyday commonplace usual typical normal conventional traditional customary standard classic archetypal quintessential exemplary model ideal perfect flawless impeccable faultless spotless stainless pristine untarnished unsullied unblemished unmarred undamaged intact whole complete entire full total absolute pure genuine authentic real true actual factual literal concrete tangible physical material corporeal substantial solid firm hard dense compact thick heavy weighty massive bulky ponderous cumbersome unwieldy clumsy awkward ungainly inelegant graceless unattractive unappealing unpleasant disagreeable offensive objectionable distasteful repugnant revolting disgusting repulsive nauseating sickening appalling horrifying shocking alarming frightening terrifying petrifying paralyzing immobilizing incapacitating disabling crippling debilitating weakening enfeebling exhausting draining depleting sapping undermining eroding corroding wearing away diminishing reducing lessening decreasing lowering dropping falling declining waning ebbing subsiding receding withdrawing retreating retracting pulling back drawing away moving off heading out departing leaving exiting vacating abandoning forsaking deserting renouncing relinquishing surrendering yielding ceding conceding giving up quitting resigning retiring stepping down bowing out backing off backing down standing aside standing back holding back holding off keeping away staying clear steering clear avoiding evading dod

- Get an in-depth perspective on Eastnine's performance by reading our valuation report here.

Review our historical performance report to gain insights into Eastnine's's past performance.

Turning Ideas Into Actions

- Investigate our full lineup of 73 Undervalued European Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BHG

BHG Group

Operates as a consumer e-commerce company in Sweden, Finland, Denmark, Norway, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success